| - |

Drug Abuse

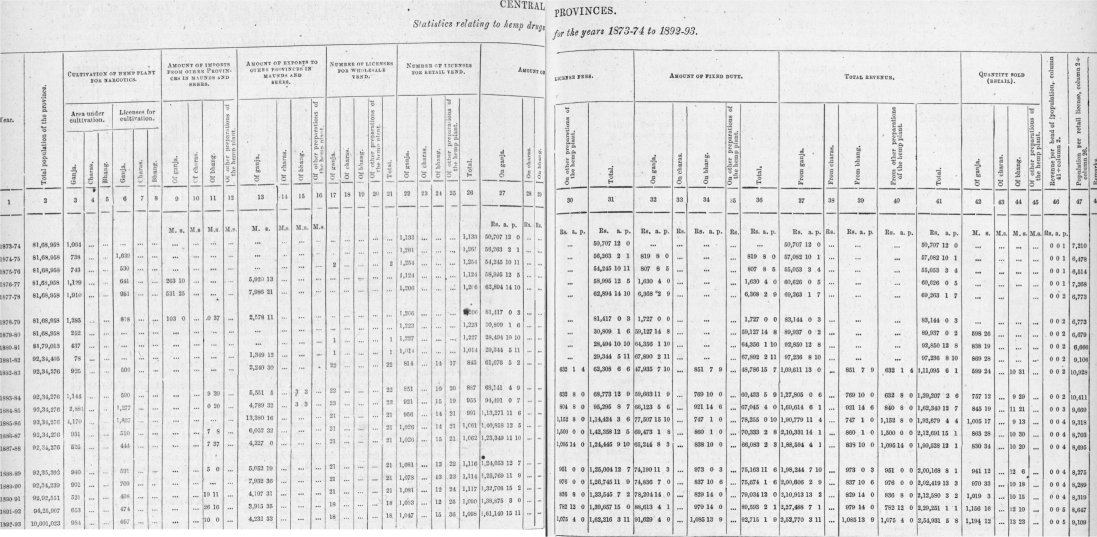

CENTRAL PROVINCES MEMORANDUM.

The period for which the Hemp Drugs Commission require statistics begins with the year 1873-74, when the Act in force in the Central Provinces regulating excise matters was No. X of 1871. The only section of that Act which authorized the levy of a duty or tax on hemp drugs (then included with opium in the term " intoxicating drugs ") was section 24, which, provided as follows:

" Whenever a license for the retail sale of * * * * intoxicating drugs is granted under this Act the Collector may demand, in consideration of the privilege granted, such tax or duty, or a tax or duty adjusted on such principles, as may from time to time be fixed by the chief revenue authority."

2. In the first year for which the Act was in force, i.e., 1871-72, the revenue from "drugs" was Rs. 70,7,13, that from opium being Rs.1,71,316. " Drugs" included "madak," in spite of the fact that madak was known to be merely a preparation of cpium. The monopoly of vend of " drugs," either for each district as a whole or for small areas, was everywhere put up to auction and knocked down to the highest bidder. The monopoly of the vend of opium was sold separately; but in most cases the same person took both it and the monopoly in respect of " drugs." From paras. 24 and 25 of the Excise Report for the year it appears that the desirability of separating receipts from ganja and those from madak was making itself felt, and also that proposals for restricting cultivation of the hemp plant were under consideration.

3. In this year madak was not classed with ganja, and the revenue from the latter fell from Rs. 59,625 in 1871-72 to Rs. 55,824, or by nearly 7 per cent. The bids for the right to retail mada,k in 1871- 72 had fetched Rs. 11,087, and that and the opium monopoly were sold together for the first time in 1872-73. In almost every district a few hemp plants were to be found in the gardens of cultivators, and it was only in Raipur and Bilaspur that a license fee was imposed on cultivation. The right of retail vend of ganja was, as before, auctioned by circles, the circle sometimes being as large as a tahsil, sometimes much smaller. The expediency of restricting cultiAiation was still being considered. The number of shops in the year was 987.

4. For some years past our retail contractors had complained that the extensive cultivation of ganja for home consumption by private individuals seriously interfered with their profits and prevented them from paying to Government as high a revenue as they otherwise might. In December 1873 Deputy Commissioners were accordingly asked to report on the following pints :--

(1) whether the people would be inconvenienced if the cultivation of ganja was prohibited except under license and in the vicinity of tahsils where existing establishments could check the produce and see it stored;

(2) whether the ganja sold under existing arrangements by retail contractors was home-grown or imported.

The reports received showed that all retail contractors except those of Bilaspur obtained their ganja from either Nimar or Nagpur, and that in every district, except perhaps Hoshangabad, Narsinghpur, Mandla, Chhindwara, and Bilaspur, the amount privately grown for home consumption was insignificant, while in Sambulpurit was nil, home-growing having been prohibited by executive order of the Deputy Commissioner. The Commissioner of Excise then moved the local Administration to restrict cultivation to the Kotal and Khandwa tahsils and to impose a license fee on each acre cultivated.

Meanwhile the Government of India had been enquiring into certain allegations regarding the effects of ganja and other preparations of the hemp plant, and on the 17th December 1873 all local Governments were instructed to discourage the consumption of ganja and bhang as far as possible by placing restrictions on their cultivation, preparation, and retail, and imposing on their use as high a rate of duty as could be levied without inducing illicit practices.

Acting on these instructions, and recognizing that section 40, Act X of 1871, only authorized such supervision of cultivation as might be deemed necessary to secure the duty leviable on the manufactured drug, the local Administration directed the Commissioner of Excise to prepare rules limiting cultivation to licensed fields in localities where existing revenue establishments were available for purposes of supervision, and fixing such a rate of license fee as would be a sensible impost on the value of the produce.

The financial results of the year were not satisfactory, the revenue falling from Rs. 55,824--9 to Rs. 50,707-12-0 in spite of the fact that in Sambulpur the monopoly of retail vend was sold for the first time and brought in Rs. 325. Shops numbered 1,133, but their distribution was palpably faulty.

5. In April 1875 rules for controlling cultivation were sanctioned, the main object of which was to put a stop to the practice of growing for home-consumption. Cultivation, except under license from the Deputy Commissioner, was prohibited, and no license was to

be obtainable for plots of less than an acre in extent. More- over, each cultivator was bound to obtain from the Tahsildar a license to cover the possession of his gathered crop until its sale to a licensed vendor or exporter, and stocks were made liable to inspection by Excise officers of all grades at all times. The rules also provided for the levy of a fee per acre on cultivation, but no fees were fixed till the year 1875-76 : in Raipur and, Bilaspur the old rate of fees, v4.• Rs. 0-8-0 an acre, remained in force. For facility of reference ChaptPr. VIII of the Excise Manual, 1875, has been reprinted and annexed as Appendix B* to this Memorandum.

The revenue of the year was derived, as before, by auctioning the monopoly of vend, and competition at the sales resulted in bids rising from Rs. 50,707-12-0 to Rs, 56,263-2-1, or by neatly 11 per cent. Shops numbered 1,261, or 1 to every 6,478 of the population served in Nagpur City and in the interior ef Hoshangabad there were 18 and 1+1 respectively„ allowances which were declared in the Resolution on the Excise Report for the year to be " inardinate." The acreage fees on cultivation in Raipur and Bilaspnr amounted to Rs. 819-8.0, and these have heen shown as fixed. duty in Appendix A. •

6. The rules of 1875 were in force throughrut the year 1875-76, but they did no influence the revenue of the year which was settled at the auction held before their issue. That revenue was Rs. 54,245.10-11, excluding acreage fees on cultivation, which amounted to Rs. 807-8-5.

The acreage fee was fixed tentatively for one year at Re, 1 per acre ; the amounts real.. ised are shown as fixed duty in Appendix A. Receipts under this head were very small in Raipur and Bilaspur compared with those for the preceding year, and prol ably iudicate that scattered cultivation had considerably diminished. The statistics of area cultivated and number of licenses granted are not quite complete, but it may be taken as certain that only in the Khandwa and Kato] talisils was ganja produced in any large quantities ; the districts of the. Nerbudda Valley with Saugur and Damoh drew their supplies from Khandwa, while the hill, districts of Betul, Chhindwara, Seoni, and Mandla and the entire Nagpur and Chhattisgarlt Divisions imported from Katol. The terms on which licensed vendors of different districts. obtained their supplies appeared to have varied greatly, but a uniform retail price of 1 pice weight for 1 pice prevailed all over the provinces. &tail shops numbered 1,254, or 7 less than in 1874-75; 12 had been closed in Hoshangabad, where the allowance had been condemned by, the Chief Commissioner as excessive, but Nagpur City • was still left with 18.

Looking to the total population, the incidence of revenue from ganja per head fell at the rate of I / pie, or less than would suffice at that time to buy an ordinary smoker one day's supply of the drug.

7. The old system of raising the revenue was adhered to in 1876-77, viz., (1) selling the farms and allowing the contractors to make their own arrangements for obtaining the drug, (2) levying an acreage fee on cultivation. These sources yielded respectively Rs. 58,995-12-5 and Rs. 1,630-4-0. The improvement in bids for the right of retail vend appears to have been due to rising confidence in the arrangements for the control of cultivation, but the Administration recognized that, no matter what precautions were taken, much ganja must be reaching consumers which had paid little or no duty, and that bidding would not be keen until every crop raised was taken under direct. eoutrol.

