2 Markets and quantities

| Reports - A Report on Global Illicit Drugs Markets 1998-2007 |

Drug Abuse

pg_0035

2 Markets and quantities

2.1 Operation of the markets

Efforts to control drug production and distribution rest on assumptions about how the markets for these substances are organ-ized, who participates and how the market responds to enforcement and other control efforts. This is the subject of Report 1.

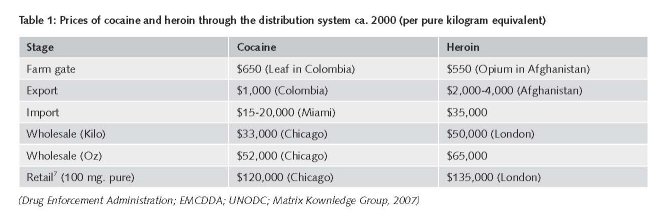

A great deal can be learned simply from observation of the price of drugs as they flow through the distribution system from farm to retail. Table 1 presents some data for cocaine and heroin from about the middle of our study period, tracking the flow from growing in Colombia and Afghanistan to sale in Chicago or London.' These figures are indicative rather than precise. A similar mark-up from production to retail sale can be observed with ATS4 but the mark-up from production to final sale is less for cannabis produced in the consuming country, probably both because the distribution chain is shorter' and the penalties following detection are generally lower when compared to cocaine and heroin. The propositions emerge from this Table:

1. The cost of production, as opposed to distribution, is a trivial share of the final price in Western countries, roughly one to two per cent. That statement holds true even if one adds the cost of refining.

2. The vast majority of costs are accounted for by domestic distribution in the consumer country. Smuggling, which is the prin-cipal transnational activity, accounts for a modest share but much more than production and refining in the source country.

3. Most of the domestic distribution revenues go to the lowest levels of the distribution system, even though the great individual fortunes are made at the higher levels of the trade. The high costs of distribution represent primarily the need to compensate low level dealers for the risks of arrest or incarceration and, in some countries, of violence by other participants. This does not require that retailers be at higher risk of detection and punishment compared to wholesalers and traffickers; it is just that the risk is distributed over a much smaller quantity of drug at the retail leve1.6

Farmers in both Afghanistan and Colombia are independent entrepreneurs, though paying taxes to various quasi-state authori-ties like the Taliban and the FARC (The Revolutionary Armed Forces in Colombia). In the case of Afghanistani opium farmers, they are imbedded in a web of complex credit relations with richer farmers, which to some extent traps them in opium growing (Buddenberg and Byrd, 2006). Trading in Afghanistan is also characterized by many small traders, at least at the initial stage; there may be some degree of regional cartelization closer to the point of export (Byrd and Jonglez, 2006).

The industry is not vertically integrated; for example, smugglers mostly sell to independent wholesalers, who in turn sell to independent retailers.' There is no indication of monopoly or even of cartels in most markets.' While in some countries, such as Mexico, there is a great deal of competitive violence, in other nations there is also considerable working collaboration among operators in the same market, at the same time as they compete on price for the same customers (Pearson and Hobbes, 2001). Paoli (2002), in a detailed study of drug markets in Frankfurt and Milan conclude that the sellers were essentially price takers rather than price setters.

The connection of drug production and trafficking to organized crime varies across countries but analysis is bedevilled by ambiguity about the proper use of the term "organized crime". Since drug distribution often requires a degree of co-ordination in order to be efficient, it will involve at least a modicum of organization among criminals. The more useful question is whether it is connected to organized crime involving other criminal activity, such as gambling, prostitution, extortion etc. That seems to depend on the degree of centralized corruption in a country. For example in some countries it appears that the same police officials who protect corrupt public procurement rackets are also involved with drug trafficking. In contrast drug distributors in the United States over the last two decades have been specialized and independent of other racketeering organizations, as shown in a detailed study of large scale cocaine distribution organizations in the early 1990s (Fuentes, 1998). ATS production and distribution is frequently connected to gangs with broader interests, particularly motor cycle gangs. This may in part represent the lack of a strong ethnic base for importing of the drug, particularly if it is produced domestically. For example, in Australia, where the importation of heroin has been dominated by Chinese and Vietnamese groups, the amphetamine market is primarily composed of groups of local residents that produce domestically (Andreas, 2007).

There is also great interest currently in the connection between drug trafficking and terrorist and guerrilla groups. Al Quaeda and the Taliban certainly generate earnings from both the production of opium and early stage trafficking of heroin. FARC in Colombia has in the last decade depended heavily on taxation of coca growers and perhaps also on cocaine exports (Sheehan, 2000). The PKK (the principal Kurdish terrorist organization in Turkey) has earned money from heroin distribution in Western Europe (Bovenkerk and Yesilgöz, 2004) and there are occasional allegations of connections between drug trafficking and the Tamil Tigers in Sri Lanka (Cillufo, 2000) and the IRA in Northern Ireland (Cillufo, 2000). Drug trafficking may be an important source of income for these groups, even if they do not account for a large share of drug trafficking revenues. Separatist groups in Myanmar have long relied on opium and heroin related industries for income (Kramer, 2005).

A striking characteristic of drug distribution in the Western world is the prominence of immigrant groups. For example, in Australia, Chinese and Vietnamese organizations have been prominent in heroin smuggling and high level distribution (Parliament of the Commonwealth of Australia, 1995). In the United States Colombian and Mexican groups have dominated cocaine smuggling and are important in high level domestic distribution. Throughout Western Europe, immigrant groups from various transhipment countries have been important (Paoli and Reuter, 2008). This probably reflects on the one hand the advantages such groups have in dealing with exporters from the transhipping countries (such as Albania, Pakistan and Turkey) as well as in evading local police efforts" and on the other their relatively weak legitimate opportunities in their host countries". However in many of the same Western European nations, non-immigrant groups appear to be dominant in the distribution of cannabis and ATS.

