| - |

Drug Abuse

MEMORANDUM ON GANJA IN MYSORE BY MR. L. RIC KETTS, EXCISE COMMISSIONER.

1. The species of Indian hemp which is in use in the Mysore Province, under the appellation of "ganja " in Hindustani, or " Bangi-soppu " in Kanarese, is what is generally known as the Cannabis saliva of Linn. The plant is cut during inflorescence with the resin carefully preserved on the leaves, dried and made into bundles.

2. The cultivation of the above hemp in Mysore is forbidden except under a free license Cultivation of Indian hemp restricted. granted by the Deputy Commissioner of the district on condition that, within one month after the preparation of ganja, the latter shall be sold to the licensed ganja contractor at a fair valuation, or exported under the Deputy Commissioner's pass, and that the licensee may, if he so desires, retain for his own private consumption ganja not exceeding 14 lbs., provided that the area of the land cultivated with hemp is not less than one acre. Except in three or four small plots of land in which the licensed cultivators failed from inexperience to make proper ganja, no attempt has been made by any one to grow the hemp in this province, evidently owing to the cultivators of land being ignorant as to the stage of growth when the plants should be cut so as to be fit for ganja. Therefore the ganja required for consumption in this province is imported from the Madras Presidency. Wild hemp is nowhere found in this province. Self-sown hemp is occasionally 0 be met with in gardens and backyards of native houses ; but when found they are immediately uprooted and destroyed.

3. Besides the pure ganja, the only preparations of it generally used and recognized in this province are majum and halva. Majum is a condiment made with ganja powder and other materials in the following proportions :—

The ganja powder is put into syrup made of jaggery and water and boiled. The mixture is then boiled with ghee and the other ingredients above referred to to form what is called majum. Halva is also a condiment prepared from the expressed juice of ganja powder boiled in water. In the liquid so obtained, sugar is dissolved and mixed with almonds, plums, cloves, nutmeg, cinnamon, cardamoms, anise-seed, and other spices.

4. The system under which the revenue from ganja is derived by the Darbar is the minimum guarantee system, under which the sole monopoly is raised, of the wholesale vend of ganja for the whole province, exclusive of the Civil and Military Station of Bangalore, is given out on contract for fixed periods, on condition that the contractor of the wholesale vend shall guarantee to the Darbar that the duty payable by him on the wholesale vend of ganja and majum at the prescribed rates shall not be less than the amount guaranteed by him per annum ; that he shall sell drugs only to licensed vendors ; that the drugs sold shall be of good quality ; that he shall always keep on hand not less than one month's supply at each wholesale shop and two months' stock at the provincial head-quarters deptit at Bangalore; that he shall carefully account for all receipts and expenditure of the drugs ; and that disorderly conduct and irregular transactions at wholesale shops shall be strictly prohibited. As the hemp is practically not cultivated in this province, as explained in paragraph 2 above, the contractor is permitted to import the supplies of ganja from the Madras Presidency. The bulk of ganja consumed in this province is obtained by him from the North Arcot district of the Madras Presidency at an average cost of 2 annas per seer. No modifications in the present system are under contemplation.

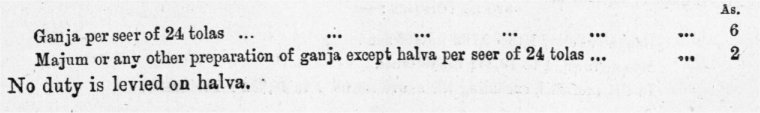

5. The rates of duty payable to the Darbar on the wholesale vend of ganja and majum are as follows :-

6. The prescribed wholesale prices at which the con tractor is bound to sell the drugs to licensed retail vendors are-

Ganja per seer of 24 tolas 10

Majum or any otherpreparation except halva per seer of 24 tolas 4

It will be seen from the above figures that the rates of gross profit allowed to the contractor by the Darbar are 4 annas per seer of ganja and 2. annas per seer of majum. It has been ascertained that the contractor's costs per seer of ganja are 8 annas and 11 pies, so that he gains 1 anna and 1 pie on every seer of ganja sold by him.

7. The minimum annual amounts guaranteed by the contractor for the current contract of four years from 1st July 1893 to 30th June 1897 are as per particulars below :—

average per annum.