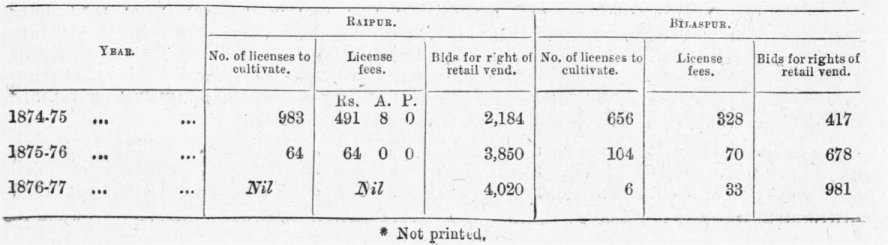

In this year a special penal fee on unlicensed cultivation was introduced : the Be. 1 rate was made applicable only to cases in which a license was obtained before sowing, and Rs. 10 was to be levied on every acre or fraction of an acre not so protected. The penal rate was realized in 33 eases in Juhbulpore and in a few cases in some other, districts. The effect of the restrictions which had by this time been placed on the right to cultivate freely was most marked in Raipur and Bilaspur, if the increase in the amounts bid for the right of retail vend. in those districts was due to it, as appears to be the ease; but the decline in the number of licenses applied for and the amount of fees levied was so sudden and rapid as to justify a saspicion that unlicensed cultivation of small plots must have been going on undetected,

The table below, bringing together statistics for three years, will make the above remarks clearer :—

The number of permanent retail shops open during the year was 1,226, but of these 123 (in Bilaspur 102, Nursinghpur 4, and Bliandara 17) were open on bazar days only. In Hoshangabed the number had been again reduced till each shop had an average population of over 5,000 persons to serve. The incidence of revenue per head of total population rose from 1¼ to nearly 1½ pie. Of consumption no satisfactory estimate can be made: in the Excise Report of the year 1,000 maunds was stated to be the probable amount.

8. Similar arrangements to those of 1876-77 were in force in the Khalsa. The most important measure taken during the year was the extension of the Khalse rules reoording the cultivation and possession of ganja to the zamindaris both feudatory and non-feudatory, of the Chhattisgarh Divieion. Very little, however, was done towards assimilating nractice in those zamindaris to that in the Khalsa, the order on the subject having issued only. a short time before the cultivating season began.

The revenue of the year was raised in the same way as that of 1876-77. Bids for the riglit of retail vend improved from Rs. 58,995-12-5 to Its. 62,894-14-10, all districts except Narsinghpur and Sambulpur contributing to this result. The penal rate of acreage fee (Rs. 10 per acre) was in several districts vigorously exacted, and collections under this head amounted to about Rs. 4,000: including fees at the rate of Re. 1 per acre, the tax on cultivation yielded Rs. 6,368-2.9. Statistics of area cultivated are not available for 2 (Wardha and Balaghat) out of the 15 districts in which fees were levied, but it is safe to say that in none except Nagpur and Ninnar was the quantity produced at all considerable.

It would appear from the statements for the 2 years that (Appendix A) St more retail shops were worked in 1877-78 than in 1876-77 ; but in the latter year there were 102 bazar shops in Bilaspur, which are not included in the total given in the statement, although they. have been taken into account in the remarks in paragraph 7 of this Memorandum, while the number of such shops in 1877-78 s not ascertaivable.

The total revenue of the year fell at the rate of rather more than i pie per head of population.

Statistics of the amounts liold by retail are not available, and no trustworthy estimate of consumption can be made. From figures in statement No. VI appended to the Excise Report for the year it appears that 3,419 maunds of ganja locally raised were exported ta different parts of the Central Provinces, while imports from other British territory and. foreign territory amounted to 532 maunds, so that in all 3,951 ['mends were imported. Adding for the undermentioned non-importing districts the amounts which were probably consumed as well as raised in them respectively, viz. :--

Nag pur 1,000

Seoni and Cbhiadwara 200

Nimar 300

a consumption of nearly 5,500 maunds seems to be aceounted for. But much ganja was doubtless consumed in Chanda which had been illicitly brought from the Nizam's Dominions, while in the Chhattisgarh Division a considerable portion of the demand must have been met by the produce of the bordering zamindaris and feudatory States. Raipur and Chanda between them imported under due authority* 376 maunds, but Bilaspur and Sambulpur made no such importations.

On the whole it would be safe to put consumption at 6,000 maunds as a minimum : the estimate in the Excise Report for the year is apparently about 5,000 maunds, hut from it are excluded imports into districts of the Central Provinces from elsewhere than Nagpur and Nimar.

In reviewing the Provincial Excise Report for 1876-77 the Government of India remarked that they were prepared to consider any suggestion that might be made for restricting the use Of ganja, and again in March 1878 they approved of the Chief Commissioner carrying out measures for restricting the cultivation of ganja and imposing on the drug gradually, or otherwise, as heavy fiscal burdens as it could be made to bear. Accordingly the subject had a large share of the Chief Commiesioner's attention during the next 3 year

9. In November 1878 a new set of rules under paragraph 2 of section 40, Act X of 1871, was issued.

The Judicial Commissioner, to whom a draft for concentrating cultivation of the hemp plant in the Katol and Khandwa tahsils and for the imposition of a prohibitive acreage tax on cultivation elsewhere had been submitted, pointed out that as the Act of 1871 merely authorized supervision of cultivation' cultivation without a license, even if the licenses were granted gratuitously, could not legally be prohibited, nor could any acreage tax be imposed. The rules finally sanctioned provided (1) that cultivators of the hemp plant sbould give notice of intended cultivation, its locality, extent, 8rc., (2) that they should give similar notice of their intention to cut, (3) that their crop should be stored in Government godowns or in authorized private store-houses, and that it should only be removed therefrom on payment of the Government duty. The duty fixed by the Chief Commissioner after considerable deliberation was Re. 1 per seer, equal to Rs. 40 per maund.

These provisions seemed to be' workable enough, especially as in only 2 districts was there anything like systematic cultivation of the hemp plant. Unexpected difficulties, however arose in the disposal of the produce by cultivators to wholesale dealers and licensed vendors. The Commissioner 9f Excise was present both in Nagpur and Nimar on the occasions when sellers and buyers unit for the disposal of the produce.. At Nagpur the wholesale dealers held aloof, being uncertain of the effects which the enhanced duty demanded on the drug might have on consumption, while the retail vendors were not prepared to purchase direct or otherwise than in previous years from the wholesale dealers. In Nimar also sellers and buyers failed to come to an understanding. Accordingly it was found necessary, in order to guard the cultivators against loss and to secure to Government the control of the entire crop to purchase on behalf of r'Government 1,856 maunds of ganja in Nagpur and some 5,000 maunds in Nimar at a total cost of nearly Rs. 50,000.- These quantities together represented nearly the entire crop of the year in the Central Provinces, so that practically Government obtained a monopoly of the drug.

The small cultivation of ganja in districts other than Nagpur and Nimar was specially dealt with. The Wardha crop was taken over by the Deputy Commissioner and forwarded to the Nagpur Store, to be there dealt with like the produce of the Katol Tahsil. In Betul, Chhindwara, Narsinghpur, and Raipur the whole produce was put up to auction and sold to licensed vendors the upset price fixed being Rs. 36 per maund : the cultivator's share of the proceeds was fixed at one-seventh.

10. The revenue was Rs. 83,141-0-3, of which Rs. 1,727 was collected on licenses cultivate, a source of income which had now to be finally abandoned in accordance with the opinion of the Judicial Commissioner on the draft rules as first drawn.

Bids for the right of retail vend increased by Rs. 18,522-1-5, Mandla and Chhindwara being the only districts which did not contribute to this improvement. The auctions bad been held much earlier than usual in order to give licensed vendors generally a fair opportunity of buying their supplies direct from producer.: hitherto the principal ganja crops had been for the most part bought up by a few persons for purposes of wholesale vend. Another probable cause of the improvement was the selling of the monopolies as far as possible in small circles, instead of in lump or by tabsils'or large circles, as bad previously been the practice in several districts.

The incidence of revenue rose to very nearly 2 pies per head of population. The number of retail shops which worked during the year is not ascertainable, but was probably much the same everywhere as in 1877-78.

11. With a view to administrative efficiency as well as economy the district formerly known as " Upper-Godavery "was abolished in this year, a small portion being transferred to the Madras Presidency and the remainder being constituted a sub-division of the Chanda district and styled " Sironcha." For the sake of preserving uniformity throughout Appendix A, the statistics relating to the Upper-Godavery district have all along been included in those of Chanda.

