America, United States of.

| Reports - Report of the International Opium Commission |

Drug Abuse

February 5th, 1909.

MR. PRESIDENT :

The American Opium Commission presents its Report on the Opium Question as it affects our States, Territories and the District of Columbia and the Possessions under our flag.

We propose to deploy our data under the following heads:—

NATIONAL.

TREATIES, with other Governments engaging us in regard to opium traffic.

TARIFFS, under which we import opium into the United States, its Territories and the District of Columbia.

EXCISE LAII S, governing the manufacture of Smoking Opium.

STATUTES, that restrain our citizens from engaging in the Opium trade.

EFFECT, of our Treaties and Tariffs on our trade in Opium.

OUR OPIUM, and where we get it.

SMOKING OPIUM, and our Chinese population.

GROWTH, of the Poppy within the United States, its Territories and the District of Columbia. DISPOSITION, of our imported Opium.

FEDERAL LAI\ S, governing the use of Opium and its derivatives.

STATE LAWS, governing the use of Opium and its derivatives.

MUNICIPAL LAWS, governing the use of Opium and its derivatives.

FINAL DESTINATION, of our Opium imported ostensibly for medicinal purposes. FINAL DESTINATION, of our imports of Smoking Opium.

RECENT EFFECT, of our National, State and Municipal laws bearing on Opium and its derivatives.

REVENUE, derived from import and excise duties on Opium. PRESENT STATUS, of our laws on Opium of various sorts. PORTO RICO.

CUBA.

INTERNATIONAL, needs to make our recent law effective.

THE PHILIPPINES.

TREATIES.

Our country has two treaties with China that engage us in regard to opium and its derivatives :

CHINA.

(1) The "Immigration and Commercial Treaties between the *United States and China " of 1880. Article II of the "Commercial Treaty " stipulates that :

"The Governments of China and of the United States mutually agree and undertake that Chinese subjects shall not be permitted to import opium into any of the ports of the United States; and citizens of the United States shall not be permitted to import opium int0 any of the open ports of China, to transport it from one open port to any other open port, or to buy and sell opium in any of the open ports of China. This absolute prohibi-tion, which extends to vessels owned by the citizens or subjects of either power, to foreign vessels employed by them, or to vessels owned by the citizens or subjects of either power, and employed by other persons for the transportation of opium, shall be enforced by appropriate legislation on the part of China and the United States; and the benefits of the favored nation clause in existing treaties shall not be claimed by the citizens or subjects of either power as against the provisions of this article.

It will be seen from this Article II of the " Commercial Treaty " of 188o, that the two Governments concerned undertook without any limitation or qualification whatever, to forbid the importation of opium into the United States by Chinese subjects ; the importation by American citizens of opium into any of the open ports of China, or its transportation from one open port to another, or the buying or selling of opium in any such open ports, etc. When this Article was negotiated it was recognized by both parties that it would be necessary for the United States in Congress assembled to pass a statute providing for the trial and punishment of its citizens offending against the provisions of this treaty. In 1887 Article II of the Treaty of 188o was made effective when Congress passed the following statute:—

AN ACT TO PROVIDE FOR THE EXECUTION OF THE PROVISIONS OF ARTICLE TWO OF THE TREATY CONCLUDED BETWEEN THE UNITED STATES OF AMERICA AND THE EMPEROR OF CHINA ON THE SEVENTEENTH DAY OF NOVEMI3ER, EIGHTEEN HUN-DRED AND EIGHTY, AND PROCLAIMED BY THE PRESIDENT OF THE UNITED STATES ON THE FIFTH DAY OF OCTOBER, EIGHTEEN HUNDRED AND EIGHTY-ONE

(Act of February 23rcl, 1887, ch., 210, 24 Stat. L. 409.)

(Sec. I) (Importation of opium by Chinese prohibited.) That the importation of opium into any of the ports of the United States by any subject of the Emperor of China is hereby prohibited. Every person guilty of a violation of the preceding provision shall be deemed guilty of a misdemeanor, and, on conviction thereof, shall be punished by a fine of not more than five hundred dollars nor less than fifty dollars, or by imprisonment for a period of not more than six months nor less than thirty days, or by both such fine and imprisonment, in the discretion of the court. (24 Stat. L. 4o9.)

(Sec. 2) (Forfeiture.) That every package containing- opium, either in whole or in part imported into the United States by any subject of the Emperor of China, shall be deemed forfeited to the United States; and proceedings for the declaration and consequences of such forfeiture may be instituted in the courts of the United States as in other cases of the violation of the laws relating to other illegal importations. (24 Stat. L. 409.)

"Sec. 3. (Citizens of United States prohibited from traffic in opium in China—punishment—jurisdiction—forfeiture.) That no citizen of the United States shall import opium into any of the open ports of China, nor transport the same from one open port to any other open port, or buy or sell opium in any of such open ports of China, nor shall any vessel owned by citizens of the United States, or any vessel, whether foreign or otherwise, employed by any citizen of the United States, or owned by any citizen of the United States, either in whole or in part, and employed by persons not citizens of the United States, take or carry opium into any of such open ports of China, or transport the same from one open port to any other open port, or be engaged in any traffic therein between or in such open ports or any of them. Citizens of the United States offending against the provisions of this section shall be deemed guilty of a misdemeanor, and upon conviction thereof, shall be punished by a fine not exceeding five hundred dollars nor less than fifty dollars, or by both such punishments, in the discretion of the court. Consular courts of the United States in China, concurrently with any district court of the United States in the district in which any offender may be found, shall have jurisdiction to hear, try, and determine all cases arising under the foregoing provisions of this section, subject to the general regulations provided by law. Evegy package of opium or package containing opium, either in whole or in part, brought, taken, or transported, trafficked, or dealt in contrary to the provisions of this section, shall be forfeited to the United States, for the benefit of the Emperor of China ; and such forfeiture, and the declaration and consequences thereof, shall be made, had, determined, and executed by the proper authorities of the United States exercising judicial powers within the Empire of China. (24 Stat. L. 09.) "

Article II of the Treaty of 188o and the statute passed in conformity with it, still remain in force.

The last treaty with China in which opium or its derivatives is mentioned is the " Treaty as to Commercial Relations," concluded October Sth, 1903, and proclaimed January 13th, 1904. Article XVI of that treaty is as follows :

"The Government of the United States consents to the prohibition by the Govern-ment of China of the importation into China of morphia anc-I of instruments for its injection, excepting morphia and instruments for its injection imported for medical purposes, on payment of tariff duty, and under regulations to be framed by China which shall effectually restrict the use of such import to the said purposes. This prohibition shall be uniformly applied to such importation from all countries. The .Chinese Government undertakes to adopt at once measures to prevent the manufacture in China of morphia and of instruments for its injection."

All Powers have adhered to the morphia clause in this "Commercial Treaty" and it went into effect January 1st of the current year.

KOREA.

We have one other treaty with a Foreign Power covering opium, namely, with Korea, In our first treaty with Korea a " Treaty of Peace, Amity, Commerce and Navigation," concluded Mav 22nd, 1882, and proclaimed June 4th, 1883, it was stipulated in Article VII :

" The Governments of the United States and of Chosen mutually agree and undertake that subjects of Chosen shall not be permitted to import opium into any of the ports of the United States, and citizens of the United States shall not be permitted to import opium into any of the open ports of Chosen, to transport it from one open port to another open port, or to traffic in it in Chosen. This absolute prohibition which extends to vessels owned by the citizens or subjects of either Power, to foreign vessels employed by them, and to vessels owned by the citizens or subjects of either Power and employed by other persons for the transportation of opium, shall be enforced by- appropriate legislation on the part of the United States and of Chosen, and offenders against it shall be severely punished."

TARIFF LAWS ON OPIUM TO 1861.

THEREAFTER ON CRUDE OPIUM FOR MEDICINAL PURPOSES.

