|

APPREHENSIONS about the constitutionality of federal action and the political influence of the pharmaceutical industry deterred the FBN from seeking federal legislation in 1930 and 1931. The bureau chose to concentrate its energies instead on securing adoption of the Uniform Act, including the cannabis provision, by the state legislatures. Even so, however, Commissioner Anslinger had not ruled out federal legislation "at the appropriate time."

The hesitation of the federal policy makers was not motivated either by philosophical objection or scientific uncertainty. For Anslinger and his colleagues, there was no philosophic issue. Crimi-nal legislation was needed simply because "Indian hemp is used in certain sections for improper purposes, that is to say, for non-medical purposes."1 It is unlikely that Anslinger ever confronted the question begged by such a statement—the role of social,policy with respect to the use of drugs for pleasure or other self-defined purposes. It may be, however, that the magnitude of the evils perceived to be associated with such use—addiction, insanity, and death—superseded this issue. But again, it is unlikely that Mr. Anslinger or his colleagues considered the relationship between crime and sin—in this case the role of the criminal law in protecting the individual from his own folly. Criminalization of consumption-related behavior apparently went hand-in-hand with any curtailment of availability. The government's burden of proof in such a case was merely one of coming forward with some evidence, not one of demonstrating the validity of that evidence. Anslinger at no time felt compelled by policy or circumstance to demonstrate the accu-racy of his beliefs about marihuana. The commissioner's hesitant attitude about federal action had nothing to do with limited information regarding the effects of the drug.

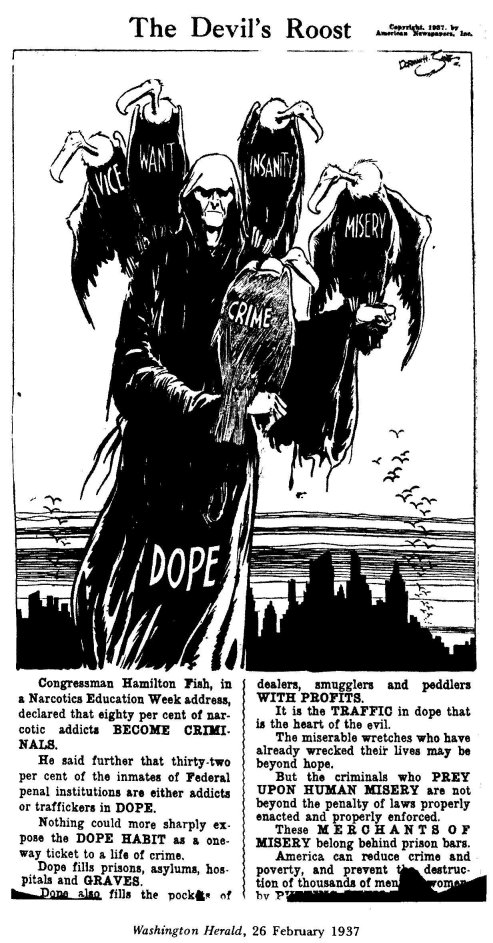

Commissioner Anslinger's decision to deflect proposals for a federal law was based instead in bureaucratic considerations—in a desire to protect the FBN's jurisdiction under the Harrison Act. His attitude is reflected in his responses to politicians who urged federal action from 1932 through 1934. Opposing a bill (introduced in 1933) of Congressman Fish of New York to amend the Harrison Act, Anslinger, for example, noted that federal action should be deferred until all the states had acted.2 A memo from Tennyson, from which Anslinger drew his response, also warned of the possible opposition of "one or two pharmaceutical houses."3 Meanwhile, however, all FBN agents were directed to refer "all complaints concerning marihuana to [Anslinger] with perhaps the possibility in view of effecting some federal laws at some future data."4

The Genesis of the Marihuana Tax Act

That "future date" may have come sooner than even Anslinger had hoped or desired. The occasion was the request, in 1935, for a Treasury Department position on a pair of bills, S. 1615 introduced by senator Hatch of New Mexico and H.R. 6145 introduced by Congressman Dempsey of New Mexico, to prohibit the shipment and transportation of cannabis in interstate or foreign commerce. This legislation had been part of a three-pronged approach which had been suggested by Anslinger in 1930. The FBN nevertheless recomiliended that the department oppose both bills because: "There is no evidence of an appreciable degree of interstate traffic in or international traffic toward the United States in cannabis for what may be termed improper purposes. . . . At this time I can see no need for the enactment of [this bill] ."5