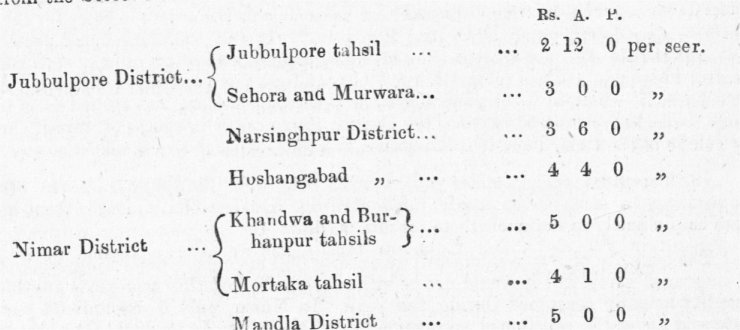

12. The arrangements for raising the revenue in 1879-80 were peculiar, owing to the position in which Government found itself as holder of almost the whole provincial stock of ganja. In five districts the circles of vend were not sold at all, but farms were given to men of capital and position, who engaged to find retail vendors and to keep them supplied with ganja taken as it came in the uneleaned state from the Government stores, paying only duty at certain fixed rates on removal from the Stores : those rates were as under :—

In the remaining district the monopoly of retail vend was sold in the usual way, at first for 3 months and then for the rest of the year. Tile plan tried in the 5 districts above named, though not an absolute failure, was soon found in practice to be open to serious objections : the farmers, not being bound to work in earnest in order to be able to pay stipulated instalments to Government, did very little towards ensuring an adequate supply to the public. For the last. nine mouth of the year, therefore, in the remaining 13 districts the retail monopolies were left in the hands of the men who had bought them for the preceding quarter at the old monthly rates of' license fees and on the condition that they purchased only at a Government store or from distributing agents appointed by Deputy Commissioners. Wholesale vendors were employed as distributing agents on a commission at rates varying from 9 pies to 14 anna per rupee on the fixed selling price of Rs. 2-14-0 per seer : this:price included-both the cost to Government and the fixed duty.

13. The ganja issued for consumption in the year was for the most part raised in the season July to November 1878, and in respect of that season's crop no difficulty in realizing duty under the arrangements just described was experienced. But at the close of the preceding year there were stocks of old ganja, the produce of the autumn of 1877, and on these a duty of Rs. 30 a maund was made leviable under the Chief Commissioner's orders : where these stocks in the hands of any one person exceeded 1 maund, a special rate in excess of Rs. 30 a maund was exacted; but in several districts payment of duty was evaded, licensed vendors having been allowed, in spite of orders to the contrary, to purchase, after the elese of 1878, quantities largely in excess of what was necessary to carry them on to the end of March 1879.

14. " Bhang " (foreign) was taxed this year for the first time, but statistics of receipts under this head are not available till 1882-83. The rate first fixed was Rs. 8 per maund, and any licensed retail vendor was permitted to import what he required on prepayment of duty at that rate. At the same time a rate of Rs. 10 was imposed on charas. The rate on bhang was raised in July to Rs. 8 per =and less than that charged for ganja, i.e., to over Rs. 100 per maund, taking the ordinary ganja rate to be Rs. 2-14-0 per seer. The cost price in Rajputana and other sources of supply was Rs. 10 to Rs. 12 per maund. From records in this office it appears that in the preceding half of the year 1879 about 7 maunds were imported into Nimar, Hoshangabad, and Jubbulpore, and that in those districts and also in Chanda, Seoni, Saugor, and Raipur there were old stocks amounting in all to 22 maunds 24 seers. The only districts in which there was any licitly imported cbaras was Jubbulpore, and the amount there was 374 seers only.

On " local bhang," or refuse ganja, a duty of 3 annas per seer was imposed, the article being issued to licensed vendors at this rate from the Government stores. The chief use of. this was as medicine for cattle to get them into good condition.

15. In this year Ganja License Forms VII and X, prescribed by Notification No. 4627, dated the 5th November 1876, were cancelled, and licenses published with Notification No. 996 dated the 12th March 1880, substituted therefor. This step was taken at the instance of the Commissioner of Excise with the object of protecting our revenue against smuggling by rail from foreign territorpor from British territory beyond the Central Provinces. Ganja was cultivated in particular in the Indore territory south of the Nerbudda, 7 villages in which the plant was raised forming a group round Sanawad on the railway line between Khandwa and Indore and constituting what was almost an island of foreign territory within the Nimar district. The amount of ganja raised annually was about 1,500 mannds, and this could be bought on the spot at from Rs. 2-4 to Its. 2-8 a maand, no pass or permit being required. The badness of the roads and the insecurity of life and property throughout Central India rendered it practically impossible for traders in this ganja to reach a market otherwise than by rail and therefore by passing through British territory. It was obviously essential to keep a watch on consignments so sent, and rules 7 and 8 of the Notification of November 1878 were meant to be read, with Forms VII and X, as requiring imports from outside the Central Provinces to be taken to a Government store-house under one license (Form VII) and then exported under another (Form X). But Form VII merely required that imported gnu ja should be delivered at the Central Store, "to be there disposed of according to the orders in force for the produce of -cultivators resident beyond the Central Provinces." It was therefore found necessary to provide specifically for the examination of consignments booked to railway stations within the Central Provinces, and the revised Form VII contained the necessary conditions. At the same time Form X, which in its original shape was practically useless, was altered so as to render all ganja whether purchased within the Central Provinces 6r in course of transit through them for sale in other parts, liable to examination by any Provincial Excise officer at any time.

16. The gross receipts under ganja for the year were Rs. 89,937, but the arrangements for securing payment of the newly imposed direct duty cost Rs. 6,636, so that net receipts were only slightly in excess of those for 1878-79.

The quantity of ganja sold retail was nearly 600 maande, representing some 800 maande of uncleaned hemp, but it would not be safe to conclude that this represents anything like the quantity actually consumed during the year. In Nimar only 6 mounds 24 seers of ganja were sold under the sanctioned arrangements, but there can be no doubt that this amount was quite insufficient for the wants of the district, and smuggling from the Sanawad pargana of Indore is known to have gone on to a great extent. Retail prices everywhere ruled much higher than they had ever done before, the cost price to licensed vendors being nowhere less than Rs. 2-12-0 per seer, or about 2 pice fur one pice weight. The total number of retail shops rose to 1,223, but the figures for districts differ greatly in many instances from those of 1877-78 and 1878-79, and no satisfactory explanation of the differences can be given. In Bilaspur and Sambulpur bazar shops appear to have been included in the enumeration :" elsewhere there were generally fewer shops, to judge from statement IV appended to the Excise Report for 1880-81. -

It is difficult to believe that only 252 acres were under ganja in the year in Nimar, but enquiry on the point has failed to bring any other statistics to light. The produce of the Katol Tahsil amounted to 250 maunds, but the area cultivated cannot now be ascertained.

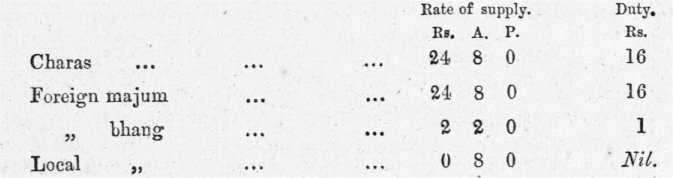

17. The Government of India, in sanctioning disbursement of the money which had been spent in 1878-79 in purchasing the crop of that year and also old stocks left in the hands of certain dealers whose licences expired on the 31st March 1879, and were not renewed, remarked that they were not disposed to favour the permanent creation of a Government monopoly of ganja. Accordingly, for 1880-81 the monopoly of wholesale vend for the whole province was granted to a single contractor (Kaluram Marwari of Kamptee), who agreed to pay a direct duty of Rs. 2 per seer on all ganja sold by him to retail vendors and to issue the drug to retail vendors at Rs. 3 per seer. Under the agreement, the text of which will be found in Appendix D,* hemp drugs other than ganja were to be supplied to retail vendors at certain fixed rates per seer : those rates and the corresponding rates of duty payable to Government were :—

Charas and foreign majum were never actually imported. For local majum, a confection made of sugar, ghi, and local bhance, separate retail licenses at the same rates as those for sale of ganja were required. In the first 8 months of the year local bhang was taxed at the rate . of 0-2-0 a seer, the right of selling it by retail being limited to the wholesale vendor of ganja and his agents, but in November 1880 the Chief Commissioner directed that clean cranja only should be issued from the Government stores, all refuse, including local bhang, detached ia the process of cleaninc, being systematically destroyed, and further that at any subsequent cleaning which might be found necessary the additional refuse should be similarly dealt with.

18. Kaluram bought up so much of the Nimar and Katol crops of the season July to November 1879 as was in the hands of cultivators, and also all Government ganja left in the provinces on the 31st March 1880, except a surplus of some 5,000 maunds at Khandwa, which he agreed to sell on behalf of Government in return for a commission on sales. He was bound to apply the ganja he purchased for home consumption in the first instance: if any remained over, it might be exported, one-half of all profits realized in this way being payable to Government.

Distribution to retail vendors was provided for by requiring Kaluram to appoint and maintain an efficient and respectable agent at the head-quarters of each district and the headquarters of each tahsil except Sironcha, which was supplied from Cocanada in the Godaveri district of the Madras Presidency and from the Nizam's dominions.

The right of retail vend was disposed of in a new way : instead of auctioning the monopoly by circles, monthly licenses were issued at fixed rates varying according to the size of the town or village and without limit as to the number of licenses existing in one place.

19. The gross revenue of the year was Rs. 92,850-12-8, or more by 3-2 per cent. than that of 1879-80. Sales by retail vendors under the sanctioned arrangements rose from nearly 600 maunds to 839 maunds 19 seers, or by 40.1 per cent., and the amount of direct duty realized by Rs: 5,228, or 8-8 per cent. only.

License fees for the right of retail vend fell off by Rs. 2,315, or 7-5 per cent.