Though drug markets generate hundreds of billions of dollars in sales and have created great wealth for some traffickers, it is important to understand that the overwhelming majority of those involved in the drug trade make very modest incomes. For example, though growing opium is much more profitable than growing other crops in Afghanistan, the average opium producing household probably earns less than $3,000 from that activity throughout much of this period.' At the other end of the distribution chain, in retail markets in rich countries, a few studies of drug sellers in the United States have found net earnings in the order of a few thousand dollars per annum (e.g. Levitt and Venkatesh, 2000; Bourgois, 2002). Partly this reflects the fact that those who sell are themselves often heavy users of drugs and thus have poor legitimate earning prospects; this means that they are willing to sell drugs for relatively low wages.

The usual explanation for high earnings in the drug trade is compensation for risks. It is thus surprising that a number of studies of mid-level dealers (e.g. Matrix Knowledge Group, 2007; Pearson and Hobbs, 2001) find that these individuals earn very large incomes indeed, in the hundreds of thousands of Euros annually, though the risk of incarceration or of experiencing violence seem to be small.'

Critical for understanding how drug markets respond to government interventions are two parameters, the elasticities of demand and supply. There is a great deal of work on the first (see e.g. the survey of Grossman, 2004) in Western countries, particularly the United States and Australia. In general the research finds that for cocaine and cannabis the elasticity of demand (the percentage decrease in demand in response to a one percent increase in price) is about -0.5, similar to that for tobacco. Thus an increase in the price of those drugs will reduce consumption but will also result in higher revenues for the distributors. For heroin there are few studies and these often draw on long-past experiences in countries where the opiates were legal." A rare exception is Bretteville-Jensen (2006), who estimates the elasticity of demand among heroin addicts in Oslo using interview data from 1993-2006; she finds that for those who are not active drug sellers the price elasticity of demand is -0.33 and for active sellers it is -0.77.

There are no estimates of the elasticity of supply, i.e. of how much supply increases in response to a 1% increase in price. Many economists (e.g. Becker et al., 2006) assume that there are no fixed factors of production and that the elasticity is infinite. I.e. producers and distributors are willing to produce any quantity at the existing price. This implies that shifting down demand, for example through effective prevention or treatment, will not result in any decline in price. Kleiman (1993) suggests that the supply curve may actually be downward sloping, since the principal cost of drug distribution is the risk of punishment, which declines when the market expands (i.e., moves along the supply curve). Plausible though that idea may be, it has not been readily accepted by economists (e.g. Manski, Pepper and Petrie, 2001).

The markets for cocaine and other psychoactive drugs are indeed markets and subject to the laws of economics. However they are not just markets; the absence of legal protections has consequences for example in determining the size and scope of enterprises. Economics is a useful frame for understanding these markets but the standard analysis may have to be modified at points. No published article examines specifically what modifications might be necessary, though there is a growing literature examining distinctive features that might explain the paradoxical decline in drug prices while enforcement became tougher'

2.2 Production

Cocaine and heroin

Amongst the most widely reported measures of drug related phenomena globally is production of coca and opium. Each year the United Nations Office on Drug and Crime, relying both on aerial observations and ground surveys, produces estimates in the World Drug Report of the area under cultivation for these two crops and also of the production of the raw materials and certain refilled products (opium and cocaine). This is widely reported in media around the world.

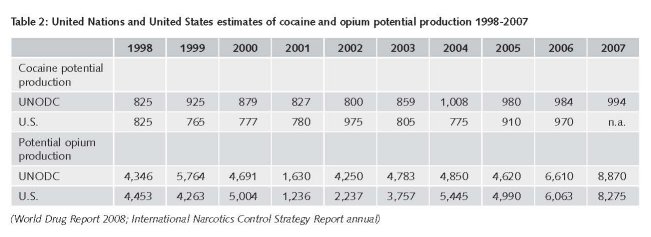

The United States government also produces an annual estimate in its international Narcotics Control Strategy Report. This receives little attention. The two estimates differ substantially, as seen in Table 1 for the 5 year period 1998-2006.'6 For example, in 2004, the UN estimate showed an increase in cocaine production of over 15%, while the US estimate showed a decline of almost 4%.' In some years the figures have differed by as much as one third in absolute value (e.g. opium in 1999).

The purpose of presenting the comparison is not to be critical of the two agencies but rather to demonstrate how difficult it is to estimate these quantities. In many cases the cultivation takes place in scattered and concealed settings; these estimates are developed under very adverse circumstances, faithfully described in the technical sections of the reporting documents.i8 Moreover the most basic story for the period of interest is consistent in the two sets of estimates. First, production since 1998 has fluctuated around a fairly constant level for cocaine and, until 2006, for opium; the increases in 2006 and 2007 for opium are hard to reconcile with other data.19 Second, though not shows in Table 2, production is increasingly concentrated in Afghanistan (opium) and Colombia (coca). A handful of countries have always accounted for most of total production but the dominant country now has an even higher share.

The shift of production to these two nations is itself an important phenomenon, partly driven by changes in other major producing countries (Myanmar for opium and Bolivia and Peru for coca) and partly by developments in the two nations themselves. In Myanmar opium production has long been concentrated in the Shan States, which have not been under the control of the central government for some decades. The ruling quasi-state, the United Wa State Army (UWSA) announced in 1998 its intention to end production of opium within ten years. Though they have not accomplished that, by 2005 they had reduced total production by about three quarters; despite a slight upturn in the last couple of years they have managed to keep the figure low by historic standards. This has been accomplished by highly coercive means, including the forced migration of hundreds of thousands of individuals from their traditional hill towns to a new area alongside the Mekong River (Kramer, 2005). The UWSA has been more successful than any government in suppressing opium production over the course of a decade; however its methods are not those that could be imitated by a democratic govern ment.

The increase in production in Afghanistan over the long term has been chronicled and analyzed in many studies, including an important collaboration between the UNODC and the World Bank (Budden berg and Byrd, 2006). By 1998 the Taliban had authority over 90 percent of the country; in 2000 it used that authority to effectively prohibit the growing of opium, though not its trade; production fell by 94% in 2001. After the fall of the Taliban regime following the post September 11 invasion by the United States and allies, opium production resumed and quickly reached previous levels, before surpassing them substantially starting in 2006. The rising weakness of the central government, a proposition attested to in public statements by the most senior officials of Western Europe and the United States in 2008 (e.g., Gebauer, 2008), helps explain the expansion of opium production (Schweich, 2008). Though opium growing is formally banned, the central government lacks the authority to coerce or persuade the large number of rural households dependent on opium for their livelihood to turn to other crops that constitute a far less reliable source of earnings (Paoli, Greenfield and Reuter, 2009, Chapter 6).