This position was stated by Tennyson and Acting Commissioner Wood while Anslinger was participating in international discussions at The Hague. But when the draft response reached Treasury Secre-tary Morgenthau's office, the bureau was overruled by Assistant Secretary Gibbons, on the advice of Herman Oliphant, the general counsel of the Treasury Department. The Congress was advised officially over Secretary Morgenthau's signature that "the Depart-ment interposes no objections to such proposed legislation. . ."6 This was on 13 April 1935.

The tide had turned. Although the Hatch and Dempsey bills did not reach the floor, the "appropriate time" for federal legislation was drawing near. The intriguing question is why: what provoked Assistant Secretary Gibbons to overrule a position taken by the agency with primary responsibility, an agency already campaigning with great fervor against the evil with which the bills dealt, and the agency which itself played such a major role in increasing public awareness of this evil? We can only surmise that political pressure was building for federal action because the FBN and its private army had generated a climate of fear in order to secure passage of the Uniform Act—but the bureau had done its job too well. As Gibbons noted sometime later, in October 1936, "steps should be taken legally or otherwise that will definitely control this product, for if we are to believe a small fraction of what is written, it is frighteningly devastating."7

Whether or not Anslinger concurred with Gibbons and Oliphant on the desirability of federal legislation, he undoubtedly preferred to wait until he and Tennyson could work out a full statutory scheme which would not endanger the Harrison Act. After Morgen-thau's decision, Tennyson had his legal staff studying alternative ways of "securing valid federal control." He and Anslinger perhaps anticipated legislation some time in 1936. For the timebeing, however, they wanted no congressional tinkering; and, more im-portant, they wanted no agitation from the lobbying public. In May 1935 Tennyson, aware of the attempts by Helen Howell Moorehead to incite congressional interest, noted that "after dis-cussing it with Mrs. Moorehead, she agreed to postpone further agitating this question until the fall."8

The bureau had not found a plan by that fall. But in January 1936 Anslinger convened a conference in New York to consider the matter, and the following month, he presented the secretary's office with what he conceived to be the only constitutionally permissible approach—a treaty with Mexico and Canada with supplementary federal legislation to enforce its terms. One may legitimately wonder what such a treaty would have to do with Congress' power to control domestic traffic in marihuana.9 To answer this we must review the bureau's apprehensions about amending the Harrison Act or using the Harrison Act model with regard to marihuana.

It will be recalled that there were two constitutional problems with "regulating" marihuana by use of the taxing power, which Congress had used in the Harrison Act to regulate the opiates and cocaine. First, because the drugs covered by the Harrison Act were almost exclusively imported, the constitutional objection that Congress was regulating production, a local activity, was not ger-mane; instead the main constitutional difficulty under the Harrison Act was that Congress was regulating the medical profession. Marihuana, however, was growing widely as a roadside weed or in gardens or fields all over the country; under these circumstances, effective control would require intensive regulation and/or the prohibition of production, either of which would go well beyond the Harrison Act. The taxing power might not suffice as a shield in this case.

Second, legitimate production of marihuana for medical purposes was decreasing, and the cost of controlling illegitimate growth under the Harrison scheme would far exceed the revenue which might be derived. In such an event—a net loss to the government—the Court would not be likely to accept Congress' word that it was exercising the taxing power and probably would not close its eyes to Congress' real motive. Of course, a more limited taxing scheme could be devised, as could schemes simply controlling interstate and foreign commercial activity; but these would not substantially affect the marihuana evil, which required tight control over culti-vation and possession. For this reason, Anslinger advised Gibbons that "under the taxing power and regulation of interstate com-merce, it would be almost hopeless to expect any kind of adequate control."1°

How would a treaty with Mexico and Canada allow more effective control? The answer lies in the famous "migratory bird case," Missouri v. Holland (1920).11 There, Congress had established open and closed seasons for killing certain birds which migrate between the United States and Canada. In so doing, Congress was regulating a clearly "local" activity; but the Supreme Court had held that this was permissible because the statute was passed merely to implement a treaty between the U.S. and Great Britain executed for the purpose of protecting these birds from extermination. The Court held that as long as legislation is "necessary and proper" for carrying out a valid treaty, Congress could go beyond its usual powers to regulate matters ordinarily reserved to the states.