It will be readily understood, however, that the statistics of the two years cannot be satisfactorily compared. In 1879-80 no amounts quit' license fees proper were realized in 5 districts, while in the rest the charge of Rs. 2-14-0 per seer made to licensed vendors included the cost of the ganja supplied as well as direct duty, though the whole has been shown in column 34 of the statement in Appendix A under the latter head : moreover, old stocks which never paid duty and consequently were left out of the account of consumption must have found their way from the hands of the contractors who owned them into those of the smoking public.

Accurate information as to the exact number of retail shops worked is not forthcoming. In several distrias the returns fail to distinguish sufficiently between licenses issued and shops opened.

20. The arrangements for this year were shaped by the necessity of getting rid of the Government stock of ganja, amounting to 3,000 maunds 1881-82. (uncleaned), which remained in store at Khandwa.

Accordingly, the representatives of Kaluram, the wholesale contractor for 1880-81, were given a contract for supplying the whole province on condition of their taking over this stock for Rs. 18,000, besides purchasing the crop raised in 1880 in Nimar only : that crop was estimated at 2,500 maunds.

The agreement entered into with the firm will be found in Appendix F.*

It will be observed that the wholesale supply of ganja, &c., was left entirely in their hands, and that they were required to maintain an agent at the bead-quarters of each district and tahsil (except Sironcha, where the existing arrangements were allowed to stand). With a view to avoiding unnecessary loss to the firm from cost of carriage of refuse stuff, it was arranged that the cleaning of the ganja should ordinarily be done at Khandwa or at Nagpur, but where the journey was likely to produce considerable injury to the drug, Deputy Commissioners were instructed to arrange for its being cleaned at its destination. The stocks maintained by the agents were to be examined by the tahsildar, or in his absence by the naibtahsildar, every fortnight. The examining officer was required to deduct the amount of the closing balance for the fortnight from the total of the opening balance and of any subsequent additions to stock : on the difference so ascertained and verified, which represented the amount sold by the agent, duty bad to be paid. Each agent of the firm was provided with a license for the wholesale vend of ganja, foreign bhang, charas, and majum, and also for theretail vend of the last mentioned article.

In most districts retail vendors held their shops as in 1880-81, i.e., on monthly licenses at rates which varied in.different localities and without restriction as to the number of licenses granted in any one place. In Seoni and Saugor shops were auctioned on the old system, and there was a large increase in receipts from license fees in those districts.

21. The revenue of the year was made up as under-

Rs.

Rs.

Sales to retail vendors increased from 838 to 869 matinds, but the increase was not general, for in seven districts, and particularly in Bila,spur and Seoni, sales declined. Receipts from license fees were larger than in 1880.-81 in 8 districts only : the system of monthly licenses, which had by this time been given an extended trial, was found to be unsuitable, accurate information having still to be collected as to the approximate consumption in different localities.

22. Statistics of cultivation in Nagpur for the 3 years 1879-80 to 1881-82 are not forthcoming. It will be remembered that government bought up the crops of 1878, and Kaluram those of 1879 in both Nimar and Katol. The Nimar crop of 1880 was purchased by the firm which succeeded to Kaluram's business, and that, together with 3,000 maunds purchased from Government, made it quite unnecessary for them to have any dealings with the Katol cultivators. Great difficulty had been experienced in corning to terms with the Katol men in respect to the crop raised in 1879 ; they had sold the produce of 1878 to Government at rates varying from Rs. 7 to Rs. 10 a maand, but for that of 1879 they held out for Rs. 30 per maund. Eventually, after the Chief Commissioner had been petitioned, in the matter, the Commissioner of Excise was requested to settle the price in a manner which would leave the cultivators no ground for complaint, and in the end payment at the rates given in the preceding year was agreed to by all concerned, the cultivators being at the same time distinctly warned that if they chose to grow ganja in the future they would do so at their own risk, as there was no chance of the Government again arranging for its purchase. In spite of this experience, about 1,100 maunds were brought to the Nagpur Store-house at the close of 1880, and this the firm oT Jaitram Mahadeo declined to buy, having, as already remarked, obtained a fully adequate supply in Khandwa under the terms of their agreement with Government. . The cultivators then demanded that their entire stock should be purchased by Government, but as they had received fair warning that they would have to make their own arrangements for finding buyers their petition was rejected. Many continued to hold out for the purchase of their produce in lump, but some were in the end induced to part-with it in lots to different dealers. All appear to have refrained from raising ganja in 1881 in consequence of their failure to obtain the terms they had insisted upon ; their energies were directed throughout the year to agitating for reconsideration of the orders passed, and after unsuccessfully moving the Governmentnf India they memorialized the Secretary of State. No certain explanation of the sudden diminution of area under ganja in Nimar can now be given : it is, however, known that the Indore crop of 1879 was unusually large (4,000 maunds against 1,000 in the preceding season), and that exports from Nimar in 1880-81 did not exceed 75 maunds, and the knowledge of these facts and of the existence of a large stock in the hands of the provincial contractors must have made cultivators doubtful whether a local crop, if raised in 1881, would find any purchasers.

No licenses to cultivate were granted in these 3 years, inasmuch as the rules of November 1878 did not provide for this formality : any one might cultivate, provided that he gave written notice of his intention to do so.

23. During the early part of the year 1881-82 the Bill which eventually became the Excise Act, 1881, was under consideration. The Act of 1871, so far as it related to hemp-drugs, had been found wanting in three important particulars, viz.:—

(1) It only empowered the Chief Commissioner to place cultivation, preparation, and store under supervision—section 40.

(2) It did not make the mere importation without a license, irrespective of the quantity of the drug imported, punishable—section 63.

(3) The punishments for illicit manufacture, sale, and possession were inadequate—sections 62, 63, 64.

The Chief Commissioner proposed to remedy the first and third defects by means of a special clause worded as under :—

" In the Central Provinces—

(a) the cultivation of hemp,

(b) the manufacture of intoxicating drugs,

(c) possession of the intoxicating drugs,

(d) the import, export, and transport of intoxicating drugs,

are prohibited, except as permitted by this Act or by rules framed under this Act by the local Government, which may grant such permission absolutely, or subject to the payment of duty, or to any other condition."

The Bill, however, was considered by the Government of India to give all the powers required for controlling cultivation, manufacture, and storage, and the second para. of section 11 of the Act corresponds word for word with that in the Bill ; the wording is as follows :—

" In the other territories to which this -Act extends, the chief revenue authority may, from time to time, make que,h rules to restrict and regulate the cultivation of hemp and the preparation of intoxicating drugs therefrom as it may deem necessary to secure the duty leviable in respect of those drugs."

As for importation, it appears to have been thought that reduction of the quantity which might be sold by retail and possessed by a private person from 20 to 6 toles in the case of ganja would meet all the requirements of the case. In the Bill as first drawn the limit of quantity in respect of bhano. also was reduced from 20 to 5 tolas, but in the Act the old limit of 20 toles is retained. The law as to import is therefore in the same state as under Act X of 1871, the only difference being that a penalty is now provided (sections 20 and 42) for breach of rules "to regulate the grant of licenses or passes to persons possessing or transporting intoxicating drugs for the supply of licensed vendors," whereas formerly no punishment was provided for breach of such rules. With regard to penalties, the Act of 187] had wade offences in respect of hemp drugs punishable by fine only in the first instance, and imprisonment in default of payment was in the civil, not in the criminal, jail, except in the case of permitting drunkenness, etc., on shop premises. The new Act gave power to sentence in respect of all such offences, except those under sections 40 and 41, to imprisonment of either description extending to three or four months, in lieu of, or in addition to fine, and it contained no provision prescribing imprisonment in the civil jail for default of payment of fine.

24. In February 1882 rules regarding the cultivation, sale, transport and import of ganja were made by the Chief Commissioner under sections 11, 13,

20, and 55 of the Act of 1881. They are printed as Appendix G* to this Memorandum., Cultivation was thus definitely restricted to the tahsils of Katol and Khandwa, and cultivators were required to obtain licenses and to deposit their crops, in the Government store-houses at the head-quarters of those tahsils.

The arrangements for raising the revenue in 1882-83 were in strict accord with these rules, and, as they have not since been materially altered, it is worth while to give an account of the main principles underlyiog them. In the first place the interests of cultivators demanded that the monopoly of wholesale vend should no longer be left in the hands of a single firm : accordingly wholesale vendors were appointed for each district separately. Next to protect wholesale vendors, in case cultivators should combine for the purpose of exacting unfair prices for their produce, import under passes from extra-provincial markets was permitted. Thirdly, in order to ensure supply to retail vendors of a good marketable drug for consumption by private persons, the rule introduced in 1881-s2, that ganja, before being issued for retail sale, should always be cleaned to the satisfaction of the Deputy Commissioner, and that all resulting " bhang ' or refuse should be immediately destroyed, was maintained. Monopolies of retail vend were in most districts auctioned, the locality and number of shops being fixed beforehand, and none being allowed except where a reasonable demand for the drug was proved to exist. It will be remembered in this connection that the system of monthly licenses at fixed rates issued without limit as to the number of shops at any one place had not generally answered, the reason being that sufficient data for deciding what fee might fairly be fixed in each case were not available.

The sale of foreign bliang was no longer permitted to retail vendors of ganja : wholeiale ganja contractors and their agents were constituted sole vendors of the drug. The bhang imported had to be stored in the same way as ganja, and a direct duty of Rs. 2 was made leviable on each seer sold. No fee was payable for a license for retail vend of foreign bhang.