The effect of the sudden and sharp decline in opium production in Afghanistan in 2001 on the world heroin market was surprisingly slight. As shown in Table 2, world production fell by 60 percent in 2001. This did have an effect on various opiate markets, traced in detail by Paoli Greenfield and Reuter (2009, Chapter 4). For example, there are signs that it reduced availability in the transhipment heroin market in Turkey in 2002 and may have accounted for observed purity declines in Western Europe in 2003. However it is clear that there were large stocks of opium and/or heroin in Afghanistan at the time of the ban, probably reflecting the bumper crops in the late 1990s. These were adequate to meet the needs caused by a one year dip in production.2°

For coca the story of the shift to Colombia in the 1990s is similar to that of the shift to Afghanistan for opium; it reflected both internal problems and pressures against growers in other countries. Bolivia and Peru undertook a variety of interventions against coca growing in the late 1990s and the early part of this decade. In the case of Bolivia, where coca was primarily grown in a relatively new area (the Chapare), the interventions were an unusual combination of alternative livelihoods, funded by many Western countries, and eradication, promoted by the United States The Chapare production fell substantially between 1994 and 2000 and has remained low even after the election to the Bolivian presidency of the former head of the indigenous coca growers (Evo Morales) in late 2005. In Peru a combination of a mid-1990s fungus that attacked the coca plants in the Upper Huallaga, eradication during the administration of President Fujimori and aggressive interception of air smuggling (supported by the United States) from Peru to Colombia made Peru a less attractive production site (Thoumi, 2003).

Colombia had long been the principal location for final processing, from cocaine base to cocaine hydrochloride, and for export to the principal market, the United States2i. During the late 1990s and the early part of this decade there was an intensifica-tion of the civil war involving the FARC (Revolutionary Armed Forces of Colombia) and a relatively new set of players, the paramilitary (the AUC; the United Self-Defence Forces of Colombia). This led to a number of massacres in well settled rural areas, generating in turn mass migration to unsettled areas away from this conflict. The displaced farmers needed a source of revenue that was not dependent on good infrastructure. Coca growing was far superior to any other crop in that setting. Combined with the deteriorating conditions (from the producers' point of view) in Bolivia and Peru, this led to a large scale transfer of coca growing to Colombia. The UNODC estimates that in 1995 Colombia accounted for about 22% of total cocaine production; by 2000 that figure had risen to almost 80%; by 2007 it had fallen but was still over 60%.

These changes are reminders that the location of production can move rapidly. Afghanistan has dominated opium production for fifteen years, overtaking Myanmar in less than a decade; similarly Colombia moved to a dominant position in coca produc-tion in a very short time. If they become less attractive production sites, other nations are likely to emerge in a very few years to take their place. The question of why coca and opium production have settled in only a few countries and what determines which country dominates is one that has been analyzed by Thoumi (2003) and by almost no other scholars. Thou mi stresses the importance of social and political factors, a theme taken up by Paoli, Greenfield and Reuter (2009, Chapter 10).

Cannabis and ATS

Even though clandestinely planted and dispersed, coca and opium production are much easier to observe than the production of either cannabis or ATS. Cannabis is produced in over 170 countries22, often indoors and in very small plots. Regular official estimates, though of dubious provenance (Reuter, 1995), are available for Mexico and Morocco, which are thought to be by far the largest producers of the drug (Leggett and Pietschmann, 2008). For other countries, production estimates are nothing more than guesswork.

Estimating the production of ATS, itself a heterogeneous collection of substances with different production technologies and different user groups is even more difficult. Production in this case frequently occurs in small movable facilities. Metham-phetamine in the United States in particular can be produced literally in kitchens, with batches of just a few thousand doses. It is hard to imagine a sampling and observation strategy that can develop defensible estimates of actual production. Existing estimates rely on seizure data, a questionable source, as discussed below, because it is impossible to determine from the available data whether a change in seizures is a function of a shift in enforcement effort and effectiveness or in the amount being produced in a specific country.

ATS production is distributed in a very different fashion geographically than are the other drugs. It is produced in a few countries but a higher number than for either coca or opium. The producer countries include Western countries (e.g. The Netherlands for ecstasy), transition countries (Russia for amphetamines) and developing countries (e.g. Myanmar for methamphetamine). !Moreover new countries enter the market on the production side quite freely (e.g., Myanmar for methamphetamine in the 1990s), in contrast to coca and opium where there is only redistribution of markets shares among the existing production countries; occasionally a country leaves production (e.g. the United Kingdom). This may reflect the fact that manufacture of synthetics is the quintessential "footloose" industry; it requires minimal fixed capital and a uses a small labour force. In contrast opium and coca growing require hundreds of thousands of hectares and workers. ATS also offers instances of producers in rich countries selling to consumers in poor countries.

ATS production seems more tied to the growing globalization of industry and labour generally, with skilled manpower being recruited in one country to help produce inputs for a manufacturer in another (Europol, 2007). Moreover, this is an industry in which specific and easily targeted precursors, such as ephedrine and pseudo-ephedrine, play an important role and involve other countries. Most precursors for ATS are made in China and India, neither of which is an important source of the final product. Amphetamine, produced primarily in Europe, seems to offer an unusual instance of the rich Western world exporting an illicit drug to other poorer nations, though these exports account for a small share of the total production.

Thus it is hard to make definite statements about whether production of ATS and cannabis has increased or decreased over the period 1998-2007. Changes in the scale of the market will rely on consumption based estimates to make the determination, taking into account seizures as well.

2.3 Consumption23

There has almost certainly been an expansion in the global number of users of cocaine and heroin over the period; the changes have been very uneven across countries, with declines in some major mature markets compensated by the emergence of user populations in countries that had quite modest consumption before. For cannabis there may have been a modest decline in the total number of users worldwide; the quantity consumed may only have stabilized. For ATS the data are exceptionally weak and no definite statement is possible.