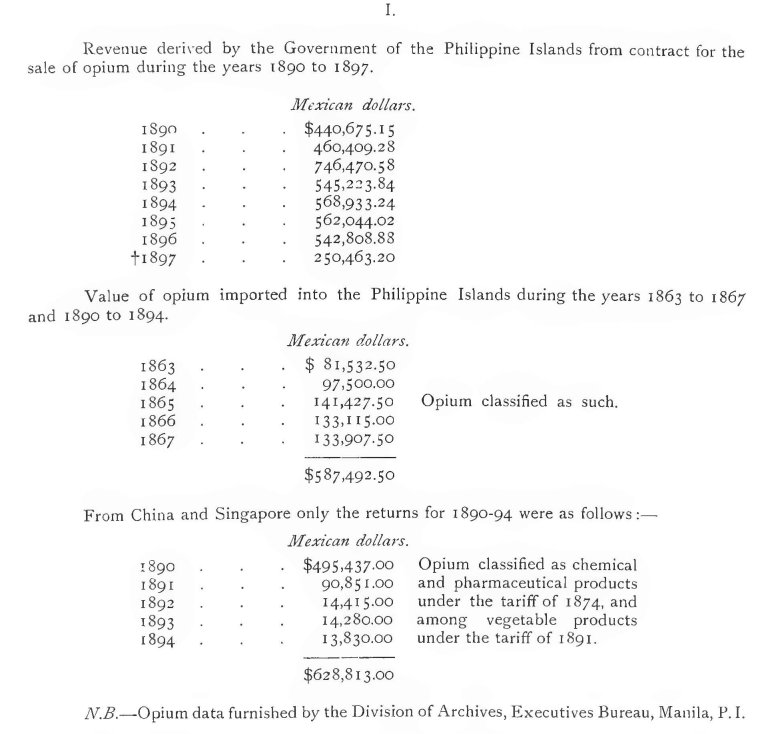

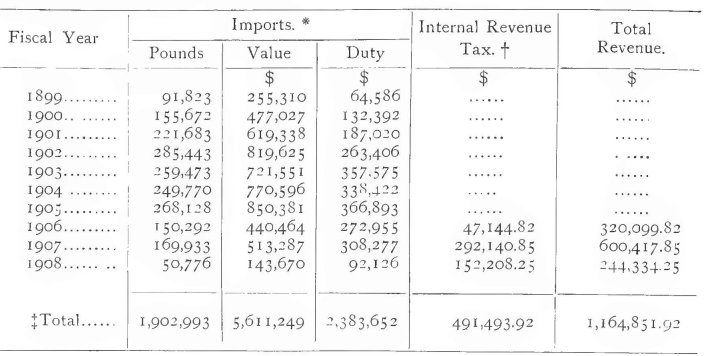

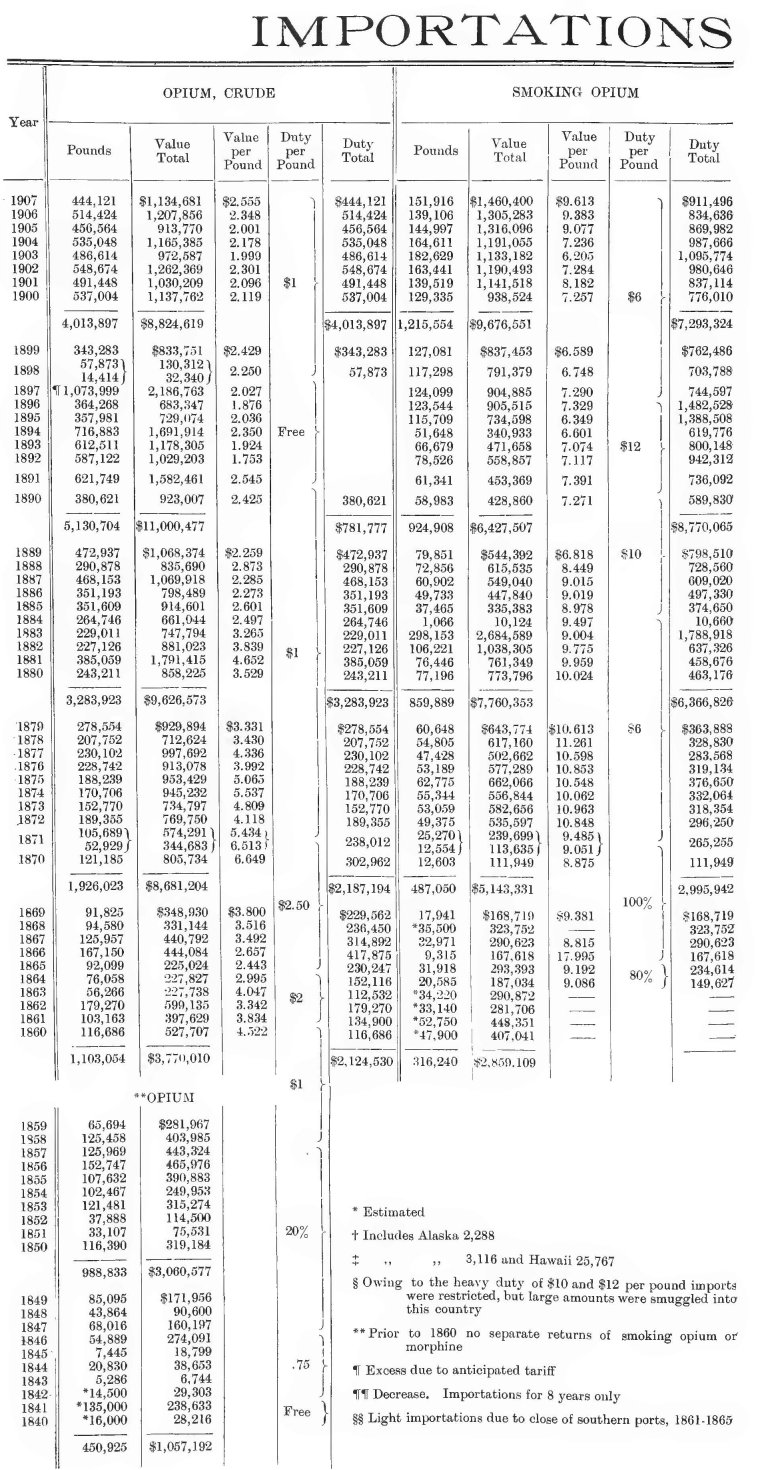

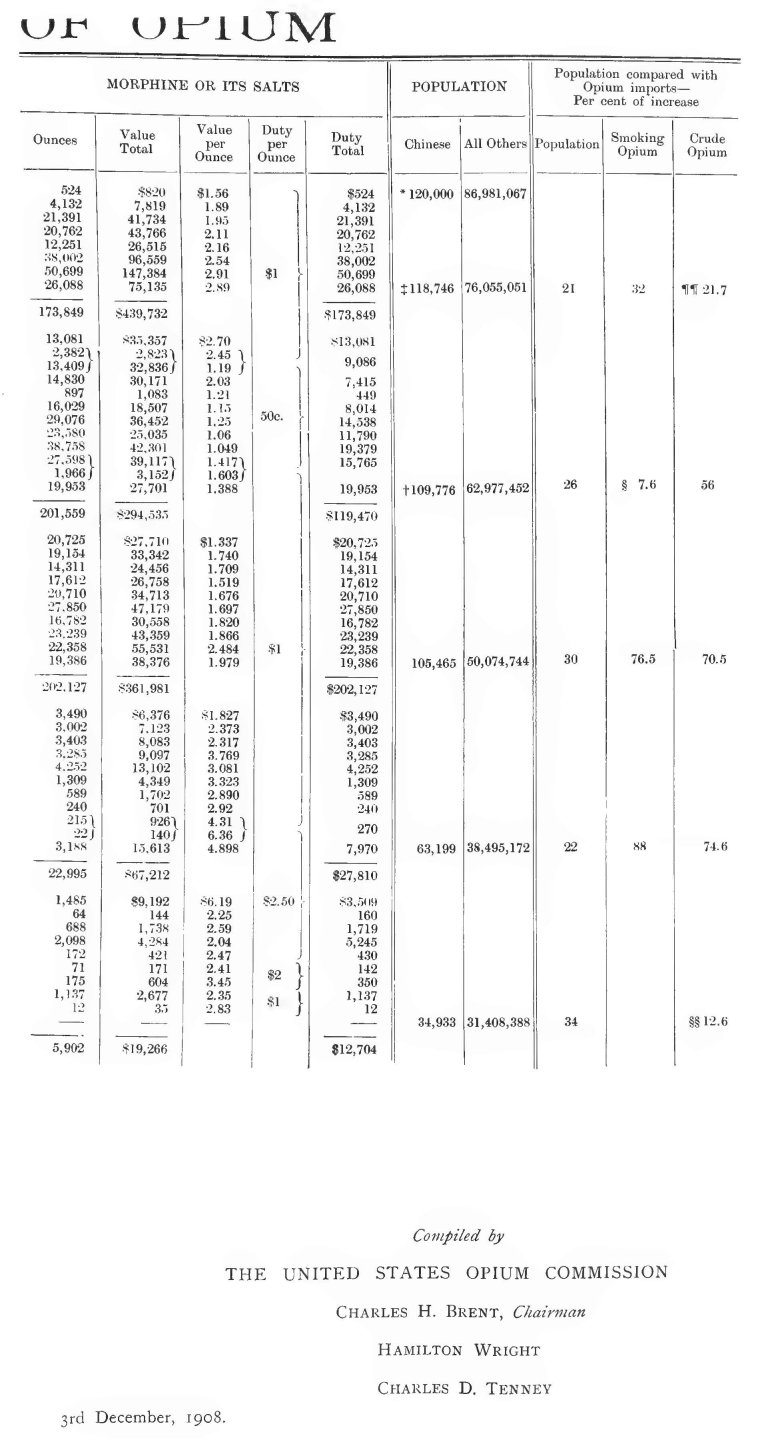

Mr. President, we think we can more readily explain our tariff laws governing the importation of opium if the International Commission has before it a table compiled by our Commission.

This table is concise as to our importation of different forms of opium and morphia, and the various duties imposed on all of them. It also presents features which will be referred to later.