Charas and foreign majum had never been imported, so no provision for their sale was required. The case of local majum appears to have been overlooked when the rules were framed but the plan started in 1880-81 of licensing separate shops for its sale continued to be followed in practice. (See para. 17.)

25. Advantage was taken of the opportunity afforded by the breaking up of the monopoly of wholesale vend to obtain some revenue from wholesale license fees. The arrangement with the firm of Jaitram Mahadeo had been to levy duty at Rs. 2 per seer on the cleaned ganja issued, and to allow them to sell that ganja at Its. 3 per seer to retail vendors. The terms of that arrangement were more favourable than the circumstances of most districts justified, and each wholesale vendor had henceforward to pay a certain amount per seer in addition to the direct duty of Rs. 2, the rate varying in different districts and being generally determined by tender.

26. The Sirencha sub-division of the Chands district had from the first, as already remarked, been excluded from the system of supply prevailing in the rest of the province. Retail vendors had always supplied themselves with ganja from the Hyderabad and Madras country. The rules of February 1882, however, only permitted import by wholesale vendors, and licenses could only be granted by the Deputy Commissioner and with the sanction of the Commissioner of Excise. To meet this special case, a rule was added empowering the Assistant Commissioner of the Sironcha sub-division to grant import licenses to. any authorized vendor of ganja.

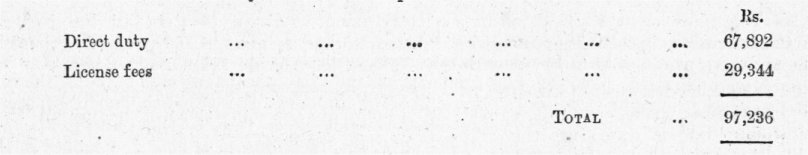

27. The gross revenue of the year, excluding credits to Government on sales of ganja to certain feudatory States in the Raipur district, was Rs. 1,11,095-6-1, made up as follows :—

The amount of taxed ganja consumed was a few seers short of 600 maunds. Besides thin, about 56 maunds were supplied by a wholesale vendor to feudatory States and zanaindarie. Retail sales decreased in all districts except Chanda and Damoh, and-the fall was very marked in Raipur and Bilasptir, where, however, the statistics given for 1881-82 include sales to feudatories and zamindmis. The pressure of the higher retail rates was now being generally felt by consumers, and smuggling and illicit cultivation had to be contended with in consequence. In some districts, too, the wholesale vendor had supplied old and inferior ganja ; to guard against a repetition of this they were required to supply in 1883-84 none but ganja of the crop raised in 1882.

In Sambulpur the revenue had always been insignificant, and the rate per seer for issue to retail vendors was reduced from Rs. 3 to Rs. 2 for that district, in order to give our taxed drug a chance against that smuggled from the Tributary Mahals of Orissa and the States of Chntia Nagpur ; at the same time the direct duty was lowered to Re. 1 per seer. Similarly, in the case of the Raipur district, the south and south-east portions of which suffered from the illicit introduction of ganja from Bastar, the rate of issue to retail vendors in the Sihawa Fergana was reduced to RS. 2, on condition that none should be sold for consumption beyond the limits of that pargana.

For this year and onwards satisfactory statistics of cultivation in Nagpur and Nimar are available. The total amount of the roughly manufactured drug deposited in the Govern, went stores was 4,021 mantels, nearly 5-6ths of which was raised in Nimar.

The number of retail shops was considerably reduced, the most important change being in Balaghat, where the allowance in 1881-82 had been far too large in proportion to population. The average incidence of revenue was a little more than 21 pies per head.

28. There were no important administrative changes in 1883-84.

The total revenue from the I.halsa proper was Rs. 1,29,207-2-6, made up as under :-

In all districts except Hoshangabad and Chhindwara the wholesale gnu ja contract was given to a single contractor : in the two districts named, the contracts were given by tahsils, as in the preceding year.

29. The amount of ganja sold by wholesale vendors to retail dealers increased by 157 maunds, and there was a consequent rise in the direct duty levied. Wholesale vendors, however, paid on the whole less for their monopolies, the reason being that in some districts a lower rate per seer bad been accepted, with the object of leaving the contractor a good margin of prcfit and so encouraging him to supply good ganja and maintain efficient agents at tahsils.

The lowering of the price to retail vendors from Rs. 3 to Rs. 2 in Sambulpur was supplemented by special efforts to repress smuggling from feudatory States, and by enforcement of the agreement with the wholesale vendor that only good, clean ganja should be supplied : the result of these combined forces was that sales went up from nearly 5 maunds in 1882-83 to 21 maunds, the total revenue being at the same time more than doubled. Other districts in which sales improved considerably were Nagpur, Jubbulpur, Seoui, Raipur and Bilaspur. In Nimar sales fell off largely, but the retail license fee demand more than doubled, circumstances which are explained in the Excise Report for the year by the breaking up of gangs of labourers employed in the preceding year on the G. I. P. and Rajputana railways and by reckless bidding at the sales by two rival contractors who had quarrelled.

No material change took place in the number of shops anywhere except in Sambulpur, where the larger sales of taxed ganja demanded an increase in the number of licensed places of vend.

The incidence of gross revenue per head of population was ij pies.

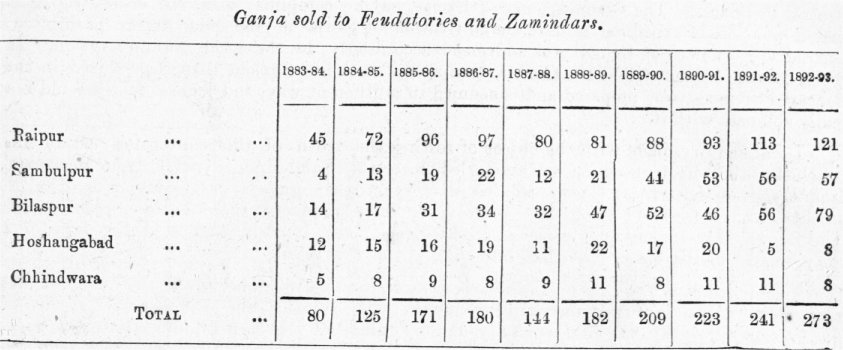

30. The amount of manja taken by feudatories and by zamindars who controlled their own revenue from hemp-drugs was 80 maunds against 56 in 1882-83. The improvement was due to the success in Raipur and Bilaspur of the arrangements made in 1880. The Sambulpur feudatory Chiefs, on the other hand, did not co-operate cordially in the suppression of ganja cultivation, and they took from the district wholesale vendor less than half of the amount taken in the preceding year.

31. In 1884-85 a new form of wholesale license was introduced. The form prescribed in1882 was not found to be sufficiently complete, and it was supplemented in practice by a separate agreement. 'I he Gazette Notification publishing the substituted form is reproduced as Appendix J* to this Memorandum.

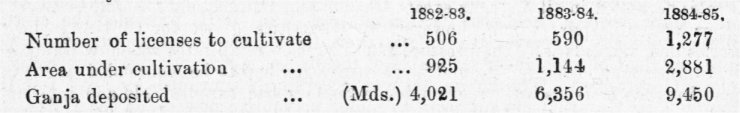

32. The number of licenses for cultivation, the area cultivated, and the quantity of ganja deposited in the Central Stores were all unprecedentedly high in this year. The figures for 3 years are subjoined

Most of the increase was in Nimar, where a large export trade was developing yearly. In Nagpur cultivation had apparently been resumed by those who in 1881 refused to come to terms with the provincial wholesale contractors : there was a substantial demand for them to meet, as the locally produced drug was then preferred in the Nagpur country to that imported from Nimar.

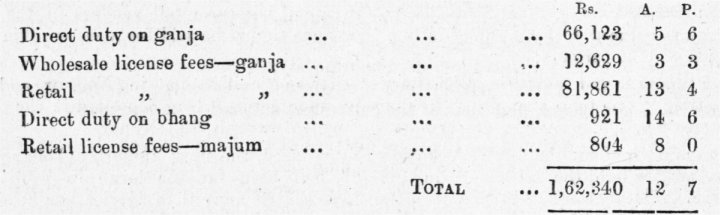

33. The revenue of the year was made up as follows:— Es. A. P.

Es. A. P.

The amount of taxed g,anja consu-ned in the Khalsa proper rose by 11 per cent. and the total revenue demand by 25 per cent. This all round improvement was attributed in the Excise Report for the year to the improved quality of the drug supplied, and the case of Sambulpur, where retail license fees had risen by nearly Rs. 1,000, consumption had almost doubled, and supplies to the surrounding feudatory States had gone up from 4i to 134 maunds, was cited as proving the correctness of this explanation.

The total number of shops for retail vend increased from 851 to 921. All except 5 of the additional shops were opened in the Nagpur district, where the retail monopolies were auctioned for the whole year instead of being given out from month to month as in 1883-81, when the average number of licenses issued monthly was only 45.

