Report 1 Introduction and overview

| Reports - A Report on Global Illicit Drugs Markets 1998-2007 |

Drug Abuse

1 Introduction and overview

Illicit drugs, predominantly Amphetamine Type Stimulants (ATS), cannabis, cocaine and heroin, now generate a substantial

international and domestic trade. There are substantial differences among the drugs in the distribution of production across

countries, but more similarity in the distribution of income across different levels of the trade and in the ways in which the

drugs are distributed.

For cocaine and heroin, production is concentrated in a tiny number of poor nations and the bulk of revenues, though not

of consumption, is generated by users in wealthy countries. Earnings have an odd shape; most of the money goes to a very

large number of low level retailers in wealthy countries while the fortunes are made by a small number of entrepreneurs, many

of whom come from the producing countries. Actual producers and refiners receive one or two percent of the total; almost

all the rest is payment for distribution labour. The industry is in general competitive, though some sectors in some countries

have small numbers of competing organizations.

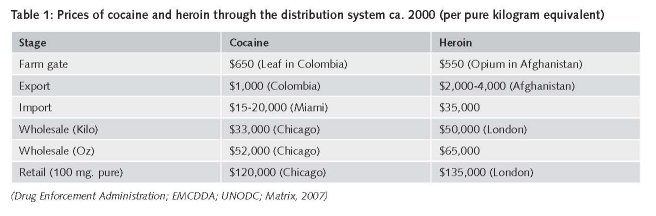

The principal costs of the cocaine and heroin industries are associated with distribution rather than production; Table 1

provides approximate figures on the cost of cocaine at different points in the distribution system to the United States and

generates three observations, which are also true for heroin and for Western Europe:

These figures, which are indicative rather than precise, suggest three general propositions:

1. The cost of production, as opposed to distribution, is a trivial share of the final price. That statement holds true even if

one adds the cost of refining.

2. The vast majority of costs are accounted for by domestic distribution in the consumer country. Smuggling, which is the

principal transnational activity, accounts for a modest share but much more than production and refining.

3. Most of the domestic distribution revenues go to the lowest levels of the distribution system. If the retailer and lowest

level wholesaler each raise their purchase price by 75 percent, which until recently was a low estimate of the margin, they

account for two thirds of the final price. This is consistent with the enormous increase in price from the ounce level to retail

observed in Table 1. The high costs of distribution represent primarily the need to compensate low level dealers for the

risks of arrest or incarceration and, in some countries, of violence by other participants. This does not require that retailers

be at higher risk of detection and punishment compared to wholesalers and traffickers; it is just that the risk is distributed

over a much smaller quantity of drug at the retail level, as discussed below.

For marijuana the location and distribution of earnings are very different. Production occurs in most nations that also consume

and domestic producers account for most of the total. Only two developing countries, Mexico and Morocco, both in the

Middle Income category, are regarded as having a major role in supplying rich countries. A larger share of the total revenues

go to the producers, though there are no comprehensive data that would allow for a global estimate of the share going to

producers as opposed to traffickers and sellers. The international trade component is slight.

ATS, a diverse set of substances including amphetamines, ecstasy and methamphetamine, present yet another configuration. The

number of producing countries is more than the handful in the cocaine and heroin industries but much less than for cannabis.

While there is a large flow from production of methamphetamine in poor countries to consumers in rich countries, there is also a

flow of ecstasy the other way. As with cocaine and heroin, poor country producers receive a very small share of total revenues.

It is not difficult to explain why production of cocaine and heroin occurs primarily in poor countries and only a little harder

to understand why the accounting profits1 for those drugs are downstream or the higher share going to cannabis growers

in rich countries. Almost everything else about the trade presents a challenge, both descriptively and analytically. Why is

the production of cocaine and heroin concentrated in such a small number of poor countries? How are the different sectors

organized, in terms of enterprise size and internal structure? What is the relationship of drug trafficking and distribution to

other transnational and organized criminal activities? Why are the compensation for mid-level dealers in cannabis and ATS

so high, in face of apparently low risks of either arrest or violent victimization?

The next chapter discusses the location of production. Chapter 3 presents information about the smuggling sector, which

leads to chapter 4: on immigrants and drug distribution, since smuggling and immigration have been closely linked in many

countries. Chapter 5 describes the organization of the market at higher levels. Chapter 6 provides a summary description of

the large literature on retailing and chapter 7 gives concluding comments.

1 The distinction here is between true economic profits, which take account of opportunity costs, and a more common-language concept of profits

as revenues in excess of actual payments for labor, transportation, rental etc. In a very risky business, accounting profits may be high while true

economic profits are low or even negative, once risk compensation is included in costs. See Boyum (1992).

| < Prev | Next > |

|---|