The wholesale vendor shall not sell the drugs in any less quantity than as specified below :—

In Bangalore and Mysore towns ••• ••• ••• ••• 10 5

At all other places ••• ••• ••• ••• 5 2

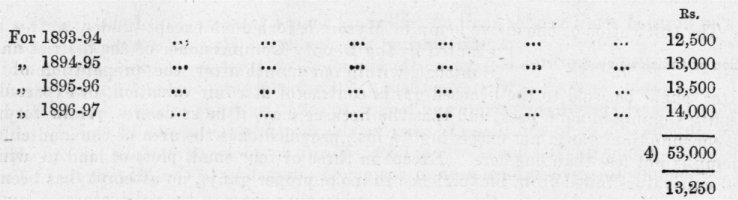

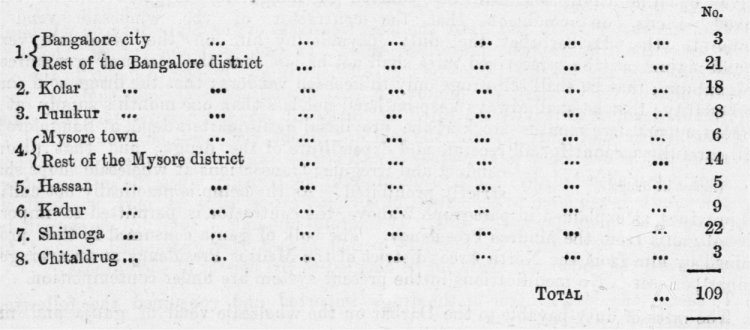

9. The wholesale shops licensed free by the Deputy Commissioners of districts for the convenience of retail vendors number as follows :—

10. The number of retail shops is limited to meet the wants of the consuming public. The existing retail shops are as per particulars below :—

11. In principal towns the rates of retail shops to population are as follows :—

Bangalore city, 1 to 26,762 inhabitants.

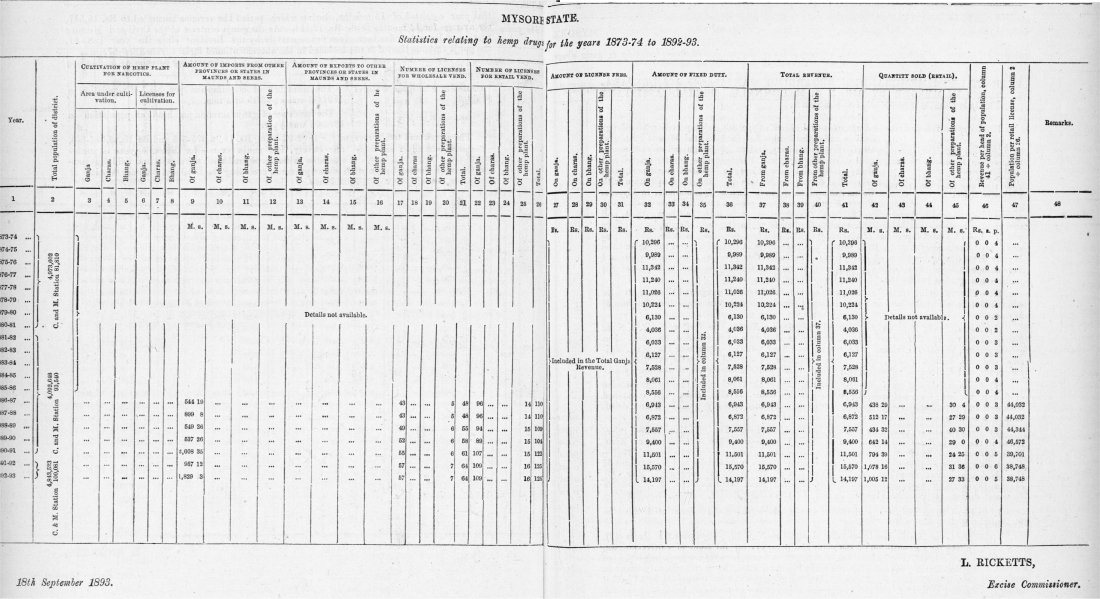

Mysore town, 1 to 12,341 inhabitants.

In the mofussil, excluding the above towns 1 to 46,892 inhabitants.