As with production, it is necessary to analyze each of the four drugs separately. An added difficulty here is that the available data speak almost entirely to the numbers of users in individual countries, and not the quantities they consume. Since for cocaine and heroin an experienced user on average consumes more per annum than a new user, counts of users are insufficient to determine whether quantity consumed has increased. We developed quantity estimates for many countries in the course of estimating revenues (Report 3) but only in a very few countries is it possible to compare quantities in 1998 and 2007.

Measurement

Though in general we have consigned technical measurement issues to Report 6 ("Methodological problems confronting cross-national assessments of drug problems and policies"), a discussion of consumption measurement cannot be avoided here. The most widely reported statistics come from general population surveys, either of the household population or of specific age groups in schools. For example, ESPAD (the European School Survey Project on Alcohol and Other Drugs www.espad.org) collects data every four years in classrooms from school children aged 15-16 in most Western European nations. There are no comparable consistent cross-national household surveys; instead each nation conducts its own from time to time. A few nations do it annually (e.g. the UK through the British Crime Survey) but most do it every two to five years (e.g. Australia conducts the National Drug Strategy Household Survey every three years).

These surveys provide good indicators of trends in occasional use of many drugs and useful information about heavy cannabis use. They are however of little value in estimating the size, or rate of change, of the much smaller populations that use psychoactive drugs frequently, particularly those drugs that are expensive and lead to high criminal offending rates among frequent users, notably cocaine and heroin. These populations have high rates of homelessness, lead erratic life-styles that make them hard to contact through a survey, have high rates of interview refusal and under-report consumption (Rehm et al., 2005). As a consequence, in every country where efforts have been made to develop estimates of the extent of "problematic drug use" the term developed by the European Monitoring Centre for Drugs and Drug Addiction, they have been found to be much higher than suggested by the surveys. For example, in the United States for 1998 the National Household Survey on Drug Abuse (now the National Survey on Drug Use and Health) estimated that 253,000 persons had used heroin in the past year. In contrast, estimates that took account of drug tests and self-reports of arrestees estimated that roughly 900,000 individuals consumed heroin at least ten times in the previous month (ONDCP, 2001).

In what follows we rely primarily on general population surveys for cannabis and ATS. For cocaine and heroin we use instead estimates that come from a variety of other data sources, including criminal justice and treatment client populations. We consider each drug separately and then briefly discuss countries as the unit of aggregation.

Cannabis

For countries where cannabis use was common by the early 1990s (e.g. Australia, Canada, the United Kingdom and the United States) there has been a broadly common pattern of change over the period 1992 to 2006. Prevalence rates rose for the early part of the period, coming to a peak roughly between 1998 and 2002, and then fell substantially through to 2006, For example, in Australia the past year rate of cannabis consumption for the population over age 14 rose from 12.7% in 1993 to 17.9% in 1998 and then fell to 9.1% by 2007. Similarly in the United Kingdom, for the population aged 16-59, prevalence rose from 8.4% in 1994 to 10.9% in 2003 before falling back to 8.2% in 2007. The pattern is particularly pronounced for adolescents across countries. The EMCDDA in its 2008 Annual Report (EMCDDA, 2008) concluded that throughout the European Union cannabis use had stabilized.'

For some countries in which cannabis use was not well established the rise of the 1990s did not come to an end early in this decade. For example, France, where the prevalence rate for the 15-64 year range was only 3.9% in 1992, that rate rose in the following three surveys to 10.8% in 2005. However in the two of our sample of 18 countries that represent transitional countries (the Czech Republic and Hungary), in which cannabis use was very slight under the pre-1990 Communist regime, there were clear indicators that prevalence had begun to decline by the middle of this decade after a long rise to Western levels. Russia has a high rate in the middle of this decade but trend data are unavailable.

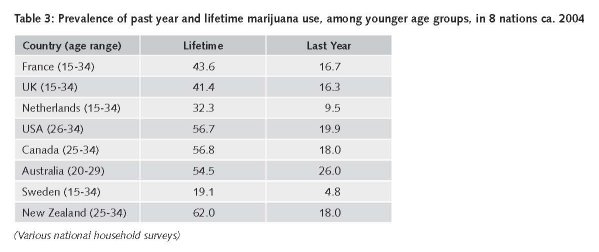

Table 3 shows prevalence rates from national surveys of the household population for seven Western countries. Though the age ranges are somewhat different, the Table shows that experience with cannabis is a normative experience in many but not all countries, a part of the process of growing up. In some countries more than 50 percent of all those born since 1980 will have tried cannabis before they have reached the age of 25.

For the four major developing countries in our 18-country sample, cannabis use remains low. China does not have a tradition of cannabis use and the drug continues to be rare there (Hao et al, 2004). India has a long tradition of cannabis use in ceremonies and a few state licensed shops dispense the drug but again national prevalence is very low; it is estimated that 3.2% of the population had tried cannabis some time in their lifetime, barely one tenth the rate in countries such as Australia and Switzerland. Even Brazil, with a growing problem of drug trafficking and consumption of cocaine shows quite modest rates, an estimated 6.9% lifetime for the population over age 14 (Galduroz et al., 2005). Mexico, the principal foreign producer for the United States cannabis market, also does not have a high level of use in the most recent surveys, even among youth; for example, only 3.2% of 12-17 year olds in a 2005 Mexico City school survey reported ever having used the drug (Benjet et al., 2007).

Heroin

In most Western countries there is evidence that the number of frequent heroin users has been in decline through most of the last ten years. For example in Britain, the European Union member country most adversely affected by heroin following a twenty five year rise in incidence (De Angelis, Hickman and Yang, 2004) it is estimated that the number of dependent users declined between 2000 and 2005. In Australia, which also experienced a major heroin epidemic in the 1990s, there has been a marked reduction post-2000. For no major Western country is there any indication of growth in the heroin using population over since 2000.25

In the same period there has been a serious epidemic of opiate use in the Russian Federation26 and many of its CIS neighbours, particularly in Central Asia. For Russia, the UNODC reports an estimate of 1.6% (ages 15-64) in the middle of this decade, giving a total opiate user population of about 1.5 million27. Rates in some Central Asia countries are comparably high but the population base is small, so they contribute little to the global problem.