It will be seen by this table that our first tariff record of the importation of opium of any sort was in 184o. Before 184o there is no mention in our tariff laws of opium or its derivatives or preparations. Opium, its derivatives, and preparations, were up to 184o admitted under the general title of " Drugs, chemicals, etc." In 184o, however, the attention of our Cong-ress was engaged to the large amount of opium then passing into the country, and it was discovered that, coincident with the influx of Chinese coolies to our Pacific Coast, a large amount of opium was entering the country. Opium was therefore (in 184o) taken out of the schedule of " Drugs and chemicals" and placed in a schedule of its own, and was put on the free list. No distinction was made at this time between crude opium imported ostensibly for medicinal purposes, morphia and its salts, and smoking opium.

It will be seen by the Table that, up to the enactment of our tariff of 1842, a considerable amount of opium entered the country. By the tariff of 1842, an ad valorem tax of 15 cents per pound was imposed and, in anticipation of it, it will be seen that in the year 1841, 135,00o pounds of opium entered the country. This large importation would appear to have been a speculative attempt to escape the 15 cts. per pound duty that was to be imposed the following year.

In 1846 a new tariff law came into operation. Opium was made to pay 2o per cent ad valorem and, as in 1841, so in 1850, in anticipation of the imposition of a higher ad valorem duty, there was again a speculative importation of a large amount of opium: 116,390 pounds. It will be seen by the Table that, in the following- years, 1851 and 1852, our importations fell off considerably. No doubt there was enough opium in the country to satisfy both licit and illicit needs.

So far as we can learn, the only object in imposing these ad valorem duties on opium was revenue needs.

It was found, however, by 1861 that it was no longer possible to collect an ad valorem rate on opium, for shippers were willing to make invoices to please buyers. A specific duty of $1.00 per pound was therefore placed on opium.

In the tariff of 1861 the distinction of crude opium, smoking opium and morphia or its salts was first made.

In our tariff laws of 1862 crude opium was taxed $2.00 a pound, and in 1864, $2.5o a pound. Undoubtedly this was primarily to produce an increased war revenue, our Civil War being waged at that ptriod.

In our tariff of 1870 a reduction of the duty on opium was made from $2.5o to r.00 a pound. That was but an expression of the general reduction in our tariff after the Civil War.

In r894 opium was put on the free list, but in our last tariff of 1897, it was again taxed $1.00 a pound.

TARIFF LAWS ON SMOKING OPIUM.

It will be noticed in the Table that by 1859 our imports of opium had reached an immense figure. It was discovered about the fifties that a large percentage of the opium imported in previous years was not crude opium imported for medicinal purposes, but largely consisted of smoking opium imported into San Francisco and other Pacific ports 1,vith the primary intention of supplying the Chinese.

In our tariff of 186r smoking opium was therefore removed from the opium schedule and placed in a schedule by itself, and taxed as opium prepared for smoking-. A larg-e ad valorem duty was placed upon this smoking opium. We shall explain later, when we come to speak of the effect of our tariff laws on importations of opium, that the importations varied considerably, due to the fact that smoking opium could not stand the high tax imposed.

Our people and Congress, realizing the iniquity of opium smoking, in the tariff laws of 1864 put a roo per cent ad valorem duty on smoking opium; hoping thereby to keep it (Art of the country. This method, however, of taxing an undesirable commodity out of the country, proved to be a failure. The only result was smuggling on an enormous scale, the enterprises being led by Chinese and by many of our "undesirable citizens." Reports from our various Collectors of Customs proved that smoking opium could not bear a tax of more than $6.00 per pound, and in our tariff law of 187o a $6.00 per pound duty was placed on it.

During the discussion of our next two tariffs there was a popular demand for the exclusion of smoking opium from our tariff schedules. This was largely due (1) to the fact that we had negotiated the treaty of 188o with China, which prohibited Chinese in the United States from importing opium; and (2) because the American people began to realize that the habit of opium smoking was spreading from the Chinese to our own American people.

Ten dollars and then twelve dollars per pound was imposed upon smoking opium; but here the old difficulty arose. It was again found that it could not bear a tariff of ten or twelve dollars a pound, and as the Table will show, though there was a considerable reduction in the amount of smoking opium entered at our Customs Houses, quite as much again or more was smuggled into the country.

Finally, in our so-called "McKinley Tariff" of 1897 after much correspondence with our Collectors of Customs, the tax on smoking- opium was reduced to $6.00 per pound, and there it has remained until to-day.

MORPHIA AND ITS SALTS.

We need not go into detail in regard to the tariff on morphia and its salts. It will be sufficient to state that the amounts shown in the Table as imported were not beyond the medicinal needs of our country up to the time, about 1890, when our manufacturers began to manufacture morphia profitably. Since then practically no morphia has entered the United States. The drugs classified as "Morphia or its Salts" are the rarer and more recently precipitated derivatives of opium, such as " heroin " and "codeine"; so that our importations of morphia and its salts are negligible.

LAST TARIFF COVERING OPIUM, MORPHIA, ET CETERA.

The following is the last tariff law covering the importation of various forms of opium, approved July 24, 1897:—

- Section 43. Opium, crude or unmanufactured, and not adulterated, containing nine per centum and over of morphia, one dollar per pound ; morphia or morphine, sulphate of, and all alkaloids or salts of opium, one dollar per ounce; aqueous extract of opium, for medicinal uses, and tincture thereof, as laudanum, and other liquid preparations of opium, not specially provided for in this Act, forty per centum ad valorem ; opium containing less than nine per centum of morphia, and opium prepared for smoking, six dollars per pound ; but opium prepared for smoking and other preparations of opium deposited in bonded warehouses shall not be removed therefrom without payment of duties, and such duties shall not be refunded."

EXCISE LAWS.

We have but one Internal Revenue Law that covers opium, a law that was approved October 1st, 1890. It is as follows:—

" Sec. 36. That an internal revenue tax of ten dollars per pound shall be levied and collected upon all opium manufactured in the United States for smoking purposes; and no person shall eng-age in the manufacture who is not a citizen of the United States and who has not given the bond required by the Commissioner of Internal Revenue.

" Sec. 37. That every manufacturer of such opium shall file with the collector of internal revenue of the district in which his manufactory is located such notices, inventories, and bonds, shall keep such books and render such returns of material and products, shall put up such signs and affix such number to his factory, and conduct his business under such surveillance of officers and agents as the Commissioner of Internal Revenue, with the approval of the Secretary of the Treasury, may by regulation, require. But the bond required of such manufacturer shall be with sureties satisfactory to the collector of internal revenue and in a penal sum of not less than five thousand dollars; and the sum of said bond may be increased from time to time and additional sureties required at the discretion of the collector and under instructions of the Commissioner of Internal Revenue.

"Sec. 38. That all prepared smoking opium imported into the United States shall, before removal from the custom house, be duly stamped in such manner as to denote that the duty thereon has been paid; and that all opium manufactured in the United States for smoking purposes, before being removed from the place of manufacture, whether for consumption or storage, shall be duly stamped in such permanent manner as to denote the payment of the internal revenue tax thereon.

" Sec. 39. That the provisions of existing laws governing the engraving-, issue, sale, account-ability, effacement, cancellation and destruction of stamps relating to tobacco and snuff, as far as applicable, are hereby made to apply to stamps provided for by the preceding section.

" Sec. 40. That a penalty of not more than one thousand dollars, or imprisonment not more than one year, or both, in the discretion of the court, shall be imposed for each and every violation of the preceding sections of this act relating to opium by any person or persons; and all prepared smoking opium wherever found within the United States without stamps required by this act shall be forfeited."

It will be seen by this law that an internal revenue tax of $10.00 per pound was imposed on smoking opium manufactured in the United States, its Territories and the District of Columbia, and that the manufacture was restricted to citizens of the United States.

We are glad to be able to state that no citizen has taken advantage of this law, and that not a pound of smoking opium has been licitly manufactured within the United States since the beginning of our government.

STATUTES IN RESTRAINT OF OPIUM TRAFFIC.

We have one other law besides that which made the American-Chinese Treaty effective, which imposes restrictions on our citizens as to the opium trade, namely :

" AN ACT TO PREVENT THE SALE OF FIREARMS, OPIUM, AND INTOXICATING

LIQUORS IN CERTAIN ISLANDS OF THE PACIFIC.

(Act of Feb. 14, igo2, ch. 18, 32 Stat. L. 33.)

" Sec. 1. (Sale of arms and intoxicants to Pacific Islands aborigines forbidden.) That any person subject to the authority of the United States who shall give, sell, or otherwise supply any arms, ammunition, explosive substance, intoxicating liquor, or opium to any aboriginal native of any of the Pacific islands lying within the twentieth parallel of north latitude and the fortieth parallel of south latitude and the one hundred and twentieth meridian of longitude west and one hundred and twentieth meridian of longitude east of Greenwich, not being in the possession or under the protection of any civilized power, shall be punishable by imprisonment not exceeding three months, with or without hard labor, or a fine not exceeding fifty dollars, or both. And in addition to such punishment all articles of a similar nature to those in respect to which an offense has been committed found in the possession of the offender may be declared forfeited. (32 Stat. L. 33.)

Sec. 2. (Medical use excepted.) That if it shall appear to the court that such opium, wine, or spirits have been given bonâ fide for medical purposes it shall be lawful for the court to dismiss the charge. (32 Stat. L. 33.)