Under the FBN's scheme, the United States and its two immediate neighbors would enter into a treaty for the purpose of eliminating traffic in marihuana among the three countries. Each would agree to undertake appropriate steps to serve that objective. Then Congress could pass a statute strictly controlling or prohibiting the domestic cultivation of marihuana.

This scheme seemed sound to Oliphant, the Treasury Department general counsel, and to Assistant Secretary Gibbons; in March 1936 they gave their approval.12 Representatives from the three govern-ments began to meet, and Canada soon expressed its "entire sympathy" with the proposal. As might be expected, however, Mexico was highly uncertain whether it could effectively carry out the terms of the treaty, and it did not respond so readily.

Six months later Assistant Secretary Gibbons grew tired of the delay. After being advised by the dean of the University of Texas Medical School that "he could absolutely prove that marihuana is a habit-forming narcotic," Gibbons fired a memorandum to Oliphant asking him to find a way to control this "frighteningly devastating" product. He said, moreover, that he simply did not understand the objection to bringing marihuana within the purview of the Harrison Act.13

Oliphant, well aware that Gibbons' urgency was aroused by the "rather considerable publicity which the marihuana problem has received," responded that the bureau did have legitimate objections to the amendment of the Harrison Act, that the treaty idea was promising, and that a reply from the Mexican government was expected imminently. He concluded that "we are making real progress toward the achievement of Federal control over a problem which I, like yourself, regard as a major evil."14

However, it soon became apparent that Mexico was unwilling to shoulder the domestic hardships which would be required in order to enforce the treaty's terms. Further, the State Department rejected Anslinger's request that the United States participate in a 1936 Geneva Conference only on the condition that any resulting convention require domestic cannabis control. This was in June.15 It became clear that a federal antimarihuana law would not rest on the treaty power.

But there was no turning back. By the fall of 1936 Oliphant had decided to employ the taxing power, but in a statute modeled after the National Firearms Act and wholly unrelated to the Harrison Act. Oliphant himself was in charge of preparing the bill. Anslinger directed his army to turn its campaign toward Washington.16

The Treasury Department did not publicize the fact that it was preparing a bill.17 Since Congress was also unaware of Treasury's activity, antimarihuana legislation was introduced in both houses at the opening of the first session of the Seventy-fifth Congress in January 1937. The Hatch Bill to prohibit the shipment and trans-portation of cannabis in interstate and foreign commerce was reintroduced in the Senate, and the Fish Bill to prohibit importation was resubmitted in the House.18 Later in the session, Congressman Hennings of Missouri introduced another bill that was probably well beyond congressional power at that time. His bill would have prohibited sale, possession, and transportation of cannabis except in compliance with regulations to be made by the commissioner of narcotics.19

On 14 April the Treasury Department, having resisted for seven years, finally unveiled the "administration proposal," H.R. 6385, to stamp out marihuana.2° H.R. 6385 was a tax measure and therefore it ran the risk of invalidation on the two grounds dis-cussed above—intensive control of domestic growth and failure to produce revenue through legitimate enterprises. By employing a separate measure, however, the Treasury Department hoped to avoid contamination of the Harrison Act. The scheme provided in H.R. 6385 was threefold: a requirement that all manufacturers, importers, dealers, and practitioners register and pay a special occupational tax; a requirement that all transactions be accom-plished through use of written order forms; and, the imposition of a tax on all transfers in the amount of $1/ounce for transfer to registered persons and a prohibitive $100/ounce for transfer to unregistered persons.