34. In the Excise Report, written by Mr. L. K. Laurie, the year's statistics are remarked upon as follows :—

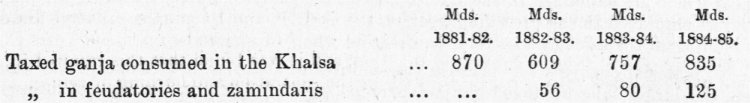

" While in most districts of the province the number of ganja shops remained stationary, the consumption of taxed ganja increased, in despite of an increase of prices which in some districts followed the enhancement of the license fees for retail vend. The probable explanation is that the improved quality of the issues of the drug attracted anew the consumers who had been driven to seek their supplies elsewhere by the poorness of the stuff sold by Government licensees in 1882-83. In 1882-83 the consumption of ganja decreased in all districts except Chanda * * * and Damoh. In 1883-84 the consumption increased in all districts except Nimar. In the year under report the increase continued in all districts except four (Nagpur, Mandla, Dan3oh, and Saugor). The quantity of taxed ganja consumed in the years 1881-85 was as under. It is not possible to carry back the distinction between the Khalsa supply and supplies to feudatories earlier than 1882-83 :—

"These figures show that in the year under report the rebound from the depression caused by the inferior issues of 1882-83 has carried the Khalsa demand to w bat it was in 1881-82, and. probably beyond. It is worthy of note that the check in consumption which occurred in 1882-83 did not affect the fees for wholesale and retail vend. These have in almost every district steadily increased since 1881-82.

" The incidence of the total demand per head of population was 3 pie, as compared with 2 pie in the preceding year. As last year, the incidence was highest in the Jubbulpur, Seoni, and Balaghat districts. The demand in Seoni and Bala-ghat stands at nearly the same figure as the demand in Raipur, which (following Jubbulpur and Nagpur) is the third highest in the provinces. This position in the list has been maintained by these two districts for several years past."

35. Before passing on it is necessary to note that the powers of police officers under sections 27, 28, and 29 of the Act of 1881 were modified during the year. In February 1881 the Chief Commissioner had authorized Deputy Commissioners to appoint, under section 21 of the Act, any police officer to be an officer for the prevention of excise offences. The Government of India, however, held that Section 20, Act V of 1861, precluded the exercise by the Police of authority as preventive officers, even though they were appointed to perform such duties by the Collector under section 24 of the Excise Act in accordance with rules made by the local Government. The Excise Act was accordingly amended by Act VI of 1885, in order to give local Governments authority to confer preventive powers on the Police. In the Central Provinces the powers exercised are—

(a) By all police officers, those conferred on Excise officers by section 27 of the Act.

(b) By any police officer in charge of a station or of or above the grade of bead constable, those conferred on Excise officers by sections 28 and 29 of the Act.

36. The profits made by cultivators on the crop raised in the autumn of 1884 resulted in a still larger number of licenses to cultivate being taken out in 1885. The quantity (18,971 maunds) of the drug deposited in the Central Stores was also much larger than in any previous year, and, despite the fact that exports to other provinces increased enormously, a considerable percentage of the stock remained unsold. The market having been thus glutted, wholesale prices fell from Rs. 7 to Its. 2 and Re. 1 per maund, and most of the cultivators suffered in consequence.

37. The wholesale contract for the three districts of the Chhattisgarh Division was given in lump to a single contractor, as in the two preceding years : this arrangement had been necessitated by the fact that men would not tender for the contract of those districts owing to the difficulty of transporting the drug from the Central Stores, the railway line extending at that time only as far as Raj-Nandgaon.

The quantity of taxed ganja sold increased by 160 maunds, one-half of which was contributed by the districts of the Chhattisgarh Division and almost a quarter by the Jubbulpur district. Unlicensed cultivation in feudatories and zamindaris had generally diminished, and in the Raipur district over 200 temporary shops had been established at bazars where illicit ganja used to be secretly sold. In Jubbulpur the retail price was lowered to 1 anna per tola, sales being enormously stimulated in consequence. In other districts the average retail price varied from I to 2 annas a,tola, i.e., from nearly 3 to nearly 4 times the price prevailing in 1875-76. The sums bid for the monopolies of wholesale and retail vend also increased, and the total revenue demand on account of ganja rose by more than Rs. 30,000, the incidence per head of population going up from 3 to 4 pies.

The districts in which the demand was greatest were :—

Jubbulpur. Raipur. Nagpur. Balaghat. Seoni. Bhandara.

Jubbulpur, as for years past, was far ahead of any other district, and Raipur now took second place in regard to both revenue and amount of ganja taxed. Balaghat and Seoni occupied the fourth and fifth places, as in 1884-85, but in reverse order.

38. The losses incurred by cultivators in 1885-86 caused them in the following year to 1886-87 take out fewer licenses and to reduce the area under ganja ; but in spite of this there was the large outturn of 9,290 maunds, which was ten times the quantity needed for provincial consumption and more than 2,000 maunds in excess of the quantity required for export and provincial consumption combined. As much as 6,000 maunds were exported to the North-West Provinces and Oudh, where the Government wee considering the advisability of imposing an import duty on the drug.

39. An important executive order was issued in this year. In 1880 (see para. 17) the Chief Commissioner had directed that ganja should be issued from the Central Stores in as clean a state as possible ; but in 1881-82 (see para. 20) and subsequent years the place of cleaning ganja had been left an open question, and it was found that this resulted in tahsildars being overburdened with work in supervising the separation and burning of refuse. It was now made obligatory in all cases to effect a partial cleaning at the Government Store-houses before packing for despatch to tahsils. At the same time the use of " hampers " instead of bags was recommended, and the practice which started thereupon was subsequently enjoined by condition 6 of the form of wholesale license as finally modified in 1891.

40. The consumption of taxed ganja in the Khalsa fell off by 141 maunds, and was only slightly in excess of that in 1884-85. The decline was most marked in the cases of Nagpur, Bliandara, Jubbulpur, and Sambulpur, and it appears to have been due partly to the failure of crops and partly to a further advance in license fees for the right of retail vend. In Sambulpur the monopolies of retail vend were auctioned for the first time, so that retail prices must have been specially affected in that district : up to this time the system introduced in 18S0-S1 of licensing shops at fixed rates and without restriction as to number had been adhered to, the idea being that smuggling from the surrounding feudatory States would best be combated by placing no limit on the number of licenses that might be issued.

Retail shops increased by 70. _There was a nominal increase of 34 in Sambulpur, where the figures for previous years are really those of average number of licenses issued monthly. 13 new shops were opened in Raipur, where the allowance had always been short, having regard to the growth of population and consumption. Of the 8 additional shops in the Narsingpur district only 3 were actua,lly worked : all were on the Bhopal frontier, and were licensed with the object of checking smuggling from that State.

The provincial incidence of revenue per head of population rose from just 4 to nearly 4½ pies.

41. The outturns of ganja in Nimar had been so la-ge in the years 1884-85 and the two 1887 88. which followed it that additional accommodation had to be hired and the market was overstocked. In order to obviate the inconvenience which had thus been found to result from over-production, a storage fee of 6 pies per maund per mensem, payable quarterly in advance, was imposed upon all ganja deposited in a Government store-house. This impost appears to have brought about the desired result, for the area under cultivation and the outturn were each little more than half of what they had been in 1886-87. Storage fees amounting to Rs. 472 were realized in the course of the year.

In October 1887 another source of revenue was invented, a permit fee of Re. 1 per maund being made leviable on all purchases of ganja effected by persons who, not being licensed vendors under the Excise Act, resorted to the Government Store-house at Khandwa for their supplies. In proposing the imposition of this fee the Commissioner of Excise wrote as follows :—

"The part played by the Khandwa store as an entrepdt for the supply of the ganja demand of those provinces is quite insignificant when compared with its use as a mart for the convenience of foreign purchasers. To it throng traders from Bhopal, Indore, Gwalior, Ratlam, Dhar, Jodhpur, Oodeypur, Rewa, Fianna, Baroda, and other States of less note, and licensed vendors from the North-West Provinces compete with contractors from Berar for the purchase of the cultivators' stock. Between 6,000 and 7,000 maunds of ganja have, on the average of the last four years, been annually exported from Khandwa, to other provinces and to Native States. For the convenience thus afforded to them all these foreign purchasers pay absolutely nothing."

Permit fees amountino.e' to Rs. 1,028 were realized before the close of the year, and this sum alone more than sufficed to cover the cost of the additions to the store-house at Khandwa, which it had been found necessary to make.

42. In June 1887 the Government of India sanctioned a substantial increase in the rates of duty on round and choor ganja in Bengal, and the Chief Commissioner thereupon requested the Commissioner of ,Excise to report whether the duty should be raised in this province also.

In reply the Commissioner reported that the effect of raising the duty of Rs. 2 a seer would be to lower the bids for retail vend monopolies, and that it would be specially inappropriate to raise the duty jast when consumption had declined owing to the losses which had followed on the failure of harvests, in whole or in part, for two successive years. Accordingly, the rate was left unchanged.

43. Two other suggestions for improving the ganja revenue were submitted, though not recommended for adoption, by the Commissioner of Excise, Mr. L. B. Laurie, in this year, viz., (1) to abolish wholesale vendors, Government purchasing and retailing the drug through its own agents, and (2) to economize establishment by closing the store at Nagpur and prohibiting cultivation in the Nagpur district altogether. The Chief Commissioner agreed with Mr. Laurie in thinking that on the whale, Government agency was unsuited for purchasing and selling the drug to retail vendors, and that it was best to postpone suppression of cultivation in Nagpur, until the effect of imposing a storage fee upon the extent of that in Nimar had been well ascertained.