" Sec. 3. (Deemed an offense on high seas.) That all offenses against this Act committed on any of said islands or on the waters, rocks, or keys adjacent thereto shall be deemed committed on the high seas on board a merchant ship or vessel belonging to the United States, and the courts of the United States shall have jurisdiction accordingly. (32 Stat. L. 33.)"

So much for our Treaties and Federal Statutes covering the opium question.

EFFECT OF OUR TREATIES, TARIFF, STATUTES, ETC.

What has been the effect of our Treaties and Tariff laws on the imports and exports of opium and its derivatives ? The Table will show it at a glance.

First as to Gum or Crude Opium for Medicinal purposes.

It will be seen that since 184o, in ten-year periods, there has been a large and progressive increase in our importations of this form of opium. Be it under a small ad valorem tax or a high specific tax, or be it on the free list, our imports of crude opium have grown.

Between 1840 and 184i the imports are largely estimated. But I have it from our Collectors of Customs that we can add another zo per cent. to the importations of that decade.

There is nothing to be remarked on the importations of the second decade from i850 to 1859.

In the third decade from 186o to 1869, we may say that our imports for that decade are estimated. The first four years of this decennium marked our Civil War and our Federal statistics do not record the opium that entered the Southern ports during those years. Undoubtedly the amount was large and would considerably swell the total of 1,10.3,054 pounds for the decade we are reviewing.

From 1870 to the present time, our statistics for crude opium may be accepted as representing the amount of opium that actually entered the country. They are net figures, for but little crude opium is re-exported from the United States.

Now, Mr. President and Fellow Commissioners, if we turn for a moment to the right hand columns of the Table, it will be seen that we have tabulated our population according to decades,—Chinese in one and all others in another column. The percent increase of population, per decade, has been reckoned, and the percent increase per decennary in our importations of crude opium.

PROPORTIONATE INCREASE IN IMPORTS OF CRUDE OPIUM.

Our importations of crude opium have not grown pari passu with our growth in population. We think it will be seen at once that this is so. In 1860 our total population increased 34 per cent. over the previous decade, while our importation of crude opium increased It should, perhaps, be 25 per cent. rather than 12.6 per cent., because, as the only i2.6 per cent. Commission will see, only light importations were,recorded due to the close of the Southern ports from 1861 to 1865.

In the next decade our population increased 2 2 per cent. and our importations of crude opium 74.6 per cent.

In 188o the proportionate increase in our population was 30 per cent. ; of crude opium 70.5 per cent.

In 189o, there was a 26 per cent. increase in population as against 56 per cent. increase in the imports of crude opium.

PROPORTIONATE INCREASE IN IMPORTS OF SMOKING OPIUM.

Now, Mr. President and Fellow Commissioners, as to the question of our importation of smoking opium.

As I stated in reviewing our tariff laws, we rnay add a considerable amount of smoking opium to the figures that are in the Table. It will be interesting now to see the proportionate rate of increase in our importations of smoking opium as compared with the proportionate increase in our Chinese and total population.

In 186o, it will be observed we had a Chinese population of slightly over 34,000. By IS7o that population had doubled, and as against 22 per cent. increase in our total population over that recorded in the previous census, we had an 88 per cent. increase in our importations of smoking opium. This, let us remind you, takes no account of the large quantities that we know were smuggled, but only of the importations recorded in the Table as having been legally entered at our Customs stations.

Ten years later 1880) we get to a period in our history when the agitation began against the immigration of Chinese coolies. Our Immigration Treaty with China was necrotiated in 1880.

The Table will show that since then our Chinese population has remained practically stationary. The increase recorded since then shows not an increased immigration into the United States, but a Chinese population that accrued to us as a result of the purchase of Alask-a and the annexation of Hawaii. In spite of the fact, however, that our Chinese population remained practically stationary, we find in 19oo a 26 per cent. increase in our total population and in the Table 7.6 per cent. increase in our importations of smoking opium. It might appear from the Table, if not carefully examined, that we had a decided fall in the percentage of increase in smoking opium at this census period. But it will be noticed that it was at this period that we had what was considered a prohibitive tariff on smoking opium,—$Io.00 and $12.00 a pound. The legalized importations fell off considerably, but we are informed by our Treasury Department that we may add to the figures from 1885 to 1896 at least 75 per cent as representing the amount of smoking opium smuggled into the country. The proportionate increase of smoking opium in i9oo should therefore more properly read 76 per cent rather than 7.6 per cent. With this explanation we propose to let the figures stand as in the Table.

By i9oo our percentage of increase in population over our population as shown in the census of 1890 was 2 per cent. as against 32 per cent. increase in our importation of smoking opium.

To review this phase of the subject hastily: In every census period we have had a per cent., increase in our importation of smoking opium, largely in excess of the per cent., increase in our population, and this in spite of the fact that our Chinese population has been practically stationary for thirty years.

WHERE DOES OUR OPIUM ORIGINATE?

We may state in passing to another phase of our opium question, that our crude opium imported ostensibly for medicinal purposes comes to us directly or indirectly from Smyrna and a few other Levantine ports. On the other hand, our smoking opium comes principally from Macao, and in some quantity from Hongkong.

It may be asked why, in view of our Treaty of 1880 with China forbidding citizens of the United States to engage in the opium trade in China and forbidding Chinese subjects to import smoking opium or manufacture it in the United States, we have continued to import smoking opium. We are informed that at the time this treaty was negotiated our State Department hoped that no American citizen would engage in the importation of smoking opium. Unfortunately, this has not been the case and up to to-day it has been the practice of American firms in San Francisco to import this smoking opium in their own names and than promptly hand it over to the real importers, certain Chinese firms on our Pacific Coast.

SMOKING OPIUM AND OUR CHINESE POPULATION.

Mr. President, it may be thought, in view of the fact that we have made a comparison between our present increase in importations of smoking opium and our Chinese population that the use of smoking opium is wholly confined to the Chinese element in our population. This is not so, however.

From a careful inquiry made in all the large Chinese communities in the United States, we have the following estimates as to the percentage of Chinese who smoke opium.

OPIUM SMOKED IN THE UNITED STATES BY CHINESE.

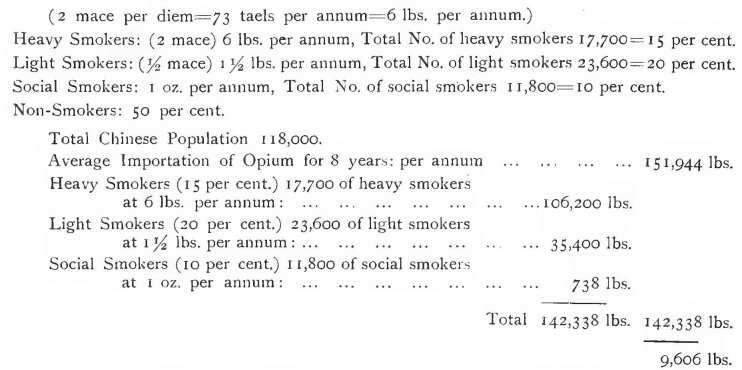

That is, from io tO 20 per cent. of our Chinese are habitual smokers and we may accept 2 mace per day as the average amount consumed by these habitués. Taking an average of 15 per cent. of heavy smokers at two mace a day, we would have as shown by the above table, 17,70o Chinese smoking 6 pounds of opium per annum, a total of Io6,20o pounds.

Light smokers, that is those who smoke when from illness they feel the need of it, say once a day or twice a week, would consume an average amount of about half a mace a day. /o per cent. of light smokers would give us 23,600 Chinese in this class. That would account for a per annum, per capita consumption of pounds, or a total of 35,400 pounds of smoking opium.

It developed in the course of our inquiry that amongst the Chinese population there is another class of smoker. We have classified this third class as the "Social Smoker," and we are quite within the case if we state that they represent io per cent. of our total Chinese population. A liberal estimate for each individual in this class is one ounce per annum. Chinese in this class confine their smoking to holidays and to ceremonial occasions, and smoke as a matter of courtesy only. This class represents say io per cent. of our Chinese population, a total of ',Soo Chinese who smoke one ounce of opium per annum, or a total of 718 pounds per annum. These smokers of different classes account for 142,338 pounds of the '52,944 pounds of our average importations for the past eight years.

This leaves 9,6o6 pounds of smoking opium not accounted for, and to it we must add an estimated, but large amount surreptitiously manufactured in the United States, and the-larger amount known to be smuggled annually. Not to depend on the figures of our Commission in the matter of this smuggled opium, it might be well to bring in the evidence of a fellow Commissioner who represents a great daughter nation of Great Britain in this. International Commission.

The Hon. Mackenzie King found in the course of his investigation of the opium question in Canada that in the coast cities of Vancouver, Victoria and New Westminster, there were at least seven factories carrying on an extensive business in the manufacture of smoking opium. He stated in his published report that it was estimated that the annual gross receipts of these combined concerns amounted for the year 1907 to between $600,000 and $650,000. Crude opium, he found, was imported from India in cocoanut shells, and was then. manufactured into smoking opium ; that these factories were owned and these manufactures. carried on by Chinese ; and that it was asserted by the owners of these establishments that all of the opium manufactured is consumed in canada by Chinese and white people ; but he himself concluded that there is strong reason for believing that much of what is produced at the present time is smuggled into China and the coast cities of the United States.