The key departure of the marihuana tax scheme from that of the Harrison Act is the notion of the prohibitive tax. Under the Harrison Act a nonmedical user could not legitimately buy or possess narcotics. To the dissenters in the Supreme Court decisions upholding the act, this clearly demonstrated that Congress' motive was to prohibit conduct rather than to raise revenue. So in the National Firearms Act, designed to prohibit traffic in machine guns, Congress "permitted" anyone to buy a machine gun but required him to pay a $200 transfer tax and to carry out the purchase on an order form. The Firearms Act, passed in June 1934, was the first act to hide Congress' motives behind a "prohibitive" tax. When the Court of Appeals for the Seventh Circuit upheld the act on 9 November 1936,21 the stage was set for a Supreme Court test of this technique. The high Court agreed to hear the case on 15 February, it was argued on 12 March, and the Court unanimously upheld the antimachine gun law on 29 March.22 Oliphant had undoubtedly been awaiting the Court's decision, and the Treasury Department introduced its marihuana tax bill two weeks later, on 14 April 1937.

It is important to understand that these legal intricacies were the essence of the marihuana "issue." There was a recognized need for the federal government to take action forbidden to it under prevailing constitutional doctrine. The legal reality of the marihuana issue was of significantly more interest to the bureaucracy and to the Congress than the scientific and social realities of marihuana use.

H.R. 6385 was introduced in April. In less than four months the Marihuana Tax Act would become law. For the first time since the drafting process of the Uniform Act, the bureau woujd be called upon to justify its concern about marihuana. Before analyzing the legislative process, it might be wise at this point to examine what the bureau actually knew, thought it knew, or had reason to know about marihuana.

Notes

1. Anslinger to Ms. M. M. Moad, 1 Oct. 1932.

2. Anslinger to Congressman Hamilton Fish, Jr., 28 Aug. 1933.

3. Memorandum from Tennyson to Anslinger, 1 Aug. 1933.

4. Memorandum from B. M. Martin, local supervisor, to agents, 13 Mar. 1934.

5. Memorandum from Will S. Wood to Assistant Secretary Gibbons, 13 Mar. 1935.

6. Morganthau to Senator Fletcher, 13 Apr. 1935.

7. Memorandum on marihuana from Gibbons to Oliphant, 5 Oct. 1936. Musto's research tends to confirm our hypothesis that a "political" decision was made in 1935 to seek federal legislation. See Musto, "The Marihuana Tax Act of 1937," Archives of General Psychiatty, 26 (1972), 101, 105.

8. Memorandum from Tennyson to Anslinger, 28 May 1935.

9. Memorandum from Anslinger to Gibbons, 1 Feb. 1936.

10. Ibid.

11. Missouri v. Holland, 252 U.S. 416 (1920).

12. Memorandum from Oliphant to Gibbons, 13 Oct. 1936.

13. Memorandum from Gibbons to Oliphant, 5 Oct. 1936.

14. Memorandum from Oliphan to Gibbons, 13 Oct. 1936.

15. Taylor, American Diplomacy and the Narcotics Traffic, 1900-1939 (Durham: Duke Univ. Press, 1969), pp. 200-203.

16. Memorandum from Anslinger to Thomas J. Morrissey, U.S. attorney for Denver, Colo., 22 Dec. 1936.

17. It is interesting to note that in testimony before the House Appropriations Committee on the Treasury budget, Anslinger emphasized the marihuana problem but did not indicate that the administration was preparing a bill:

Anslinger: I might say that the marihuana problem seems to be jumping up.... Mr. Ludlow: That is about as hellish a drug as heroin, it it not?

Anslinger: I think it is. It is certainly showing up in the crime situation. We find a number of violent crimes committed while persons were under the influence of marihuana.

(Union Signal, 6 Mar. 1937.)

18. Union Signal, 30 Jan. 1937, p. 66. The Hatch Bill was styled S. 325, 75th Cong., 1st sess., Jan. 1937, and the Fish Bill was styled H.R. 229, 75th Cong., 1st sess., Jan. 1937.

19. Union Signal, 6 Mar. 1937, p. 146.

20. Union Signal, 15 May 1937, p. 306.

21. Sonzinsky v. United States, 86 F. 2d 486 (7th Cir. 1936).

22. Sonzinsky v. United States, 300 U.S. 506 (1937).

|