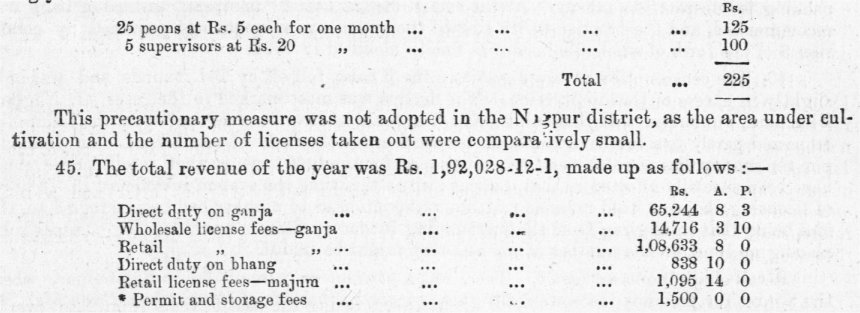

44. Supervision of harvesting, drying, and storing of the ganja crop was introduced this year, and has been exercised annually ever since. A case had been brought to light of a cultivator having a considerable quantity of the drug in his possession at his village-home, and there was thus reason to believe that many of the complaints of smuggling were due to secret disposal of ganja illicitly kept back by cultivators. rhe following establishment was accordingly entertained for the Khandwa tahsil 25 peons at Rs. 5 each for one month125

25 peons at Rs. 5 each for one month125

The amount of taxed ganja consumed fell off by nearly 33 maunds, but receipts from wholesale license fees remained at almost the same figure as in 1886-87, viz., Rs. 14,700 in round numbers. ,

Under retail license fees there was a total decline of about Rs. 17,500, but nearly Rs. 17,000 of this occurred in the districts of Nagpur, Jubbulpur, and Raipur. This was due in the first two districts to a relapse from the high bids of 1886, and in Raipur, where rice is the staple food, to the partial failure of two successive rice crops.

The labouring population, who are the largest class of drug consumers, were placed in exceptionally hard circumstances at the beginning of 1887-88, as the following extract from the Chief Commissioner's Resolution on the Revenue Administration of the Central Provinces during the year ending the 30th September 1887 sufficiently indicates :—

" The seasons resembled in their character those of the preceding year in which the rice crop was a very poor one and the linseed crop an almost total failure. * * * * Owing to the partial failure of the rice crop and to the inferiority of the crop of the preceding year there was a good deal of hardship in the rice-growing districts. A considerable portion of the labouring population was undoubtedly pinched for food to an extent rare in these provinces, and the pressure extended to the poorer cultivators. * * * * * In the northern districts the continuous high prices have unfavourably affected the condition of the labouring poor."

4e. During the period of 5 years, the statistics of which remain to be discussed, several The past quinquennium. important administrative changes were made.

In the first place a registration fee at the rate of Re. 1 per maund was made payable oi. all sales of ganja to purchasers other than licensed vendors of the Central Provinces, the object being to enhance the charge on exports to Native States and Berar which had been introduced in October 1887, and to obtain from licensed vendors of other parts of British India some return for the conveniences afforded them at the Government Store-house, libandwa. -The " permit " fees bad not especially affected export to foreign territory, which were about 3,000 maunds in 1887-88 against 3,300 maunds in 1886-87, and buyers from both foreign territory and the North-West Provinces were inconveniencing our wholesale vendors by forestalling them in the market and by raising the price.

47. Next the period of 50 days allowed to cultivators of ganja, under the rule for removal of their crop to the Government Store-house after permission to cut had been granted, was found excessive and reduced to 30 days on the recommendation of the Deputy Commissioner, Nimar. It was found that cultivators took advantage of the long period allowed to keep their crop in the villages as long as possible, thus entailing increased expense on Government for watch and ward and securing great opportunities for pilfering and illicit transfers.

48. 1889-90 was the last year in which cultivation was permitted in the Katol tahsil. The cultivators there had never been able since the introduction of the system of levying a direct duty in its existing shape to obtain a fair price for their produce, the reason apparently being that it was of inferior quality. Moreover, it was by this time certain that the amount raised in Khandwa was far in excess of provincial requirements, and would suffice to meet them even in a year of bad harvest. Accordingly, in May 1890 notices were issued to the Katol cultivators that they would not be allowed to raise ganja any more. The formal notification restricting cultivation to the Khand..va tahsil of the Nimar district was not issued till July 1891, the opportunity being taken of revising generally the rules of 1 882.

49. The revised rules are printed as Appendix 0* to this Memorandum : they are for the most part identical with those of 1882 as amended up to date, but include in addition one (3) relating to the practice of conducting harvest operations under Government supervision and two (6 and 7) calculated to ensure payment of registration and storage fee: a rule (10) was also added prescribing payment of storage fees and at the same time exempting cultivators and wholesale vendors of the Central Provinces from liability to such fees for a period of one month from dates of storage and purchase respectively. A minor change was made in respect of the authority to grant through transport passes, which were to be obtainable only from the Commissioner of Excise, instead of from the Deputy Commissioner of either Nagpur or Nimar.

50. In 1891 rules for the management of the Khandwa ganja store-house were drawn up, and were finally approved of by the Chief Commissioner in December of that year. Those rules are printed as Appendix P* to this Memorandum : they are full and explicit, and do not call for any comment here.

51. Lastly, the conduct of retail shops has been sensibly altered in two ways. In August 1890 the Chief Commissioner directed the insertion in all retail licenses to be thereafter granted for the sale of any intoxicating drug of a condition that consumption on the premises should not be permitted : this condition has been enforced throughout the Central Provinces since the ist April 1 8 9 1. The other change consisted in recasting the form of license for retail sale of ganja, and including in it a prohibition of sales on credit and by way of barter and a requirement that purchases shall be made direct from the wholesale vendor for each shop separately, shall be entered in the pass-book of the shop for which the ganja is intended, and shall then be taken to that shop and to no other : the amended form is printed as Appendix Q* to this Memorandum.

52. The total revenue from hemp-drugs has risen during the past 5 years from 2 to over 24 lakhs, and is now considerably more than double what it was in 1882-83, the year in which the present arrangements for supply of ganja to retail vendors were initiated.

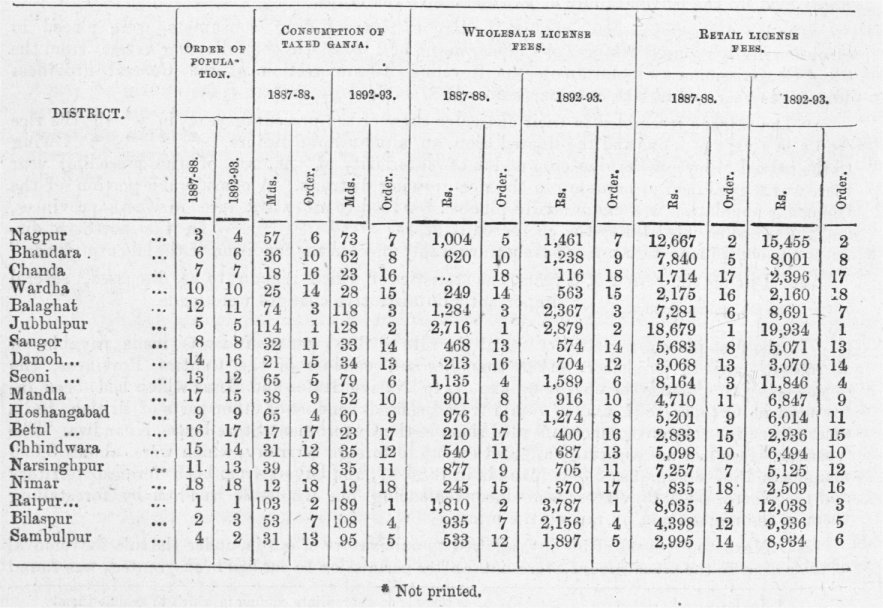

The following table shows how the position of districts has altered during this quinquennium in respect of consumption of taxed ganja and receipts on wholesale and retail licenses for the sale of that drug : the revenue from bhang and majum being comparatively insignificant is not taken into account :-

The most striking feature of the statistics is the rise of the districts of the Chhattisgarh Division to the position whi3h, in view of their population, they would naturally be expected to occupy. These districts account for more than half the increase in consumption of taxed ganja since 1887-88, and the chief causes at work have been (1) improvement in administration in feudatory States and (2) extension of the Bengal-Nagpur Railway, and in Raipur the construction of water-works. Relations with feudatory Chiefs and with zamindars who enjoy the right of making their own arrangements for retail sale in their estates will be discussed when the subject of smuggling is taken up. Nimar and Betul continue to be the districts where the consumption of taxed ganja is most noticeably short : in the former district cultivators can no longer secrete much of their crop, but ganja is still largely grown in Indore, while in Betul much Berar ganja is undoubtedly consumed. Wardha arid Nagpur and in a less degree Chhindwara also are, like Betul, exposed to smuggling from Berar, where the average retail price of ganja is only 6 pies per tola. Seoni and Balaghat have always stood high as contributors to our revenue from ganja : in the latter district licit sales have increased enormously. In Bhandara, where also sales have greatly improved, it is said that the habit of ganja-smoking is no longer considered disreputable, and that the chief cultivating class have taken to it. The Chanda district sales do not include those of the Sironcha tahsil, where retail vendors, owing to the remoteness of the tract, were allowed until the current year to supply themselves under import licenses from foreign territory : the consumption in that tahsil is probably about 6 maunds per annum. The steady rise in the provincial consumption of taxed gauja attracted the special attention of the Chief Commissioner in 1892, and in the Resolution on the Excise Report for 1891-92 the Commissioner of Excise was directed to make enquiry as to whether that drug was ousting either country liquor or opium. This enquiry is still in progress, and until the Chief Commissioner has had the results before him and recorded the conclusions to which they lead, further comment on the statistics just dealt with will serve no useful purpose.