We will not at this moment enter into the question as to what becomes of the smoking. opium imported and smuggled into our country and not consumed by the Chinese.

GROWTH OF POPPY.

Before dwelling on the disposition of the vast amount of opium which we iinport, it may be well to state that within the United States itself we have no growth of the poppy that need be seriously considered, except in one State. The poppy in the State of California is quite extensively grown for its seed; the seed, of course, being used by our Syrian and other semi-Oriental population as a food, and the oil expressed from the seed used to adulterate other oils. Except in a few instances where physicians have experimentally endeavored to grow the poppy for opium, none of our people have been engaged in the growth for that purpose.

However, our Ag-ricultural Department has within the last few years grown the poppy, the object in view being to ascertain the practicability of obtaining from the ciried capsule walls, morphia, codeine and other alkaloids 110W obtained from opium; and they have succeeded.

The total amount grown last rear covered six acres and yielded 9,600 pounds of dried capsules.

DISPOSITION OF OUR IMPORTED OPIUM.

What becomes of the vast amount of crude and smoking opium imported into the United States ? First, to explain how we arrived at the facts that we are about to lay before the Commission.

Under our Federal system of Government we are at an advantag-e in getting out data of this sort. Our Government Departments cover in their operation the entire country, and work-ing together they may collect and collate all data on any problem that affects us. In addition to them and subordinate to them there are our State Governments covering part of the statistical ground already covered by our Federal Departments, and in addition covering that part of any field of inquiry not covered by our Federal Departments of Government. So that, in this opium inquiry, we had intersecting Federal and State channels all pouring their data into our office at the State Department.

In addition to tapping all Federal and State sources of information, we had the benefit of the experience and advice of over twelve hundred of our most learned physicians and surgeons ; the views of the heads of our American Medical Association and the heads of its State branches ; of the heads of our Association of American Physicians and of the Association of American Surgeons. But in many ways the most important gr,uicles to our securing facts were those gentlemen who have been engaged in opium brokerage, or in the manufacture and distribution of opium derivatives such as morphia, and products such as laudanum.

The social side of the opium problem was investigated by personal inquiry of those who throughout the country were best able to inform us. We do not think that a stone was left unturned that might conceal a fact of which this International Commission ought to know.

Our Commission wishes to acknowledge the frankness that met all of its inquiries, and the fine spirit that animated all organizations and individuals in communicating to us informa-tion and trade statistics.

FEDERAL LAWS.

On the 1st of January, 1907, there was put into effect our " National Food and Drugs Act," passed June 3oth, 1906.

The only part of that law which affects our present subject is Section 2, which states:

" That the introduction into any State or Territory or the District of Columbia from any other State or Territory or the District of Columbia, or from any foreign country, or shipment to any foreign country of any article of food or drugs which is adulterated or misbranded, within the meaning of this act, is hereby prohibited " ;

And then the Act goes on to define adulterated and misbranded drugs, and states fines, punishments, etc.

In regard to adulteration ; Section 7 states :-

" That for the purposes of this act an article shall be deemed to be adulterated : " In case of drugs": (and this includes opium)

" First. If, when a drug is sold under or by a name recognized in the United States Pharmacopoeia or National Formulary, it differs from the standard of strength, quality, or purity, as determined by the test laid clown in the United States Pharma-copoeia or National Formulary official at the time of investigation. P rovidea' , that no drug defined in the United States Pharmacopoeia or National Formulary shall be deemed to be adulterated under this provision if the standard of strength, quality or purity be plainly stated upon the bottle, box or other container thereof although the standard may differ from that determined by the test laid down in the United States Pharmacopoeia or National Formulary."

In regard to misbranding, Section 8 of the Act states as follows :

" That the term misbranded ' as used herein, shall apply to all drugs, or articles of food, or articles which enter into the composition of food, the package or label of which shall bear any statement, design, or device regarding such article, or the ingredients or substances contained therein which shall be false or misleading in any particular, and to any food or drug product which is falsely branded as to the State, Territory, or country in which it is manufactured or produced.

" That for the purposes of this Act an article shall also be deemed to be misbranded: " In the case of drugs :

" First. If it be an imitation of or offered for sale under the name of another article.

" Second. If the contents of the package as originally put up shall have been removed, in whole or in part, and other contents shall have been placed in such package, or if the package fail to bear a statement on the label of the quantity or proportion of any . . . morphine, opium, . . . heroin, . . . or any derivative or preparation of any such substances contained therein."

Without going into details, it will be sufficient to state that since the National Food and Drugs Act was passed, all of our States have remodelled or passed " State Food and Drug Acts" based on the provisions of the National Act.

STATE LAWS.

Some states have gone farther in the regulation of the sale of drugs. In addition to this Federal law, all but three states in our Union have State laws governing the sale of poisons and governing the sale and use of smoking opium. We will present those portions of the Massachusetts State Law as an illustration of what obtains in other states. The Massachusetts law may be taken to represent all such State laws :

" Sec. 42. Whoever opens or maintains a place to be resorted to by other persons, in which opium or any of its preparations is sold or given away to be smoked at such place, whoever at such place sells or gives away opium or any of its preparations to be there smoked or otherwise used and whoever visits or resorts to any such place for the purpose of smoking- opium or any of its preparations shall be punished by a fine of not more than five hundred dollars or by imprisonment for not more than six months, or by both such fine and imprisonment.

Sec. 43. If a person makes oath before a police, district or municipal court or trial justice that he believes or has probable cause to believe that any place, house, building or tellement within the jurisdiction of such court or justice is used or resorted to for the purpose of smoking opium or any of its preparations, or for the purpose of selling or giving away opium or any of its preparations to be smoked at such place, house, building or tenement, and that persons resort thereto for such purposes, such court or trial justice, whether the names of the persons last mentioned are known or unknown to the complainant, shall, if satisfied that there is probable cause therefor, issue a warrant commanding the sheriff or his deputy or any constable or police officer to enter such place, house, building or tenement and there to arrest the keepers thereof, and all persons there present, whether stnoking or not, if the implements for smoking opium or any of its preparations are there found, and seize all the opium or preparations thereof and all the implements for smoking the same and all the furniture, fixtures and other personal property there found, and to keep said persons, opium, preparations thereof, imple-ments, furniture, fixtures and property so that they may be produced before a court or magistrate, to be dealt with according to law. Whoever is found so present or so smoking shall be punished by a fine of not more than one hundred dollars for each offence. The provisions of sections three to eight, inclusive, of chapter 217 relative to articles seized under clause eleven of section one of said chapter shall apply to all opium, preparations thereof, implements, furniture, fixtures and property so seized.

"Sec. 44. An officer who makes a search under the provisions of the preceding section shall not be permitted to use any evidence of any crime, except that of opium smoking, which he may discover, in making further prosecutions against the persons whose premises are searched.

" CHAPTER 213, REVISED LAWS OF MASSACHUSETTS.

Sec. 2. Whoever sells arsenic (arsenious acid), atropia or any of its salts, chloral hydrate, chloroform, cotton root and its fluid extract, corrosive sublimate, cyannide of potassium, Donovan's solution, ergot and its fluid extract, Fowler's solution, laudanum, McMunn's elixir, morphia or any of its salts, oil of pennyroyal, oil of savin, oil of tansy, opium, Paris green, Parson's vermin exterminator, phosphorus, prussic acid, rough on rats,' strychnia, or any of its salts, tarter emetic, tincture of aconite, tincture of belladonna, tincture of digitalis, tincture of nox vornica, tincture of veratrum viride, or cabolic acid,. without the written prescription of a physician, shall affix to the bottle, box or wrapper containing the article sold a label of red paper upon which shall be printed in large black letters the name and place of business of the vendor and the words Poison and Antidote,. and the label shall also contain the name of an antidote, if any, for the poison sold. He shall also keep a record of the name and quantity of the article sold and of the name and residence of the person or persons to whom it was delivered, which shall be made before the article is delivered and shall at all times be open to inspection by the officers of the district police and by the police authorities, and officers of cities and towns ; but no sale of cocaine or its salts shall be made except upon the prescription of a physician. Whoever neglects to affix such label to such bottle, box or wrapper before delivery thereof to the purchaser or whoever neglects to keep or refuses to show to said officers such record or whoever purchases any of said poisons and gives a false or fictitious name to the vendor shall be punished by a fine of not more than fifty dollars. The provisions of this section shall not apply to sales bv wholesale dealers or manufacturing chemists, to retail dealers, or to a genera-1 merchant who sells Paris green, London purple or other arsenical poisons in unbroken packages containing not less than one-quartet- of a pound, for the sole purpose of destroying potato bugs or other insects upon plants, vines, or trees except that he shall record each sale and label each package sold, as above provided."

The following are the New York statutes relating- to the use of opium and its. derivatives:—

"Sec. 4o5 of the Penal Code of the State of New York, REGULATIONS AS TO. PRESCRIPTIONS OF OPIUNI AND MORPHINE.' person who, except on written or verbal order of a physician, refills more than once prescriptions containing opium,. morphine or preparations of either, in which the dose of opium exceeds one-fourth grain or morphine one-twentieth g-rain is guilty of a misdemeanor.

Sec. 2 IS of the Public Health Law. PRESCRIPTION OF OPIUM, MORPHINE, COCAINE AND.