China experienced an epidemic of heroin dependence in the western provinces near the border with Myanmar in the 1990s (Chu and Levy, 2005). There is no evidence of much expansion of that epidemic since the late 1990s to other regions. Though the absolute number of heroin users is large (approximately 2 million, double the United States figure) in the context of China's huge population, it is a low prevalence, barely 0.25% of the population aged 15-64. India, like China a country with a long history of opiate addiction, has a modest reported prevalence, a high absolute total and no evidence of much expansion in the last decade.28

Iranian data indicate that it probably has the most severe opiate' consumption problem (2.8% of the 15-64 population). However the prevalence estimates are too crude to determine whether the number has grown since 1998.

This has so far been an analysis of prevalence, not consumption. Heroin prices generally have fallen. Given the evidence reviewed above that consumption of current users is responsive to price (i.e. that a heroin user consumes more if the drug becomes cheaper), it is likely that consumption levels per user have risen during the period. ONDCP (2001) reports an increase in total consumption of heroin in the United States during the period 1988-1998, during a period in which the number of chronic heroin users fell, while the price of heroin declined precipitously; the implication is that average heroin consumption per user rose substantially. There are no other countries for which average per user or total heroin consumption over time has been estimated. Given the paucity of data on quantity per user, it is impossible to develop robust estimates of how global consumption has changed over time or to match production and consumption for any recent year.3°

Cocaine

The United States has been the dominant market for cocaine, in terms of both users and quantity, since the emergence of the modern cocaine epidemic in the 1980s. In the study period there was a decline in estimated United States prevalence31 and a substantial expansion in the European market, particularly in Spain and the United Kingdom. The European change is reflected most clearly in treatment statistics; for the first time there were nations in Europe in which cocaine was the primary drug of abuse for a substantial fraction of those entering treatment. In Spain 21% of 1998 treatment entries were for cocaine; by 2005 that had risen to 63%.32 No other EU country had a rate higher than 35% in 2005, but many had seen a large relative increase in the first half of this decade. The rise in treatment numbers for cocaine in Europe also indicates that the cocaine epidemic has reached a new stage at which a larger share of those who use the drug are using frequently and are experiencing problems with it.

There remains little evidence of wide-spread cocaine use in any country outside of North America, Europe and a few countries in South America (notably Brazil). This is a reminder that the spread of use of specific drugs is dependent on a variety of factors about which liftle is known.

ATS

We note once again the heterogeneity of ATS as a group and the difficulty of making general statements about the category for that reason. Patterns of change have varied considerably across the globe, with less consistency within groupings such as Western countries or Asia than even for cocaine and heroin. For example, methamphetamine, which seemed on the point of becoming common recreational drugs in the United States in the late 1990s, has since faded in the general population, even as the number of methamphetamine users showing up in treatment has increased.' Australia on the other hand seems still to be in the midst of a methamphetamine and amphetamine epidemie' Japan has experienced an occasional outbreak of amphetamine use since 1945 but there is no sign of recent increases (UNODC, 2005).

Modelling the patterns of change

The total number of users globally is dominated by the number of cannabis users; that is true both of 2007 and 1998. For example in 2007 there were an estimated 160 million past year cannabis users, compared to a total of just 40 million for the other listed drugs (ATS, cocaine and heroin). Statements about the change in the global prevalence of drug use thus are statements about cannabis, even though that drug accounts, in terms of health and social harms, for a small share of the global burden of drug-related harms. Thus we focus on individual drugs rather than on the total.

The crudest summary would be that consumption ten years after UNGASS is only moderately changed. The major changes in the decade since UNGASS are (1) the broad decline in the prevalence of cannabis use in many Western countries, many of which have also seen a modest decline in the number of heroin users; (2) the expansion of the Russian and neighbouring country heroin markets, now probably stabilizecr; (3) the growth of cocaine use in Western Europe apparently roughly compensated for a decline in the United States and (4) the stabilizing of the numbers of ATS users, though the pattern is uneven across countries.

An interesting feature is the variability of prevalence across countries. For example, amongst wealthy nations there is huge variation in the extent of cannabis use; for Sweden Life Time Prevalence (ages 15-64) was only 12% compared to 44.5% in Canada. Cocaine is hardly known in rich countries of Asia, such as Japan, Korea and Singapore, despite their deep integration into the global consumer culture. Some countries through which heroin has flowed for decades, such as Mexico and Turkey, have seen minimal local use emerging while the countries of Central Asia have been seen a serious epidemic following the development of the transhipment route of heroin to the Russian market.

2.4 Revenues

One adverse consequence of illicit drugs for global society is that they create large illegal incomes. It is these incomes that generate the corruption and violence that accompany drug markets in some countries and which lead many young people (mostly men) in those countries to abandon education and legitimate employment to seek their fortunes illegally. Thus one measure of how the world's drug problem has changed since 1998 is the change in revenues generated by drug sales. Report 2 ("Estimating the size of the global drug market revenues") presents new estimates, paying attention to their distribution across the various levels of distribution and production.

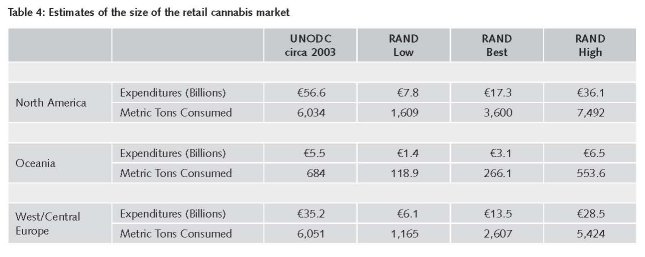

The United Nations Office on Drugs and Crime (2005) developed the first documented estimates of the global retail market for cannabis. Their estimate of the cannabis market circa 2003 is about €130B, which implies a larger retail market for cannabis than for cocaine and opiates combined.36 The UNODC acknowledged the uncertainty surrounding this figure because of data inconsistencies. They suggested that the difference between their estimate and the "true value of the cannabis market could be significant . . ." (2005, 134). Table 4 compares UNODC's figures with our low, best, and high estimates for North America, Oceania, and Western and Central Europe.