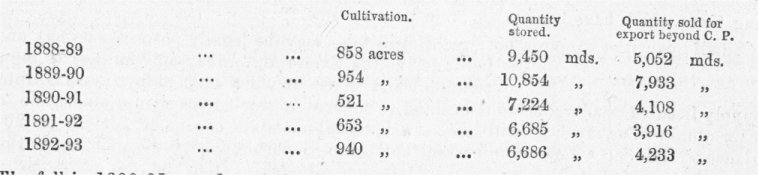

53. Sales of foreign bhang do not fluctuate much from year to year : the average of the past quinquennium is about 12 maunds per annum. This drug is not sold at all in the districts of Chanda, Seoni, and Mandla, and very little in Bhandara and Wardha. Most is sold where Marwaris are most numerous, Nagpur, Jubbulpur, Narsinghpur, Hoshangabad, Raipur, and Bilaspur.

54. Statistics of area cultivated and quantities stored and exported for each of the past five years are as under for the Nimar district :-

The fall in 1890-91 was due to the market being overstocked with the large outturn of the previous year, and to the ryots having unsuccessfully combined to resist dealer's low prices .. in 1891-92, the losses which had been sustained in this way and excess rainfall prevented any considerable extension of operations, besides damaging the crop raised on the area worked. In the latter year, however, cultivators realized high prices averaging Rs. 8 per maund, and were encouraged to sow more ganja in 1892-93, but the crop raised was again damaged by excessive rain, and the quality was generally inferior. It may be mentioned here that consumption in the Central Provinces themselves has little, if any, effect on the area cultivated, for the reason that only about one-fifth of the crop is consumed locally : during the past five years local coesumption, including that of feudatories and zamindaris, bas ranged from 1,123 to 1,468 maunds, the annual average being 1,282 maunds. In 1888-89 and 1889-90 there was a little cultivation in the Katol tahsil of the Nagpur district :in the former year 79 acres yielded 377 maunds, the corresponding figures for the latter year being 39 acres and 312 maunds.

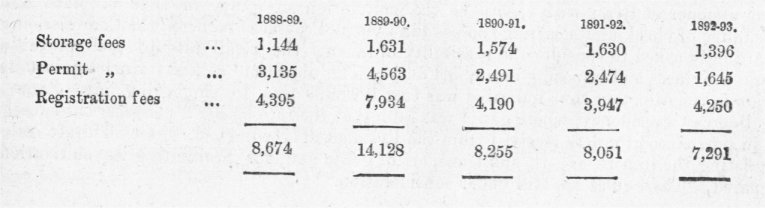

During the same period fees at the Government Store-house, Khandwa, aggregated Rs. 46,399. The yearly receipts are not included in the statements in Appendix A for the reason already stated in the footnote to para. 45 of this Memorandum.

Details of the total revenue under this head are :--

1888-89. 1889-90. 1890-91. 1891-92. 1893-93.

1888-89. 1889-90. 1890-91. 1891-92. 1893-93.

55. The average retail price in most districts for small quantities of ganja is 2 annas per tola, but where the full amount of which possession is allowed by law, viz., 5 tolas, is bought, a rate of 0-1-6 per tola is generally taken. In the elistricts open to smuggling from Native States on the north and west, rates on the border are as low as 0-1-3 and sometimes even 1 anna per tole. In rural areas in the Sambulpur district and also in the Drug and Simga Tahsils of Raipur the rate is 1 anna per tola : in the Sheorinarain Tahsil of the Bilispur district it is 0-1-3 per tola.

56. A system of modified local option in respect to the licensing of country liquor shops was introduced into the Central Provinces under the orders of the Government of India in 1889 : such shops are more than six times as numerous as those for the sale of ganja, and no orders for consulting the residents in places where ganja shops are to be licensed have yet been issued. The Administration has all along shaped its policy in regard to the licensing of ganja shops on the assumption that the drug is extremely deleterious, and it is a standing order that no more should be licensed than are necessary to meet the demands of consumers who, if a licit supply were not obtainable, would probably supply themselves illicitly. Moreover, the location of drug shops is a matter of comparatively little importance now that consumption on the premises has been prohibited. Upset prices are not fixed i but no shop is licensed unless a reasonable bid is forthcoming.

57. It is believed that the hemp plant does not grow wild in any part of these provinces.

58. An endeavour has been made in the foregoing paragraphs to trace the development of the present excise system in respect to hemp-drugs in the Central Provinces, and to notice the most striking ng variations from year to year in the area under the ganja-produc- ino. plant, the outturn therefrom and the revenue raised by means of taxing consumption of the two preparations in use, vie., ganja and bhang. It remains to give in a brief yet comprehensive farm an account of the system as now worked : the necessary information bas been embodied in Appendix It, which follows closely Chapter V of the Excise Manual drawn up in 1885 by Mr. F. C. Anderson, when Commissioner of Excise, and includes also the instructions given in a few important subsidiary circulars.

59. This Memorandum will now be brought to a conclusion with a brief statement of the difficulties in the way of realizing a tax on all ganja consumed within the province and of.the chief measures for combating them which have been taken from time to time.

Small quantities of ganja not exceeding 5 tolas may be legally possessed by any one, and inasmuch as the Excise Act, 1881, only authorizes regulation of import and transport when effected by persons intending to supply licensed vendors, there i4 nothing to prevent a smoker carrying about, no matter whence obtained, as much as will suffice an habitual moderate consumer for 15 or 20 days. A glance at the map which accompanied the Excise Report for 1889-90 will show that the Central Provinces are cut off by Native States and Chiefships from the rest of British territory except in the extreme south and south-east, in the extreme west and in the northwest, where the border runs for comparatively short distances with those of the Lalitpur, Khandesh, and Godaveri districts respectively. Starting from the extreme south and working alono. the Western border, we find first the Nizam's Dominions, separated from the Sironcha and along tahsils of the Chanda district by a water boundary consisting of the Godaveri and

its tributaries, the Pranhita, and Wardha rivers. Until August of the current year the Sironcha tabsil, owing to its inaccessibility and the cheapness of ganja in Hyderabad territory, was, as already remarked (para. 26), exempted from the direct tax on consumption introduced in 1880-81 : it has now been experimentally brought under the system prevailing elsewhere in the Khalsa propere information having been received that in consequence of certain fiscal re- forms the price ofganja has risen in Hyderabad. The Resident has been addressed with the object of ascertaining the nature of the alleged reforms, and his reply is still awaited.

60. Proceeding northwards we find the Berars marching with the Mul and Warora tahsils of Chanda, all three tahsils of Wardha the Katol tahsil of Nagpur, the Saosar tahsil of Chhindwara, both tahsils of Betul, and lastly the Bnrhanpur tabsil of Nimar. The revenue from ganja is raised by (1) levying a license fee of Rs. 10 per acre or part of an acre on cultivation and (2) auctioning the right of retail vend ; but the retail price is nowhere higher than 1 anna per tola, while in the Wan district it is only 3 pies, and elsewhere generally 6 pies. In 1888 the Chief Commissioner authorized the Commissioner of Excise to consult the Commissioner of Berar with regard to the cultivation of ganja in that province and the possibility of checking its carriage across the Central Provinces borders : the Commissioner was accordingly asked to consider the possibility of raising the retail rate to that prevailing in these provinces and imposing an import duty. The objection at first raised against taking action in the direction thus indicated was that it would lead to smuggling into Berar from the Bombay Presidency, where ganja was selling at the rate of Rs. 2 per seer, but subsequently, in pursuance of orders received from the Resident at Hyderabad, a set of draft rules for regulating the import, export, and transport of ganja and for prohibiting its cultivation was prepared. These rules are still under consideration.

In 1880-81 two special peons on Rs. 5 per mensem were entertained, one by Government and the Other by Kaluram, the wholesale contractor, for the purpose of detecting smuggling on the western frortibr of the Betrd district, but they proved a failure, and their services were dispensed with after ? few months.. The fact is that salaried detectives are of little or no use, as they are liable to be bribed by the very men whom they are paid to watch.

61. The Khandesh Collectorate of the Bombay Presidency succeeds the Berars as centerminous territory, and it is the Burhanpur tabsil of the Nimar district. Which is on the Central Provinces side of the boundary. Reference has already been made to the extremely low price of ganja throughout the Bombay Presidency : cultivation of the ganja-producing hemp plant is not restricted in any way, though manufacture and sale of the intoxicating drug is required to be covered by licenses, and the revenue, which is under 1. lakhs, is derived from annual farms of retail monopolies and from permit fees at the rate of Rs. 5 per 10 maunds on imports exports, mid transport. Cultivation is largely practised in Kbandesh and also in Alimadnagar and to a less extent in the Broach, Sholapur, Surat, Satara, and Poona Colleetorates : ganjais one of the few articles of export of these comparatively poor districts, and it would appear that Government is accordingly unwilling to lay any very heavy tax on trade in the drug.