| Articles |

Drug Abuse

Rational Addiction and the Effect of Price on Consumption

BY GARY S. BECKER, MlCHAEL GROSSMAN, AND KEVIN M. MURPHY

Legalization of such substances as marijuana, heroin, and cocaine surely will reduce the prices of these harmful addictive drugs. By the law of the downward-sloping demand function, their consumption will rise. But by how much? According to conventional wisdom, the consumption of these illegal addictive substances is not responsive to price.

However, conventional wisdom is contradicted by Becker and Murphy's (1988) theoretical model of rational addiction. The Becker-Murphy (B-M) analysis implies that addictive substances are likely to be quite responsive to price. In this paper, we summarize B-M's model of rational addiction and the empirical evidence in support of it. We use the theory and evidence to draw highly tentative inferences concerning the effects of legalization of currently banned substances on consumption in the aggregate and for selected groups in the population.

Addictive behavior is usually assumed to involve both "reinforcement" and "tolerance." Reinforcement means that greater past consumption of addictive goods, such as drugs or cigarettes, increases the desire for present consumption. But tolerance cautions that the utility from a given amount of consumption is lower when past consumption is greater.

These aspects of addictive behavior imply several restrictions on the instantaneous utility function

![]()

where U(t) is utility at t, c( t ) is consumption of the addictive good, y( t ) is a nonaddictive good, and S( t ) is the stock of "addictive capital" that depends on past consumption of c and on life cycle events. Tolerance is defined by du / (dS = u³< 0, which means that addictions are harmful in the sense that greater past consumption of addictive goods lowers current utility. Stated differently higher c(t) lowers future utility by raising future values of S.

Reinforcement (dc /dS > 0) requires that an increase in past use raises the marginal utility of current consumption: (d ²u / (d c(d s=Ucs >0). This is a sufficient condition for myopic utility maximizers who do not consider the future consequences of their current behavior. But rational utility maximizers also consider the future harmful consequences of their current behavior. Reinforcement for them requires that the positive effect of an increase in S(t) on the marginal utility of c(r) exceeds the negative effect of higher S(t) on the future harm from greater c(t).

Becker-Murphy (p. 680) show that a necessary and sufficient condition for reinforcement near a steady state (where c = (d S) is

![]()

where u" and u" are local approximations near the steady state, e is the rate of time preference, and d is the rate of depreciation on addictive capital. Reinforcement is stronger, the bigger the left-hand side is relative to the right-hand side. Clearly, ucs > 0 is necessary if u is concave in S(U5, < 0), that is, if tolerance increases as S increases.

It is not surprising that addiction is more likely for people who discount the future heavily (a higher e) since they pay less attention to the adverse consequences. Addiction to a good is also stronger when the effects of past consumption depreciate more rapidly (6 is larger), for then current consumption has smaller negative effects on future utility. The harmful effects of smoking, drinking, and much drug use do generally disappear within a few years after a person stops the addiction unless vital organs, such as the liver, get irreversibly damaged.

Reinforcement as summarized in equation (2) has the important implication that the consumption of an- addictive good at different times are compliments. Therefore, an increase in either past or expected future prices decreases current consumption. The relation between these effects of past and future prices depends on both time preference and the depreciation rate.

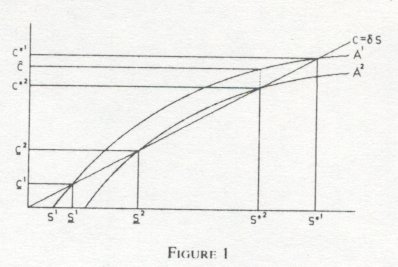

Figure I illustrates several implications of our approach to addiction, where S(t) is measured along the horizontal axis and c(t) along the vertical one. The line c - AS gives all possible steady states where c and S are constant over time. The positively sloped curves Al give the relation between c and S for an addicted consumer who has a particular utility function, faces given prices of c and y, and has a given wealth. The initial stock (S°) depends on past consumption and past life cycle experience. Both c and S grow over time when S° is in the interval where Al is above the steady-state line, and both fall over time when S° is in the intervals where Al is below the steady-state line.