CHLORAL.' No pharmacist. druggist, apothecary or other person shall refill more than once, prescriptions containing opium or morphine or preparations of either of them or cocaine or chloral, in which the dose of opium shall exceed one-quarter of a grain, or of morphine one-twentieth of a grain, or of cocaine one-half of a grain, or of chloral ten grains, except upon the written order of a physician.

"Sec. 402 of the Penal Code: 'SELLING POISON WITIIOUT LABELLING AND RECORDING THE SALE.' It shall be unlawful for any person to sell at retail or furnish any of the-poisons named in the schedules hereinafter set forth, without affixing or causing to be affixed to the bottle, box, vessel or package, a label containing the name of the article and the word 'Poison' distinctly shown, with the name and place of business of the seller all printed in red ink, together with the name of such poisons printed or written thereupon in plain, legible characters, which schedules are as follows, to wit:

" SCHEDULE A.

" Arsenic, cyanide of potassium, hydrocyanic acid, cocaine, morphine, strychnia and all other poisonous alkaloids and.their salts, oil of bitter almonds containing hydrocyanic acid, opiunz ana' its preparations, except paregoric and such others as contain less than two grains of opium to the ounce."

" Sec. 388 of the Penal Code: PERMITTING BUILDINGS TO BE USED FOR NUISANCE, ETC.'. A person who,

" 1. Lets, or permits to be used, a building, or a portion of a building, knowing that. it is intended to be used for committing or maintaining a public nuisance, or

" 2. Opens or maintains a place where opium, or any of its preparations, is smoked by other persons, or

" 3. At such place sells or gives away any opium, or its said preparations, to be there smoked or otherwise used, or

"4. Visits or resorts to any such place for the purpose of smoking opium or its said preparations ; is guilty of a misdemeanor."

THE FOLLOWING IS A

LAW OF ONE OF OUR SOUTHERN STATES.

NARCOTIC BILL OF GEORGIA.

AN ACT TO PROVIDE AGAINST THE EVILS RESULTING FRONI THE TRAFFIC IN CERTAIN NARCOTIC DRUGS AND TO REGULATE THE SALE THEREOF.

SeC. I. Be it enacted by the General Assembly of the State of Georgia, That it shall be unlawful for any person, firm or corporation to sell, furnish or give away any cocaine, alpha or beta eucaine, opium, morphine, heroin, chloral hydrate or any salt or compound of any of the foregoing substances, or any perparation or compound containing any of the foregoing substances, or their salts, or compounds, except upon the original written orders or prescription of a lawfully authorized practitioner of medicine, dentistry or veterinary medicine, which order or prescription shall be dated and shall contain the name of the person for whom prescribed, or if ordered by a practitioner of veterinary medicine, shall state the kind of animal for which ordered, and shall be signed by the person given the prescription or order. Such written order or prescription shall be permanently retained on file by the person, firm or corporation who shall compound or dispense the articles ordered or prescribed, and it shall not be again cotnpounded or dispensed except upon the written order of the prescriber for each and every subsequent compounding or dispensing. No copy or duplicate of such written order or prescription shall be made or delivered to any person, but the original shall at all times be open to inspection by the prescriber and properly authorized officers of the law. Provided, however, that the above provisions shall not apply to pre-parations containing not more than four grains of opium, or not more than one grain of morphine, or not more than one-fourth grain of heroin, or not more than one-eighth grain of alpha or beta eucaine, or not more than twenty grains of chloral hydrate in one fluid ounce, or if, a solid preparation, in one avoirdupois ounce. Provided, also, that the above provisions shall not apply to preparations containing opium and recommended and sold in good faith for diarrhoea and cholera, each bottle or package of which is accompanied by specific directions for use, and a caution against habitual use, nor to powder of ipecac and opium, commonly known as Dover's Powders, nor to liniments or ointments plainly labelled " For External Use Only." And provided further, That the above provisions shall not apply, to sales at wholesale by jobbers, wholesalers and manufacturers, to retail druggists or qualified physicians or to each other, nor to sales at retail by retail druggists to regular practitioners of medicine, dentistry or veterinary medicine, nor to sales made to manufacturers of proprietary or pharmaceutical preparations for use in the manufacture of such preparations, nor to sales to hospitals, colleges, scientific or public institutions.

Sec 2. It shall be unlawful for any practitioner of medicine, dentistry or veterinary medicine to furnish to or to prescribe for the use of any habitual user of the same any cocaine, heroin, alpha or beta eucaine, opium, morphine, chloral hydrate or any salt or compound of any of the foregoing substances, or any preparation containing any of the foregoing substances or their salts or compounds, and it shall also be unlawful for anv practitioner of dentistry to prescribe any of the foregoing substances for any person not under his treatment in the regular practice of his profession, or for any practitioner of veterinary medicine to prescribe any of the foregoing substances for the use of any human being. Provided, however, that the provisions of this Section shall not be construed to prevent any lawfully authorized practitioner of medicine from furnishing or prescribing in good faith for the use of any habitual user of any narcotic drugs, who is under his professional care, such substances as he may deem necessary for their treatment, when such prescriptions are not given or substances furnished for the purpose of evading the purposes of this Act.

Sec. 3. Any person who shall violate any of the provisions of this Act shall be deemed guilty of a misdemeanor, and upon conviction shall be punished as prescribed in Section to39 of Volume Three of the Code of 1895. It shall be the duty under this Act of Judges of the Superior Court in this State at every regular term thereof to charge all regular impannelled grand juries to diligently inquire into and investigate all cases of the violation of the provisions of this Act, and to make a true presentment of all persons guilty of such violation. It shall be the duty of the Board of Pharmacy to cause the prosecution of all persons, violating the provisions of this Act. No prosecution shall be brought for the sale of any proprietary or patent medicines containing any of the drugs or preparations herein before mentioned until the Board of Pharmacy shall certify that such medicine contains any of the said drugs or preparations in excess of the maximum percentage herein before mentioned.

Sec. 4. In any proceedings under the provisions of this Act the charge may be brought against any or all of the members of a partnership or against the directors or executive officers of a corporation, or against the agent of any person, partnership or corporation.

Sec. 5. All laws and parts of laws in conflict with this Act are hereby repealed.

MUNICIPAL LAWS.

In addition to these State laws, every large city in our union has police regulations governing- the sale and use of smoking opium and in many instances of all the better known poisons.

\AN ACT TO REGULATE TIIE I'RACTICE OF PHARMACY AND THE SALE OF POISONS IN THE DISTRICT OF COLUMBIA, AND FOR 0THER PURPOSES.

(Approved May 7, 1906. Public—No. 148.)

Be it enacted by the Senate and House of Representatives of the Unitea' States of America in Congress assembled, That it shall be unlawful for any person not licensed as a pharmacist within the meaning of this Act to conduct or manage any pharmacy, drug or chemical store, apothecary shop, or other place of business for the retailing, compounding, or dispensing of any drugs, chemicals, or poisons, or for the compounding of physicians' prescriptions, or to keep exposed for sale, at retail, any drugs, chemicals, or poisons, except as hereinafter provided ; or, except as hereinafter provided, for any person not licensed as a pharmacist within the meaning of this Act to compound, dispense, or sell, at retail, any dru,g, chemical, poison, or phartnaceutical preparation upon the prescription of a physician, or othervvise, or to cotnpound physicians' prescrip-tions, except as an aid to and under the proper supervision of a pharmacist licensed under this Act. And it shall be unlawful for any owner or manager of a pharmacy, drug store, or other place of business to cause or permit any person other than a licensed pharmacist to compound, dispense, or sell, at retail, any drug, medicine, or poison, except as an aid to and under the proper supervision of a licensed pharmacist : Provided, That nothing in this section shall be construed to interfere with any legally registered practitioner of medicine, dentistry, or veterinary surgery in the compounding of hiQ oi,vn prescriptions, or to prevent him from supplying to his patients such medicines as he may deem proper ; nor with the exclusively wholesale business of any dealer who shall be licensed as a pharmacist, or who shall keep in his employ at least one person who is so licensed, except as hereinafter provided ; nor with the sale by others than pharmacists of poisonous substances sold exclusively for use in the arts, or as insecticides, when such sub-stances are sold in unbroken packages bearing labels having plainly printed upon them the name of the contents, the word " poison," when practicable the name of at least one suitable antidote, and the name and address of the vendor : Provided further, That such person, firm, or corporation has obtained a permit from the board of supervisors in medicine and pharmacy, which grants the right and privilege to make such sales, such permit to be issued for a period of three years, and that each sale of such substance be registered as required of a licensed pharmacist, and it shall be unlawful for any person under the age of twenty-one years to sell such substances, and in no case shall the sale be made to a person under eighteen years of age except upon the written order of a person known or believed to be an adult : And provided further, That persons other than registered pharmacists may sell household ammonia and concentrated lye, in sealed containers plainly labelled, so as to indicate the nature of the contents, with the word " poison," and with a statement of two or more antidotes to be used in case of poisoning and may sell bicarbonate of' soda, borax, cream of tartar, olive oil, sal ammoniac, sal soda; and persons other than registered pharmacists may, furthermore, sell in original sealed containers, properly labeled, such compounds as are commonly known as " patent " or " proprietary " medicines, except those the sale of which is regulated by the provisions of sections eleven and thirteen of this Act.