While Table 4 only includes estimates from three of the 16 regions used in the UNODC calculations, the UNODC reports that these three regions account for 78% of the global cannabis retail market and hence represent the bulk of their global estimate. Because adequate data are not available for the other 13 regions (22%), the work presented in this chapter focuses on improving the estimates for the thme regions and takes as correct those estimates constructed by the UNODC for the other 13. Assuming that consumption patterns have remained relatively stable in these 13 regions between 2002/2003 and 2005 (not an unreasonable assumption), adding this figure to the sum of the best estimates for North America, Oceania, and Western and Central Europe generates a global estimate of the retail market for cannabis of approximately €70B—about half of what the UNODC estimated for 2002/2003. A similar computation employing the low and high estimates for the three main regions generates an approximate range for the global retail market of €40B and €120B.

A number of assumptions in the UNODC calculations also seem likely to raise the estimate of total revenues for other drugs above plausible levels. For example, UNODC assumes a very high annual consumption of heroin per user in the region with the highest price; in Oceania (mostly Australia) the annual consumption per user is 57 grams (vs. 17 in the US) though the price is almost €500 per gram (vs. €350 in the US).

We do not report a total estimate for all drugs globally. There are too many countries for which the data am simply lacking or suspect, particularly on prices. For ATS there are simply too many prices and products for which the quality and quantity of price data are inadequate. For opiates, Iran, a very important market, is a nation for which data are conspicuously lacking.

Our stylized model suggests that the annual value of the cocaine trade (i.e., the revenue generated by shipping it from Colombia to Europe and North America) is likely to be between €6 billion and €9 billion. This value includes transportation costs, payoffs, compensation for trafficker risk, and other markups. As previously mentioned, this model does not cover all consuming countries, but it accounts for those where the most of the trafficker revenue is generated. For opiates the intra-Asia trade is hard to value because of the dearth of import price data. Out rough calculations again suggest that total world international heroin trade can be no more than €20 billion.

e has been purged of individuals who might have also resold some of their cannabis at a higher level. Further, our estimate account for the quantity discounts that often ocarr at the retail level (Wilkins et al., 2005; Caulkins and Pacula, 2006).

This suggests that illicit drugs constitute a very modest item in international trade. The conclusion is different from that reached by UNODC in 2005; UNODC compared trade revenues for wine and beer (totalling €22 billion) with the wholesale value of illicit drugs. Wholesale prices are much higher than import prices; the difference is part of domestic value-added and thus not appropriately compared with other international trade figures. The use of wholesale rather than import prices overstates the value of the trade in illicit drugs.

Of similar importance for the current study is whether revenues have fallen or risen over the period 1998-2007. Revenues are a function of prices and quantities sold. Unfortunately the price data for a systematic estimate of 1998 global revenues for any of the four drugs are not available. However we think it likely that revenues have fallen because prices have generally declined and production quantities have fluctuated around a stable level for cocaine and heroin. Over the period, retail cocaine and heroin prices have fallen in much of the world; in the case of the United States and Europe, two major markets accounting for a large share of total revenues, the fall has been precipitous. For cannabis the prevalence estimates suggest no increase in total consumption and prices have also not had an upward trend.' For ATS the picture across countries is so mixed that no statement about change is possible.

For a handful of countries the revenues from the drug trade have macroeconomic significance, another dimension of the problem. It is well known that heroin exports may add nearly 50 percent to Afghanistan's GDP (Buddenberg and Byrd, 2006). For Tajikistan, a major transhipment country for those exports, the percentage GDP contribution may be comparable; Paoli, Greenfield and Reuter (2009; Appendix C) estimate that early in this decade the percentage was at least 30 percent. Given the crude nature of GDP and revenue estimates for Afghanistan in 1998, it is hard to assess whether the percentage has increased. There are no earlier estimates for Tajikistan. There is no indication that cannabis production is of macroeconomic significance for any nation.

With the possible exception of some small island states in the Caribbean, there is no country for which drug production or trafficking is as economically significant as it is in Afghanistan and Tajikistan. It has been moderately important for the Andean countries but the estimates of GDP contribution for Bolivia, Colombia and Peru never exceeded 10 percent (e.g., Alvarez, 1995) and have been much lower than that for the last decade, reflecting the stagnation of cocaine production and growth of the legitimate economy.

Prices

The fall of retail prices in many markets since 1998 is itself an important phenomenon. In terms of the subject of this section, revenues, the fall is desirable; lower prices will reduce criminal revenues for a given level of drug consumption and also reduce incentives for crime and theft related to drugs. On the other hand lower prices may lead to heavier consumption by current users and increase their health risks.

Prices have not fallen throughout the production and distribution chain. In particular, opium farm-gate prices in Afghanistan remain above their 1998 ($60) levels in 2007 ($120), even after adjusting for inflation.' They are much below the levels reached after the end of the Taliban opium production ban (ca. $600 in early 2003). The ban depleted inventories and thus created higher demand in 2002-2003. However, even with the massive expansion in production that surely has restored inventories, the price remains well above earlier levels. This may reflect improved agricultural productivity generally, which would raise the price of land and rural labour, the two major inputs to opium production. However this increase in opium price has little consequence for the retail price of heroin, since the price of the opium input accounts for less than 1 percent of that retail price.

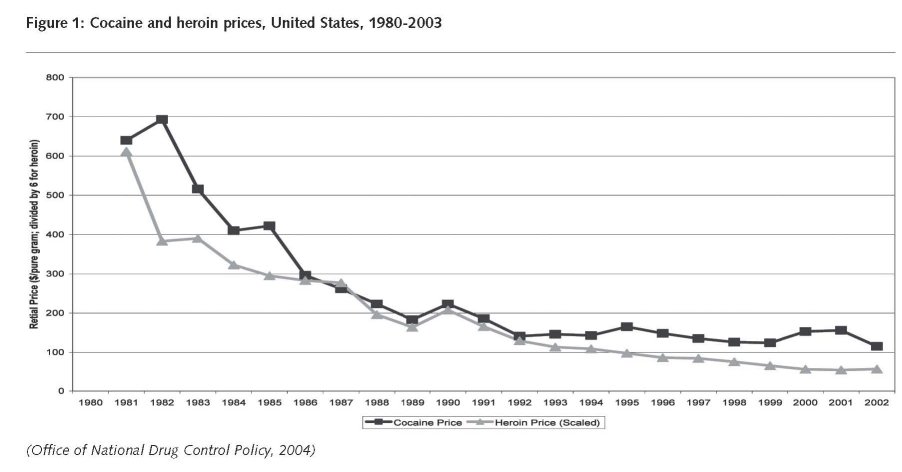

In the United States, the fall in retail prices for cocaine and heroin has occurred over more than a twenty year period. Figure 1 shows (inflation adjusted) prices for a pure gram of cocaine and heroin for the period 1980-2003.'9 As will be discussed in the policy section of this report, what is striking about these declines is that they have occurred during a period of massive increase in incarceration of sellers of cocaine and heroin. Nor are the falls found for every drug. Cannabis prices remained fairly constant over the period 1998-2003, increasing just slightly in inflation adjusted terms, though that may reflect a rise in potency.4°