Figure I shows dearly why the degree of addiction is very sensitive to the initial level of addictive capital. If S° is below Sl in the figure, a rational consumer eventually lays off the addictive good. But if SO is above Ss, even a rational consumer becomes addicted, and ends up consuming large quantities of the addictive good.

The curve A1 intersects the steady-state line at two points: c1 = δS1, and c*1 = δS*1. Other relevant points are where c = 0 and S<S1. The second point and third set of points are locally stable. If initially c = 0, S < S1, and a divorce or other events raise the stock of addictive capital to a level below S1, c may become positive, but eventually the consumer again refrains from consuming c. Similarly, if initially C = c*1 = δS*1, e falls at first if say finding a good job lowers S from S*1 to a level > S1 But c then begins to rise over time and returns toward c *1 . The other steady state, c1 = δS1, is locally and globally unstable: even small changes in S cause cumulative movements toward c = 0 or c = c*1.

Unstable steady states are an important part of the analysis of rational addictions, for they explain why the same person is sometimes heavily addicted to cigarettes, drugs, or other goods, and yet at other times lays off completely. Suppose the consumer starts out at c*1 = δS*1, and experiences favorable events that lower his stock of addictive capital below S', the unstable steady state with A'. The consumer goes from being strongly addicted to eventually giving up c entirely. If A' is very steep when S is below the unstable steady state (if reinforcement is powerful in this interval), consumers would quit their addiction "cold turkey" (see the more extended analysis in B-M).

To analyze rational addicts' responses to changes in the cost of addictive goods, suppose they are at c*2 = δS*2 along A2, and that a fall in the price of c raises the demand curve for c from A2 to A1. Consumption increases at first from c*2 to ĉ, and then c grows further over time since cĉ is above the steady-state line. Consumption grows toward the new stable steady state at c*1 = δS*1 This shows that long-run responses to price changes exceed short-run responses because initial increases in consumption of addictive goods cause a subsequent growth in the stocks of addictive capital, which then stimulates further growth in consumption

Since the degree of addiction is stronger when A is steeper and since long-run responses to price changes are also greater when A is steeper strong addictions do not imply weak price elasticities. Indeed if anything rational addicts respond more to price changes in the long run than do non-addicts.1 The short-run change is smaller than the long-run change because the stock of addictive capital is fixed Even in the short run however, rational' addicts respond to the anticipated growth in future consumption since future and current consumption of addictive goods are complements for them But the ratio of short- to long-run responses does decline as the degree of addiction increases 2

The presence of unstable steady states for highly addictive goods means that the full effect of a price change on consumption could be much greater for these goods than the change between stable steady states given in footnote 1 Households with initial consumption capital between S2 and S1 in Figure I would be to the left of the unstable steady state at S2 when price equals p2 but they would be to the right of the unstable steady state at S1 when price equals p2 A reduction in price from p2 to p1 greatly raises the long-run demand by these households because they move from low initial consumption to a stable steady state with a high level of consumption

The total cost of addictive goods to consumers equals the sum of the good's price and the money value of any future adverse effects such as the negative effects on earnings and health of smoking heavy drinking or dependence on crack Either a higher price of the good (due perhaps to a larger tax) or a higher future cost (due perhaps to greater information about health hazards) reduces consumption in both the short and long run

It is intuitively plausible that as price becomes a bigger share of total cost long run changes in demand induced by a given percentage change in the money price get larger relative to the long-run changes induced by an equal percentage change in future costs (see our 1991 paper fn 3) Money price tends to be relatively more important to poorer and younger consumers partly because they generally place a smaller monetary value on health and other harmful future effects

Poorer and younger persons also appear to discount the future more heavily (this is suggested by the theoretical analysis in Becker I99() It can be shown that addicts with higher discount rates respond more to changes in money prices of addictive goods whereas addicts with lower rates of discount respond more to changes in the harmful future consequences 3