12. The prescribed retail prices at which licensed retail vendors are bound to sell the drugs to the public are :

Ganja per seer of 24 tolas ••• 13

Majum or any other preparation, except halva, per seer of 24 tolas ••• 6

The rates of profit allowed to them by the Darbar are therefore 3 annas per seer of ganja and 2 annas per seer of majum.

13. No license fees are levied for the retail vend of the drugs except in the cities of Bangalore and Mysore, where a fee of Rs. 3 per mensem is charged for each license.

14. The licensed retail vendor shall not sell more than 4 toles weight of the drugs to any person during any one day. He shall not permit disorderly behaviour in his shop or premises, suffer any gambling whatever therein, knowingly permit prostitutes or persons of bad character to meet therein, or permit any person to take the drugs in any such quantity as to produce stupefaction or to consume the same in the shop or premises, or knowingly sell the same to persons keeping ganja-khanas, where people resort to smoke or partake of the drugs. He shall be bound to give information of suspicious characters to the Magistrate or Police officer.

15. The direction and control of the administration of ganja revenue, as well as other items of excise revenue, vest in the Excise Commissioner, the principal executive authorities being the Deputy Com- missioners of districts.

16. The Excise laws under which the ganja revenue is administered throughout the province under one uniform system described in paragraph 4 above are the Imperial Excise Act XXII of 1881 as amended by Act VI of 1885, and as extended to this State by Regulation III of 1885 and the rules framed thereunder.

17. The drug is imported by the contractor on duly signed passes, and, on its arrival at Bangalore, it is duly weighed and checked with the entries pervision. in the passes by the Government supervisor in charge of the provincial depth. The drug is then stored in the provincial dep0t. The requisite supplies of the drug are on written application issued to the wholesale shops under the contractor with transport passes duly signed and sealed by the supervisor in charge of the provincial dep6t. On arrival of the consignments at the places of destination, the local taluk officials duly check them and make them over to the wholesale vendors concerned, who at once duly book the con.- signments in the prescribed registers furnished by the Darbar. The wholesale shops are from time to time inspected and the sales therein checked and verified by the inspecting officers of the department: The sales in retail shops are likewise checked and verified by the said officers.

18. The duty is collected in the following manner :—

1. The minimum amount guaranteed by the contractor is payable to the Darbar in 12 equal monthly instalments on or before the 20th of each month.

2. The contractor shall pay into the local treasuries of the State duty on wholesale sales of the drugs at the prescribed rates. If the total amount of the duty accruing on the wholesale sales be not sufficient in any month to make up the instalment of the guaranteed amount for that month, the contractor shall pay such further amount as may be required to make up the deficiency. On the other hand, if the said duty exceed the said instalment, the excess shall be available to make up the deficiency in any other month of the same official year, this deficiency being adjusted by short payments into the treasury when the instalment for the month is tendered to the extent of such net excess sales as may be available when such instalment fell due. If the total amount of duty due on the wholesale sales for any year of the contract period exceed the guaranteed amount for that year, the contractor shall not be entitled to the benefit of such excess.

3. To secure the duty leviable on the drugs imported and consumed the following precautions are adopted : —

(a) No one shall be permitted to import or sell the drugs by wholesale except the licensed contractor.

(b) Any person found in possession of more than 5 toles of the drugs shall be liable to prosecution.

(c) No person except licensed vendors shall sell the drugs in any form whatever.

(d) No on except the licensed contractor shall purchase the drugs from any one permitted to cultivate the hemp.

19. The right of retail vend is not disposed of generally by public auction. But when more than one application is received for one and the same shop, the Deputy Commissioner of the district concerned sometimes puts it up to auction. When an application for a license to sell the drugs is received, the local residents and officials are consulted; and if the want for a shop is really felt, the license is granted by the Deputy Commissioner with the previous sanction of the Excise Commissioner, the site for the shop being fixed by the Deputy Commissioner.

20. In addition to the establishment of a separate excise staff for the prevention and detection of clandestine cultivation and import of ganja, the members of the Police Revenue Sayer, Octroi, and Municipal Departments have been appointed as Excise officers under sections 24 and 34A of the Excise Act. Illicit cultivation and smuggling are not carried on to any appreciable extent.