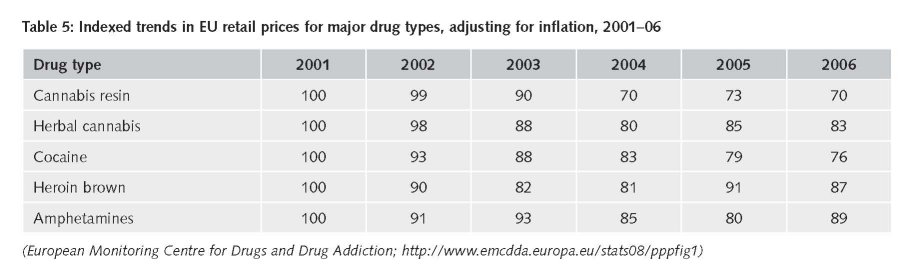

For no European country except Norway is there a comparable price series based on individual observations of price and purity in seizures and undercover purchases. However the available data do suggest that there has been a decrease in inflation-adjusted prices for all drugs at least for the period 2001-2006. Table 5 reports an index of prices without adjustment for purity or potency (for cannabis).

Consistent and systematic price data are available for only a few other countries, not including any of the other major consumer countries (Brazil, China, India, Iran, Russia). Thus it is impossible to assess what happened to revenues in those countries over the study period.

3 These figures, like many others in this report, are presented in dollars rather than Euros. This is a consequence of how they appear in the source documents. Dates are often not precise, so conversion to Euros would also be approximate.

4 For example, the UNODC reported that pills manufactured in the Netherlands cost 1-3 Euros per tablet and sold at retail in Germany for

8-22 Euro per tablet fhttp://www.unodc.org/documents/commissions/CND-Session51/CND-UNGASS-CRPs/ECN72008CRPO4.pdf: accessed February 12 2009]

5 The smaller number of transactions from producer to final user means that fewer individuals have to be compensated for taking risks.

6 This is easily explained in the standard risk compensation model used by economists. Assume that a trafficker sells 1 kilogram of cocaine and has a 1 percent probability of being imprisoned for one year as a result of the transaction; the rich trafficker values a year in prison at 100,000 Euros. A retailer sells 1 gram of cocaine and has only a 1 in 1,000 chance of the sarne imprisonment; he values a year in prison at 25,000 Euros. The traffid<er will charge 1 Euro per gram to cover the risk, while the retailer, even though he has a lower chance of being jailed and values that less highly, needs 25 Euro to cover the risk assodated with one grarn The figures are intended to be illustrative only.

7 The ratio of the retail price to the export price is misleading as a measure of the relative costs of the different chains in the distribution system because of seizures. For example, if one third of all cocaine exports are seized, then it takes three kilos of export level cocaine to support two kilos of retail sales and the cost share associated with exports should be increased by half. However, this makes small difference here because the export price is so low relative to retail.

8 There is no agreed terminology for the various levels of the market. We use the term smuggler or trafficker for those that bring drugs in large quantities (e.g. kilograms of heroin) across international boundaries. Those who handle large quantities domestically will be referred to as wholesalers and those who sell to final customers are designated retailers. Those who operate at intermediate levels, involving for example the sale of a few grams to heroin retailers, will be characterized as low level wholesalers.

9 References to the Medellin "cartel" were inaccurate. There was no evidence that it had the ability to restrict production or export. Rather it was

a complex set of collaborative and competitive relationships for which the term "syndicate" would have been more appropriate.

10 For example, language can be a major barrier. Few European police are able to understand the various dialects spoken in Albanian immigrant communities.

11 In this respect Paoli and Reuter observe that the large Iranian diaspora in Europe, though coming from a major trans-shipment and consuming country, are little involved in drug trafficking. This probably reflects their more middle-dass origins and better opportunities in their new countries.

12 UNODC (2003) estimated per farmer income for the period 1994-2000at $475-950 per annum (pp.62-64). In 2002, with opium prices ten times as high, the UNODC tentatively estimated that the figure might be $5,000; prices have fallen substantially since then so that the per farmer income figure has also declined a great deal.

13 The claim of the low risk of incarceration is speculative but derives from the observation that many of the subjects interviewed by Matrix Knowledge Group (2007) had operated for years before being arrested The sample is small and the response rate low, so that those who chose to participate may be systematically different from the larger universe of dealers.

14 For example, Chandra (2000) uses data from the opium regie in the Dutch East Indies in the early 20th century to show that higher prices reduced consumption by licensed opium users.

15 For example Caulkins, Reuter and Taylor (2005) developed a model in which tougher enforcement, if it removed more violent dealers first, would lead to price declines. They assume that sellers need to be compensated both for the risk of violence from other partidpants as well as for the risk of imprisonment. That may capture an element of reality but makes no daim to be a complete model of the determination of drug prices.

16 The U.S. has not yet published estimates for 2007.

17 Indeed, it is worth noting that for every year between 1998 and 2005, the UN and US cocaine estimates moved in opposite directions; i.e. if the UN estimate rose from the previous year, the UN estimate fell.

18 For example, after describing difficulties in estimating yields per hectare the UNODC goes on to say "The transformation ratios used to calculate

the potential cocaine production from coca leaf or the heroin production from opium are even more problematic." (WDR 2008; p.292.)