These implications of rational addiction can be tested with evidence on the demand for cigarettes heavy consumption of alcohol and gambling Our earlier paper (1990) fit models of rational addiction to cigarettes a time-series of state cross sections for the period 1955-85. We find a sizable long run price elasticity of demand ranging between -.7 and -.8, while the elasticity of consumption with respect to price in the first year after a permanent price change (the short-run price elasticity) is about -.4. Smoking in different years appear to be complements: cigarette consumption in any ear is lower when both future prices and past prices are higher.

Frank Chaloupka (forthcoming) analyzes cigarette smoking over time by a panel of individuals. He finds similar short- and long-run price elasticities to those we estimate, and that future as well as past increases in cigarette prices reduce current smoking. He also finds that smoking by the less educated responds much more to changes in cigarette prices than does smoking by the more educated; a similar result has been obtained by Joy Townsend (1987) with British data. Eugene Lewit et al. (1981) and Lewit and Douglas Coate (1982) report that youths respond more than adults to changes in cigarette prices. By contrast, the information that began to emerge in the early 1960's about the harmful long-run effects of smoking has had a much greater effect on smoking by the rich and more educated than by the poor and less educated (see Phillip Farrell and Victor Fuchs 1982, for the United States; Townsend for Britain).

Philip Cook and George Tauchen (1982) examine variations in death rates from cirrhosis of the liver (a standard measure of heavy alcohol use), as well as variations in per capita consumption of distilled spirits in a time-series of state cross sections for 1962-77. They find that state excise taxes on distilled spirits have a negative and statiscally significant effect on the cirrhosis death rate. Moreover, a small increase in prices in a state's excise tax lowers death rates by a larger percentage than it lowers per capita consumption.

Pamela Mobilia (1990) applies the rational addiction framework to the demand for gambling at horse racing tracks. Her data consist of a U.S. time-series of racing track cross sections for the period 1950-86 (tracks over time are the units of observation). She measures consumption by the real amount bet per person attending (handle per attendant), and price by the takeout rate (the fraction of the total amount bet that is retained by the track). Her findings are similar to those in the rational addictive studies of cigarettes. The long-run price elasticity of demand for gambling equals -.7 and is more than twice as large as the short-run elasticity of -.3. Moreover, an increase in the current takeout rate lowers handle per attendant in both past and future years.

The evidence from smoking, heavy drinking, and gambling rather strongly supports our model of rational addiction. In particular, long-run price elasticities are sizable and much bigger than short-run elasticities, higher future as well as past prices reduce current consumption, lower-income persons respond more to changes in prices of addictive goods than do higher-income persons, whereas the latter respond more to changes in future harmful effects, and younger persons respond more to price changes than older persons. It seems reasonable to us that what holds for smoking, heavy drinking, and gambling tends to hold also for drug use, although direct evidence is not yet available and many experts on drugs would be skeptical. Lacking the evidence, we simply indicate what to expect from various kinds of price changes if responses of drug addicts are similar to those of persons addicted to other goods.

To fix ideas, consider a large permanent reduction in the price of drugs (perhaps due to partial or complete legalization) combined with much greater efforts to educate the population about the harm from drug use. Our analysis predicts that much lower prices could significantly expand use even in the short run, and it would surely stimulate much greater addiction in the long run. Note, however, that the elasticity of response to large price changes would be less than that to modest changes if the elasticity is smaller at lower prices.