Sec. 2. That every person now registered as a pharmacist in the District of Columbia, under an Act to regtilate the practice of pharmacy in the District of Columbia, approved June fifteenth, eighteen hundred and seventy-eight, shall be entitled to be licensed under this Act without examination or payment of fee, provided that he make application therefor on or before the thirty-first day of December next ensuing after the passage of this Act. Any person registered as aforesaid shall, until said date, by virture of such registration be entitled to all the rights, privileges, and immunities to which pharmacists licensed under this Act are entitled, and be subject to all the obligations and duties of such licentiates.

Sec. 3. That every person not registered under an Act to regulate the practice of pharmacy, in the District of Columbia, approved June fifteenth, eighteen hundred and seventy-eight, who shall desire to be licensed as a pharmacist shall file with the board of supervisors in medicine and pharmacy an application, duly verified under oath, setting forth the name and age of the applicant, the place or places at which he pursued, and the time spent in the study of pharmacy, the experience which the applicant has haci in com-pounding physicians' prescriptions under the direction of a licensed pharmacist, and the name and location of the school or college of pharmacy, if any, of which he is a graduate, and shall submit evidence sufficient to show to the satisfaction of said board that Ile is of good moral character and not addicted to the use of alcoholic liquors or narcotic drugs so as to render him unfit to practice pharmacy; and said applicant shall appear at a time and place designated by the board of supervisors aforesaid and submit to an examination by the board of pharmaceutical examiners as to his qualifications for license as a pharmacist: Provided, That applicants shall be not less than twenty-one years of age, and shall have had at least four years' experience in the practice of pharmacy or shall have served three years under the instruction of a regular licensed pharmacist, and any applicant who has been graduated from a school or college of pharmacy re-cognized by said board as in good standing- shall be entitled to examination upon presentation of his diploma: Provided firrther, That any applicant intending to limit his practice to compounding and dispensing homeopathic remedies and prescriptions may be licensed, if otherwise qualified. Any applicant intending to compound and dispense homeopathic remedies and prescriptions shall so state in his application for license as a pharmacist, and it shall thereupon become the duty of the board of supervisors afore-said to appoint a committee of three, physicians or pharmacists, or both, adherents to the homeopathic system of medical practice, to examine said applicant in homeopathic materia medica and pharmacy, .and to report the result thereof to said boarci. Every such applicant, however, shall be subjected in all respects to the same examinations by the board of pharmaceutical examiners as are applicants generally, except that an applicant intending to limit his practice to the compounding and dispensing of homeo-pathic remec-lies and prescriptions shall not be examined by said board of pharmaceutical examiners in materia medica and pharmacy. But the license issued to any applicant after a limited examination as aforesaid shall permit him to compound or dispense homeopathic remedies and prescriptions only. No person shall compound or dispense homeopathic remedies or prescriptions who has not been licensed so to do, nor shall any person who has been licensed to compound and dispense homeopathic remedies and prescriptions alone compound or dispense other remedies or prescriptions, except "patent" or " proprietary " remedies in original packages.

Sec. 4. That if the applicant for license as a pharmacist has complied with the requirements of either of the two preceding sections, the board of supervisors in medicine and pharmacy shall issue to him a license which shall entitle him to practice pharmacy in the District of Columbia, subject to the provisions of this Act.

Sec. 5. That the board of supervisors in medicine and pharmacy shall issue licenses to practice pharmacy in the District of Columbia without examination, or after limited examination, as said board may determine, to such persons as have been legally registered or licensed as pharmacists in States, Territories, or foreign countries : Provided, That the applicant for such license present satisfactory evidence of qualifications equal to those required of licentiates examined under this Act, and that he was registered or licensed after examination in such State, Territory, or foreign country not less than one year prior to the date of application ; that the standard of competence required in such State, Territory, or foreign country is not lower than that required in the District of Columbia, and that such State, Territory, or foreign country accords similar recognition to licentiates of the District of Columbia, all of which shall be determinable by the board of supervisors aforesaid. Applicants for license under this section shall forward with their application a fee of ten dollars.

Sec. 6. That the license of any person to practice pharmacy in the District of Columbia may be revoked if such person be found to have obtained such license by fraud ; or to be addicted to the use of any narcotic or stimulant, or to be suffering from physical or mental disease, in such manner and to such an extent as to render it expedient that in the interests of the public his license be cancelled ; or to be of an immoral character ; or if such person be convicted in any court of competent jurisdiction of any offense involving moral turpitude. It shall be the duty of the major and superintendent of police of said District to investigate any case in which it is discovered by him, or made to appear to his satisfaction, that any license issued under the provisions of this Act is revocable and to report the result of such investigation to the board of supervisors in medicine and pharmacy, which board shall, after full hearing, if in their judgment the facts warrant it, revoke such license.

Sec. 7. That in the month of November of each year every licensed dealer in poisons for use in the arts or as insecticides, whose permit has been issued not less than three years prior to the first day of such month, shall apply to the board of supervisors in medicine and pharmacy for the renewal of such permit. And said board is hereby authorized, upon the payment of such fees as are hereinafter provided, to renew such permit in the month of November for a period of three years from the thirty-first day of October immediately preceding the date thereof. And every permit not renewed within the month of November as aforesaid shall be void and of no effect unless and until renewed. Any license, permit, or renewal obtained through fraud, or by any false or fraudulent representation, shall be void and of no effect. No person shall make any false or fraudulent representation for the purpose of procuring a license, permit, or renewal thereof, either for himself or for another.

Every license to practice pharmacy, and every permit to sell poisons, for use in the arts or as insecticides, and every current renewal of such permit shall be conspicuously displayed by the person to whom the same has been issued in the pharmacy, drug store, or place of business, if any, of which the said person is the owner or manager.

Sec. 8. That there shall be in and for the District of Columbia a board of pharmaceutical examiners, consisting of five licensed pharmacists, appointed by the Commissioners of said District, each of whom shall have been for the five years immediately preceding, and shall be during the term of his appointment, actively engaged in the practice of pharmacy in said District. All appointments shall be made in such manner that the term of office of one examiner shall expire on the thirtieth day of June of each year, but every examiner shall hold office after the expiration of the term for which he has been formally appointed until his successor has been appointed and qualified. No appointee shall enter upon the discharge of his duties until he has taken oath fairly and impartially to perform the same. Said Commissioners may remove, after full hearing, any member of said board for neglect of duty or other just cause.

That annually the board of pharmaceutical examiners shall organize by the election of a president and a secretary, both of whom shall be members of said board, who shall hold office for one year and until their successors shall have been elected and qualified. Said board shall hold meetings for the examination of candidates and for the discharge of such other business as may come before it, commencing on the second Thursdays in January, April, July, and October of each year and at such other times as the board of supervisors in medicine and pharmacy shall direct ; and said board of pharmaceutical examiners shall examine all applicants for license to practice pharmacy certified to it for that purpose by the board of supervisors in medicine and pharmacy, and shall report the results of such examination to said board of supervisors as speedily as practicable.

Sec. 9. That from and after the passage of this Act the board of medical supervisors of the District of Columbia shall be known as the board of supervisors in medicine and pharmacy of the District of Columbia ; and the president of the board of pharmaceutical examiners shall be ex o cio a member of said board of supervisors in addition to the members now provided for by law ; and said board of pharmaceutical examiners shall bear in all respects the same relations to the board of supervisors aforesaid as each of the boards of medical examiners of said District now bears to the board of medical supervisors thereof; and said board of supervisors shall have all such rights, powers, and duties with respect to the examination of applicants for license as pharmacists and with reference to the issue of licenses to practice pharmacy and of permits to sell poisons for use in the arts, or as insecticides as said board now has with reference to the examination of applicants for license to practice medicine, surgery, and midwifery, and with reference to the issue of licenses to such persons, except in so far as may be inconsistent with the provisions of this Act. Said board shall elect from its membership a secretary and treasurer, respec-tively. The treasurer of said board shall give such bond for the proper performance ot his duties as the Commissioners of the Disirict of Columbia shall deem proper and shall render to said Commissioners accounts of his receipts and disbursements from time to time as said Commissioners shall direct. All licenses issued by said board of supervisors shall be countersigned by the president of the examining board by which the candidate was, examined. Said board of supervisors shall keep records of its proceedings, and such records shall be priml facie evidence of all matters contained therein in all courts in the District of Columbia. Said board of supervisors shall, in the month of July of each year, make to the Commissioners of the District of Columbia a written report of its proceedings, of its receipts and disbursements, and of all licenses and permits issued. All records, funds, and other property in the possession of the commissioners of pharmacy of the District of Columbia at the time of the passage of this Act shall be delivered to such officer, or officers of the board of supervisors in medicine and pharmacy as may be designated by said board. And such funds may be used for the payment of such necessary expenses as said board of supervisors may incur in the execution of the provisions of this Act during the twelve months immediately following the passage thereof, and any balance which remains on hand at the expiration of that time shall be deposited with the collector of taxes in said District and by him deposited in the Treasury of the United States to the credit of the District of Columbia.