19 The very large increases in estimated production for 2006 and 2007, entirely explained by rises in Afghanistan estimates, are troubling. The dedine in farmgate prices, reported in the World Drug Report 2008 (p.40) to be only about 20% in 2007 seem very small relative to the two year rise of more than 100 percent in production. The period 2002-2005 probably saw a re-stocking of inventory drawn down in 2001 when production fell so dramatically, so it is unlikely that a desire to build inventory would lead to higher demand in 2007. Nor is there evidence in the rest of the world of unusual price declines or increases in demand.

20 The interesting analytic question is why the industry in Afghanistan seeks such a high ratio of inventory to annual shipments.

21 Brazil may now be comparably important for shipment to the growing European market.

22 This reflects statements about national responses to the UNODC Annual Reports Questionnaire.

23 We use the term consumption rather than demand, an economic term, because the latter refers to the relationship between price and the quantity desired by customers at that price. All that we observe in many settings is the quantity consumed; hence the analysis is based on consumption measurement. This also parallels the earlier section labeled Production rather than Supply.

24 "Information from recent national surveys suggests that cannabis use is stabilising in many counties. Of the 16 countries for which it is possible to analyse the trend from 2001 and 2006, last year prevalence among young adults increased by 15% or more in six countries, decreased in three by a similar amount and was stable in seven." (p 42)

25 In the press release accompanying publication of its 2008 Annual Report, the EMCDDA was more cautious "across Europe, data suggest that new reoruitment to heroin use is still occurring at a rate that will ensure that the problem will not decline significantly in the foreseeable future". The spedfic countries dted by the EMCDDA in support were either small, new to the EU or (mostly) both.

26 A substantial percentage of Russia's opiate users continue to consume a variety of less refined domestic products other than heroin or opium.

27 The World Drug Report 2008 (p.56) reports considerable uncertainty about this number. It does not appear that there is a documented base for the estimate.

28 Even compared to other counties, where male rates exceed female, the Indian problem is disproportionately male, so that surveys are occasion-ally only of the male population.

29 Iran continues to be a major consumer of smoked opium, though heroin's chare of the market has risen in recent decades. Given that heroin is a more effident mode of consumption, that may have reduced per addict annual consumption in morphine equivalents.

30 Paoli, Greenfield and Reuter (2009, Chapter 5) show that it is possible to reconcile consumption and production data for the years 1996-2003. In each year except 2001 there is a surplus of production (after taking into account seizures); in 2001 consumption plus seizures substantially exceeded production. No reconciliation has been done for any more recent year. Over the entire period the difference was not very large relative to the total estimated production.

31 Changes in the methodology of the household survey in 2002 prevent comparison of the 1998 and 2007 figures for cocaine use in the household population. The new methodology appears to have resulted in higher estimated prevalence for cannabis and cocaine. Over the period 2002 to 2007 the estimated number of past year users of cocaine stayed essentially the same, around 5.8 million [htIp://www.oas.samhsa. govinsduh/2k7nsduh/tabs/Sect8peTabs1to21.pdf, last accessed February 14, 20091 The evidence for the decline in consumption is that the population in treatment for cocaine continued to age: whereas in 1992 over 50% of those entering treatment were under the age of 31, that figure had dropped to less than 20% in 2005 (unpublished analysis of .the Treatnent Episode Data System).

32 Data from the EMCDDA Table TD1 http://www.emcdda.europa.eu/stats08/tditab3b [accessed December 7, 2008].

33 For example, the prevalence of last month methamphetamine use in the household population aged 18-25 rose from 0.3% in 2000 to 0.7% in 2001 but then has never risen higher than that. In 2007, the figure was 0.6%. Meanwhile the total number of treatment admissions for methamphetamine rose from 67,000 in 2000 to 148,000 in 2005.

34 McKetin et al. (2005) estimate that the number of heavy methamphetamine users in Auslralia at about 100,000, comparable to the peak number of heroin users and equivalent to about 5 per 1,000 population. While methamphetamine is the amphetamine most commonly used in Australia, other forms are also used.

35 The evidence on the heroin market in the Russian Federation is exceptionally weak; the statement about the end of the epidemic, i.e. a sharp decline in annual initiation rates, is based on expert judgment. Weak support can be found in the time pattern of the number of "registered users", partly generated by criminal justice activities. This rose ten fold in the decade up to 2002 and then was constant over the next three years; approximately three quarters of that number are opiate addicts.

36 The UNODC estimate for the United States (the largest market) is larger than ours since it implies that every past year user consumes on average 165 grams annually whereas we assume an average of 96 grams. Since the average joint has probably 0.30-0.50 grams of cannabis (see Report 2), this is equivalent to the average user being a daily smoker of cannabis. No survey suggests that more than about one fifth of last year users fall into that category. Further, the UNODC applies an average retail price that is more than twice as high as the figure we use (€4.8 per gram and €12.5, respectively). We prefer our price figure since it is based on self-reported information from cannabis buyers who consumed or gave their cannabis away, and henc

37 Another complication for cannabis is that a substantial share of users receive the drug as a gift and some of that is self-produced. Thus total retail revenues are less than the result of multiplying total consumption by average retail price; the share that is self-produced may have changed over the study period.

38 The prices reported here are unweighted averages of the provindal prices, which can vary a great deal. For example, in Nlarch 1998 the prices in the two major provinces were $41for Kandahar and $95 for Nangahar. Since the composition of production across provinces changes substanti-ally both year to year and in the long-run, a simple average may be misleading.39 Though the Office of National Drug Control Policy has issued brief statements about prices post-2003, the lack of documentation of the methods used for generating those estimates and the lack of matdi with the dod_rmented estimates in the short period of overlap give them low credibility; see http://voices.washingtonpost.com/fact-checker/2007/11/is_there_a_cocaine_shortage_1.htrnl. There is evidence that the prices of cocaine and methamphetarnine rose in 2007. See ht1p://www.usdoj.gov/clea/concern/meth_prices_purity.htrnl, last accessed 15 January 2009.

40 The prices are unadjusted for potency. Data from a sample of the same seizures and purchases show that average potency has risen but this cannot be related to the individual observations.45

| < Prev | Next > |

|---|