The effects of a fall in drug prices on demand would be countered by the education program. But since drug use by the poor would be more sensitive to the price fall than to greater information about harmful longer-run effects, drug addiction among the poor is likely to become more important relative to addiction among the middle classes and rich For similar seasons addiction among the young may rise more than that among other segments of the population

A misleading impression about the reaction to permanent price changes may have been created by the effects of temporary police crackdowns on drugs, or temporary federal "wars" on drugs Since temporary policies raise current but not future prices (they would even lower future prices if drug inventories are built up during a crackdown period), there is no complementary fall in current use from a fall in future use Consequently, even if drug addicts are rational, a temporary war that greatly raised street prices of drugs may well have only a small effect on drug use, whereas a permanent war could have much bigger effects, even in the short run

Clearly, we have not provided enough evidence to evaluate whether or not the use of heroin, cocaine, and other drugs should be legalized A cost-benefit analysis of many effects is needed to decide between a regime in which drugs are legal and one in which they are not What this paper shows is that the permanent reduction in price caused by legalization is likely to have a substantial positive effect on use, particularly among the poor and young

1 Becker-Murphy show (equation (18), p. 685) that the long-run response between stable steady states to a permanent change in p, is dc* /dpc = μ /α,ccB1, where p is the marginal utility of wealth. The term B1 measures the degree of addiction, where B1 ranges between 1 (no addiction) and 0 for an addictive good that has a stable steady state.

2 One can show that a rational addict's short-run response to a permanent change in p, equals dc2 / dpc, = -(λ/δXdc*/dpc), where -δ<λ<0, and A is larger when the degree of addiction is stronger (see B-M, pp. 679-80). Therefore, the ratio of the short- to long-term response gets smaller as the degree of addiction (measured by A) is larger. But one can also show that dc2/dpc, itself gets larger as the degree of addiction increases.

3. If μ is concave -δ2ucc -u22 >28uc2. This implies that either or both of the following inequalities hold: - u„lb a >u„l8, and - u_>u,,1S. We assume both hold. The second inequality states that an increase in c between steady states reduces the marginal utility of c by more than the increase in S raises it. The first inequality assumes that the increase in S has a larger effect on its marginal utility than does the increase in c.

The absolute value of the long-run change in c induced by a change in p, is raised by an increase in o if - u„ > 8u„. Similarly, the absolute value of the long-run change in c with respect a change in future costs is reduced by an increase in o if - u„8 > uc,. (For more details, see our 1991 paper, in. 4).

REFERENCES

Becker, Gary S, "Optimal Discounting of the Future," Department of Economics, University of Chicago, April 1990

Becker, Gary S,Grossman, Michael and Murphy, Kevin M, "An Empirical Analysis of Cigarette Addiction," NBER Working Paper No 3322, April 1990

Becker, Gary S, and Murphy, Kewin M, "A Theory of Rational Addiction,"Journal of Political Economy, August 1988, 9a5, 675-700

Chaloupka, Frank J, "Rational Addictive Behavior and Cigarette Smoking," Journal of Politcal Economy, forthcoming

Cook, Phillip J and Tauchen, George, "The Effect of Liquor Taxes on Heavy Drinking," Bell Journal of Economics, Autumn 1982, 13, 379-90

Farrell, Phililp and Fuchs Victor R*, "Schooling and Health The Cigarette Connection," Journal of Health Economics December 1982, 1, 217-30

Lewit, Eugene and Coate, Douglas, "The Potential for Using Excise Taxes to Reduce Smoking," Journal of Health Economics August 1982, 1, 121-45

Lewit, Eugene and Coate, and Grossman, Michael, "The Effects of Government Regulation on Teenage Smoking," Joumal of Law and Eeonomics, December 1981, 24, 545-69

Mobilia, Pamela "An Economic Analysis of Addictive Behavior The Case of Gambling," unpublished doctoral dissertation, City University of New York, 1990

Townsend, Jay L, "Cigarette Tax, Economic Welfare and Social Class Patterns of Smoking," Applied Economics, 1987, 19, 355-365

Chaloupka, Frank J, "Rational Addictive Behavior and Cigarette Smoking," Journal of Politcal Economy, forthcoming

Cook, Phillip J and Tauchen, George, "The Effect of Liquor Taxes on Heavy Drinking," Bell Journal of Economics, Autumn 1982, 13, 379-90