Sec. 10. That applicants for license to practice pharmacy and for permits to sell poisons for use in the arts or as insecticides shall pay the following fees: For examination for license as pharmacist, ten dollars; for a permit for the sale of poisons for use in the arts or as insecticides, one dollar, and for each renewal thereof, fifty cents.

And hereafter all fees for licenses to practice medicine and surgery and all fees aforesaid shall be paid to the treasurer of the board of supervisors in medicine and pharmacy of the-District of Columbia before any applicant may be admitted to examination and before any license or permit, or any renewal thereof, may be issued by the said board. And all expenses of said board and of the boards of examiners incident to the execution of the provisions of this Act and of an Act to regulate the practice of medicine and surgery, to license physicians and surgeons, and to punish persons violating the provisions thereof in the District of Columbia, approved June third, eighteen hundred and ninety-six, shall be paid from the fees collected by the board of supervisors aforesaid. If any balance remain on hand on the thirtieth day of June of any year the meinbers of said board appointed as such shall be paid therefrom such reasonable amounts as the Commissioners of the District of Columbia may determine. And the balance then in hand, or so much thereof as said board of supervisors may deem proper, shall be divided among the several boards of examiners in proportion to the number of candidates examined by each, each member of such board of examiners to receive such part of the entire amount paid to that board as that board itself may determine.

Sec. 11. That it shall be unlawful for any person, by himself, or by his servant or agent, or as the servant or agent of any other person, or of any firm or corporation, to sell, furnish, or give away any cocaine, salts of cocaine, or preparation containing cocaine or salts ot cocaine; morphine, salts of morphine, or preparation containing mOrphine or salts of morphine; or any opium, or preparation containing opium ; or any chloral hydrate, or preparation containing chloral hydrate, except upon the original written order or prescrip-tion of a lawfully authorized practitioner of medicine, dentistry, or veterinary medicine, which order or prescription shall be dated and shall contain the name of the person for whom prescribed or, if ordered by a practitioner of veterinary medicine, shall state the kind of animal for which ordered, and shall be signed by the person giving the order or prescription. Such order or prescription shall be, for a period of three years, retained on, file by the person, firm, or corporation who compounds or dispenses the article ordered or prescribed, and it shall not be compounded or dispensed after the first time, except upon the written order of the original prescriber : Provided, That the above provisions shall not apply to preparations containing not more than two grains of opium, or not more than one-quarter g,rain of morphine, or not more than one-quarter grain of cocaine, or not more than two grains of chloral hydrate in the fluid ounce, or, if a solid preparation, in one avoirdupois ounce. The above provisions shall not apply to preparations sold in good faith for diarrhoea and cholera, each bottle or package of which is accompanied by specific directions for use and caution against habitual use, nor to liniments or ointments sold in good faith as such when plainly labelled " for external use only," nor to powder of ipecac and opium, commonly known as Dover's powder, when sold in quantities not exceeding twenty grains : Provided further, That the above provisions shall not apply to sales at wholesale by jobbers, manufacturers, aud retail druggists, hospitals, and scientific or public institutions.

Sec. 12. That no physician in the District of Columbia, knowing, or when he might by reasonable inquiry know, that any person is addicted to the use of cocaine, morphine, opium, or chloral hydrate, shall furnish to or for the use of such person, or prescribe for such person, the drug aforesaid, to the use of which such person is addicted, or any compound thereof, or any preparation containing the same, except as it may be necessary to furnish or prescribe such drug, compound, or preparation aforesaid for the cure of drug addiction aforesaid, or for the treatment of disease, injury', or deformity : Provided, That no physician shall be convicted under the provisions of this section \vho shows to the satisfaction of the court before which he is tried that, having exercised due diligence and acting in good faith, he furnished or prescribed such drug, compound, or preparation aforesaid believing the same to be necessary, for the cure of drug addiction aforesaid, or for the treatment of disease, injury, or deformity, and for no other purpose whatsoever. No dentist shall furnish or prescribe any drug, compound, or preparation aforesaid to, or for the use of, anv person not under his treatment in the regular course of his professional work, nor in any- case otherwise than may be required by such work. No practitioner of veterinary medicine shall furnish or prescribe any drug, compound, or preparation aforesaid for the use of any human being, or when Ile has reasonable ground for believing that the drug, compound, or preparation aforesaid is desired or intended for the use of any human being : P rovided further, That nothing in this section contained shall be construed to give to dentists or to practitioners of veterinary, medicine the right to furnish or prescribe anv drug, compound, or preparation whatsoever otherwise than as is usual and customary, in the practice of dentistry and veterinary medicine, respectively.

Sec. 13. That it shall be unlawful for any person to sell or deliver to any other person any of the following, described substances, or any poisonous compound, combination, or prepara-tion thereof, to wit : The compounds of and salts of antimony, arsenic, barium, chromium, copper, gold, lead, mercury, silver, and zinc ; the caustic hydrates of sodium and potassium, solution or water of ammonia, methyl alcohol, paregoric, the concentrated mineral acids, oxalic and hydrocyanic acids and their salts, yellow phosphorus, Paris green, carbolic acid, the essential oils of almonds, pennyroyal, tansy, rue, and savin ; croton oil, creosote, chloroform, cantharides, or aconite, belladonna, bitter almonds, colchicum, cotton root, cocculus indicus, conium, cannabis indica, digitalis, ergot, hyos-yamus, ignatia, lobelia, nux vomica, physostigma, phytolacca, strophantus, stramonium, veratrum viride, or any of the poisonous alkaloids or alkaloidal salts derived from the foregoing, or any other poisonous alkaloids or their salts. or any other virulent poison, except in the manner following, and, moreover, if the applicant be less than eighteen years of age, except upon the written order of a person known or believed to be an adult.

It shall first be learned, by due inquiry, that the person to whom delivery is about to be made is aware of the poisonous character of the substance, and that it is desired for a lawful purpose, and the box, bottle, or other package shall be plainly labelled with the name of the substance, the word " poison," the name of at least one suitable antidote when practicable, and the name and address of the person, firm, or corporation dispensing the substance. And before delivery be made of any of the foregoing substances, excepting solution or water of ammonia, and sulphate of copper, there shall be recorded in a book kept for that purpose the name of the article, the quantity, delivered, the purpose for which it is to be used, the date of delivery, the name and address of the person for whom it is procured, and the name of the individual personally dispensing the same; and said book shall be preserved by the owner thereof for at least three years after the date of the last entry therein. The foregoing provisions shall not apply to articles dispensed upon the order of persons believed by the dispenser to be lawfully authorized practitioners of medicine, dentistry, or veterinary surgery : Provided, That when a physician writes upon his prescription a request that it be marked or labelled " poison," the pharmacist shall, in the case of liquids, place the same in a colored glass, roughened bottle, of the kind commonly known in trade as a " poison bottle," and, in the case of dry substances, he shall place a poison label upon the container. The record of sale and delivery, above mentioned shall not be required of manufacturers and wholesalers who shall sell any of the foregoing substances at wholesale to licensed pharmacists, but the box, bottle, or other package containing such substance, when sold at wholesale, shall be properly labelled with the name of the substance, the word " poison," and the name and address of the manufacturer or wholesaler: Provided further, That it shall not be necessary, in sales either at wholesale or at retail, to place a poison label upon, nor to record the delivery of, the sulphide of antimony, or the oxide or carbonate of zinc, or of colors ground in oil and intended for use as paints, or calomel, or of pareg-oric when sold in quantities not over two fluid ounces ; nor, in the case of preparations containing any. of the substances named in this section, when a single box, bottle, or other package, or when the bulk of one-half fluid ounce, or the weight of one-half avoirdupois ounce, does not contain more than an adult medicinal dose of such substance ; nor in the case of liniments or ointments, sold in good faith as such, when plainly labeled " for external use only." ; nor in the case of prepara-tions put up and sold in the form of pills, tablets, or lozenges, containing any of the substances enumerated in this section and intended, for internal use, when the dose recommended does not contain more than one-fourth of an adult medicinal dose of such substance.

For the purpose of this and of every other section of this Act no box, bottle, or other package shall be regarded as having been labelled " poison " unles,, the word " poison " appears conspicuously thereon, printed in plain, uncondensed Gothic letters in red ink.

Sec. 14. That no person seeking to procure in the District of Columbia any, substance the sale of which is regulated by the provisions of this Act shall make any fraudulent repre-sentations so as to evade or defeat the restrictions herein imposed.

Sec. 15. That every proprietor or manager of a drug store or pharmacy shall keep in his place of business a suitable book or file, in which shall be preserved, for a period of not less than three years, the original of every prescription compounded or dispensed at such store or pharmacy, or a copy of such prescription, except when the preservation of the original is required by section eleven of this Act. Upon request, the proprietor or manager of such store shall furnish to the prescribing phvsician, or to the person for whom such prescription was compounded or dispensed, a true and correct copy thereof. Any prescription required by section eleven of this Act, and any prescription for, or register of sales of, substances mentioned in section thirteen of this Act shall at all times be open to inspection by duly authorized officers of the law. No person shall, in the District of Columbia, compound or dispense any drug or drugs, or deliver the same to any other person, without marking on the container there of the name of the drug or drugs coiltainecl therein, or directions for using the same.