21. Ganja is used for smoking by simply crushing the dry leaves and mixing them with tobacco in the proportion of two parts of the former to ganja is consumed, and its effects ? one part of the latter. Majum and halve, are generally eaten in sweetmeats. An infusion of the withered flowers of the hemp plant is occasionally made and mixed with pepper, poppy-seed, and fried Bengal gram, the preparations being either diluted and drunk under the name of " rarnras," or made up into pills and swallowed, or dissolved in jaggery water and milk or expressed juice of the cocoanut and drunk under the name of " bhang." The generality of the consumers are said to be Mahomedans, many of whom are idle and disreputable men of the lower classes, as also Bairaghis, Gosayis, Rajputs, and a few other Hindus. It is represented that where the quantity consumed is below 24 tolas weight, it does not produce any bad effects; but where this is exceeded, stupefaction or even temporary insanity is the result. In the Lunatic Asylum, Bangalore City, instances were to be met with of patients affected by excessive use of ganja. The Excise Commissioner is, however, not aware of any instances in which crime was excited under its influence or permanent insanity was produced by it. He is informed that it tends to affect the nervous system and undermine the constitution gradually.

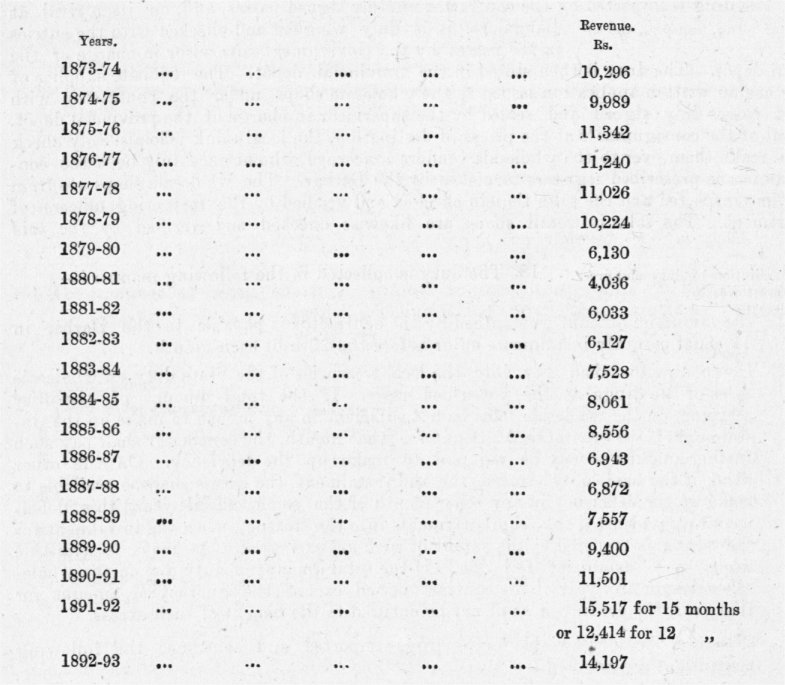

22. The revenue from ganja for the past 20 years is as per particulars below :—

In the year 1878-79 the privilege of selling ganja in the province was partly rented out and partly worked under a system of license fees. The gradual fall of the revenue from 1879- 80 was due to the contract system having been replaced by the amani management. In consequence of efficient preventive measures adopted since June 1889 to put down illicit cultivation of the hemp and smuggling of the drug, the revenue increased from Rs. 9,400 in the year 1889-90 to Rs. 14,197 in the year 1892-93. In 1891-92 the official year was ordered to be reckoned from ist July to 30th June instead of from ist April to 31st March, and therefore that year consisted of 15 months, during which period the revenue amounted to Rs. 15,517, the average for 12 months being Ets. 12,414. As the ganja contract of the Civil and Military Station of Bangalore has been given out separately by the Resident since the year 1886-87, the ganja revenue thereof is not included in the abovementioned figures from 1886-87.

The total consumption of the drugs in 1892-93 was 41,326 seers.

The incidence of consumption per head of population in 1892-93 was one-fifth of a tola.

The incidence of ganja revenue per head of population in 1892-93 was ½pie.

The arrack and toddy revenue for 1892-93 being Rs. 15,92,475-5-6 and Rs. 13,89,054-8-8, respectively, the ganja revenue for the same year is inconrevenue. siderable when compared with the arrack and toddy revenue and also with the total population of the province, excluding the Civil and Military Station of Bangalore, namely, 4,843,523 inhabitants.